Breaking: US Blinken: Believes Russia WILL Invade Ukraine before the night is over

The US Secretary Of State Blinken said that he believes that Russia will invade Ukraine before the night is over, as reported by NBC News.

Meanwhile, the UN Security Council will hold an emergency session on this tonight at 9:30pm according to the Minister of Foreign Affairs of Ukraine.

Ukrainian President Volodymyr Zelensky also said in an impassioned address on Wednesday night that Russian President Vladimir Putin had ordered an invasion of his country but that if Russia attacks, "you will see our faces, not our backs."

Ukraine has requested an urgent meeting of the UN Security Council due to the appeal by Russian occupation administrations in Donetsk and Luhansk to Russia with a request to provide them with military assistance, which is a further escalation of the security situation.

— Dmytro Kuleba (@DmytroKuleba) February 23, 2022

Ukraine entered a state of emergency on Wednesday as the Pentagon warned that Russia's preparations for invasion appear to be complete, and Ukrainian citizens prepared for war.

In related news, Russia has closed some airspace in Rostov flight information region on the eastern border of Ukraine.

The markets around the world are responding kind and the yen is advancing across the board while gold prices are on the verge of meeting this year's high of $1,916.52 having already printed $1,913.55 so far.

Earlier, it was rumoured that Russia will invade Ukraine at 4 am local time and was reported here as follows:

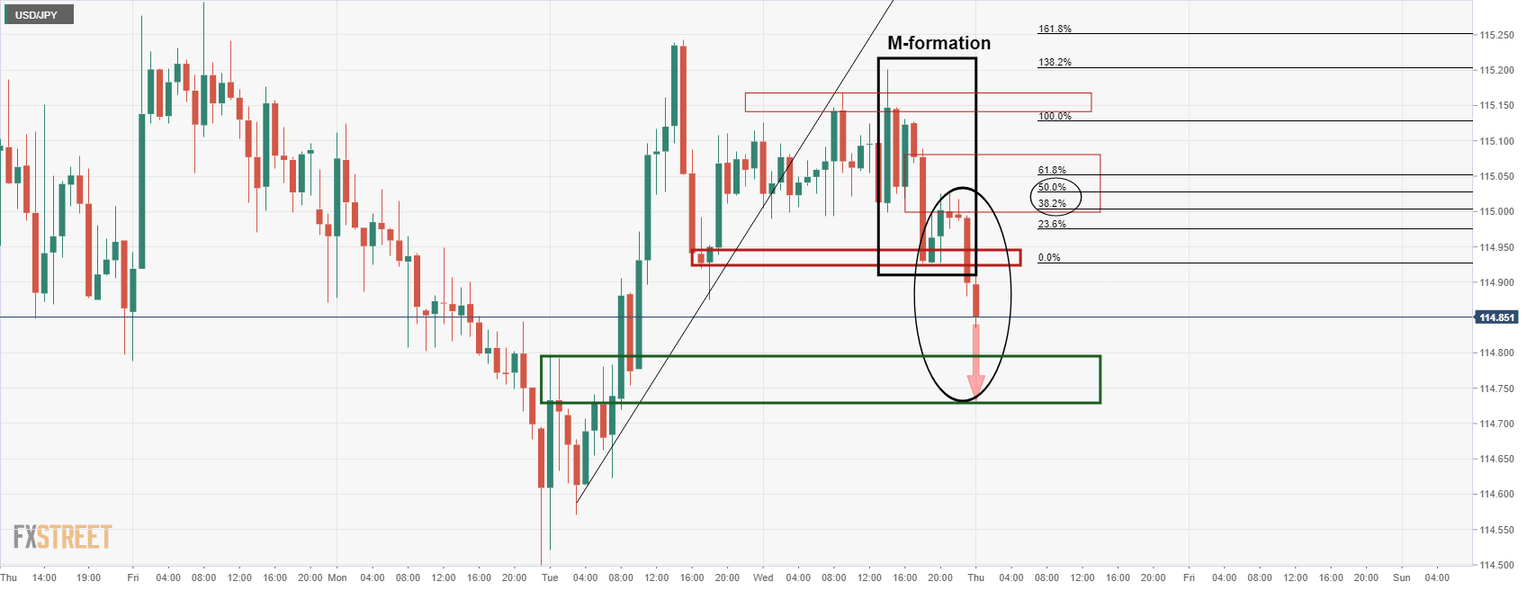

At the time, the yen was picking up the safe-haven bid and has now moved even high vs fellow currencies. Against the yen, it is now trading near the lows of 114.82:

