Breaking: GBP/USD spikes to 1.1050 on reports of BOE extending bond-buying

GBP/USD has changed its course and jumped beyond 1.1000, in a knee-jerk reaction to a Financial Times (FT) report, citing that the Bank of England (BOE) signalled privately to bankers it may extend bond-buying.

Citing people briefed on the discussions, the FT reported that the BOE has communicated privately to bankers that it could extend its emergency bond-buying programme past this Friday’s deadline.

This comes after BOE Governor Andrew Bailey warned late Tuesday, “My message to the (pension) funds involved and all the firms is you’ve got three days left now. You’ve got to get this done.”

Bailey's comments knocked the GBP/USD pair below 1.1000, as he hinted that the central bank will halt its market support.

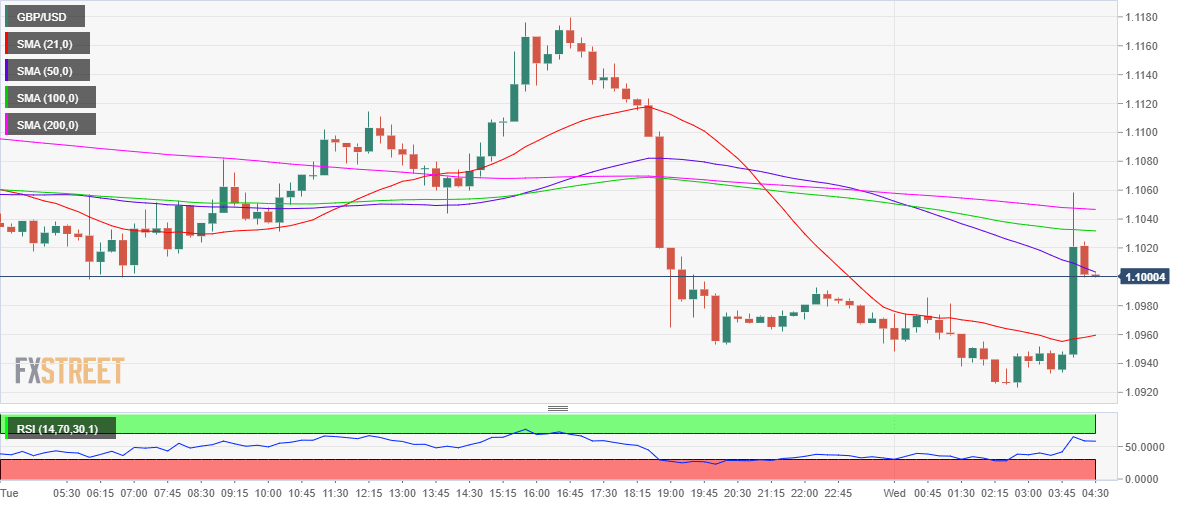

However, the latest report renewed speculation of the UK central bank intervention to support the local currency, which put a fresh bid under the major, propelling it one big figure from 1.0945 levels to 1.1049. Cable was last seen trading at 1.1008, quickly retreating but still adding 0.40% on the day.

Earlier on Tuesday, the BOE announced to include inflation-linked debt in its bond-buying programme, in an effort to avert what it called a “fire sale” that threatens financial stability.

Uncertainty around the UK monetary policy continues to keep GBP sellers alive and kicking, limiting any upside attempts in the currency pair. Attention now turns towards the UK monthly GDP and Industrial Production data while the BOE operations will be closely followed ahead of the US inflation and FOMC minutes.

GBP/USD: 15-minutes chart

Author

FXStreet Team

FXStreet