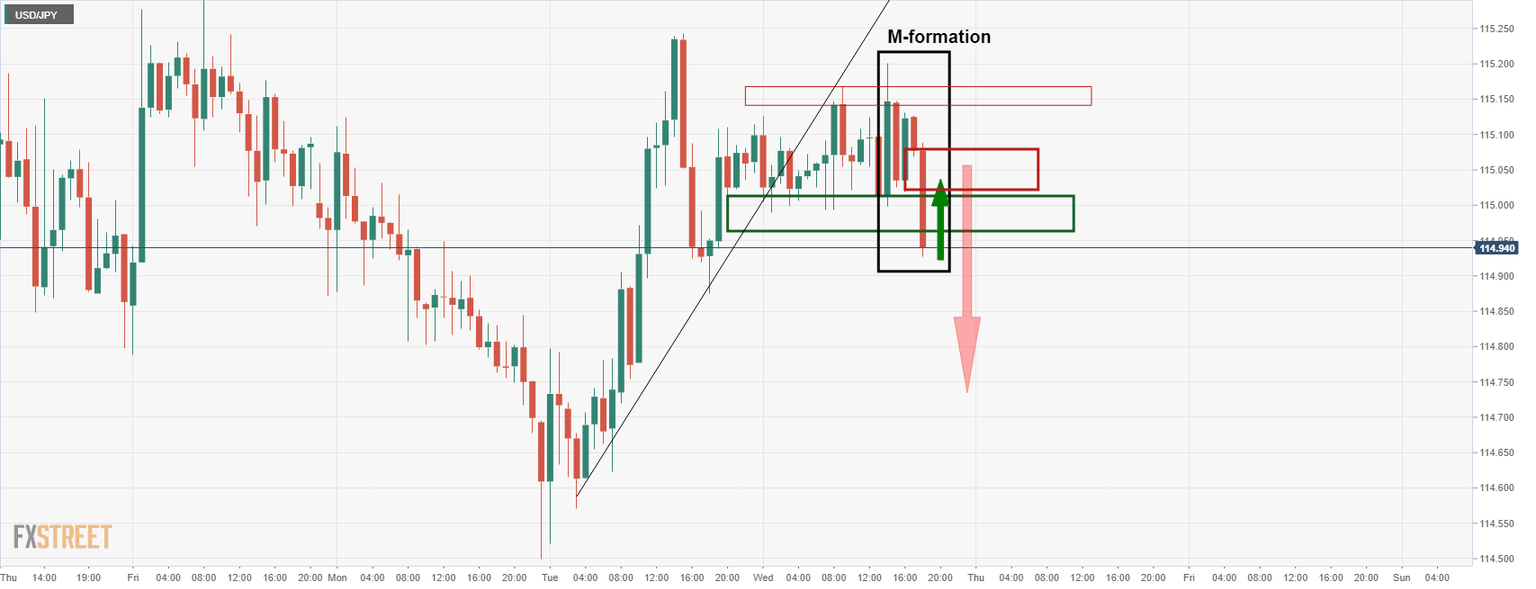

This was a move forecasted in earlier analysis which can be read here:

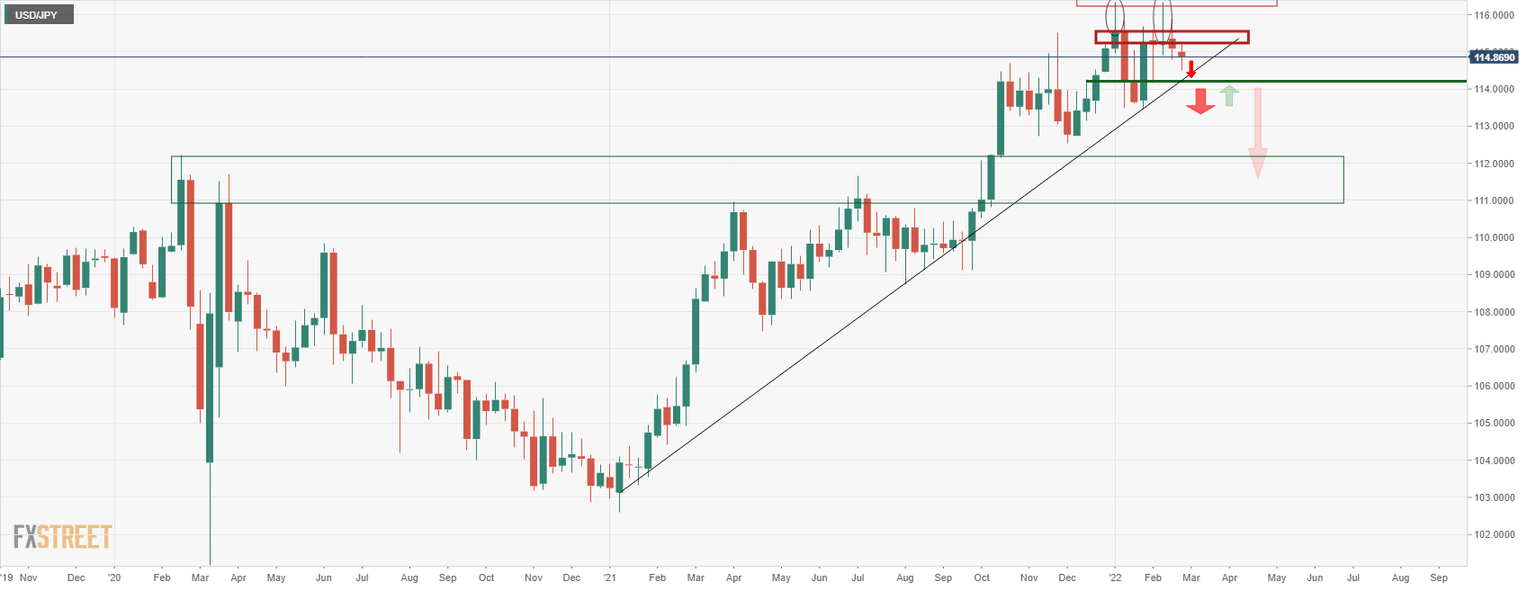

The analysis, it illustrates a worsening outlook for the pair from a daily and weekly perspective as we encroach on the Japanese fiscal year-end and seasonal flows from Japanese exporters buying at the end of their financial year.

The accumulation of short positions against the US dollar looks vulnerable to a further squeeze over the coming weeks:

Author

FXStreet Team

FXStreet