Breaking: Aussie CPI comes in hotter and lifts AUD over 26 pips off the bat

Australia’s fourth-quarter Consumer Price Index has been published as follows:

Australia Core Inflation 2.6% YoY vs the expected 2.4%.

- CPI (YoY) Q4: 3.5% (est 3.2%, prev 3.0%).

- CPI Trimmed Mean (QoQ) Q4: 1.0% (est 0.7%, prev 0.7%).

In terms of key drivers, dwelling purchase prices, auto fuel and food will have played an important role in this release, analysts at Westpac explained in a note ahead of the event.

Meanwhile, this data will mean a lot for markets. ''Most immediately for the Reserve Bank of Australia, which may need to acknowledge that a rate hike in 2022 is no longer completely out of the question, analysts at ANZ Bank said. ''It could also have political implications, with the cost of living shaping up as a key issue for the upcoming Federal election.''

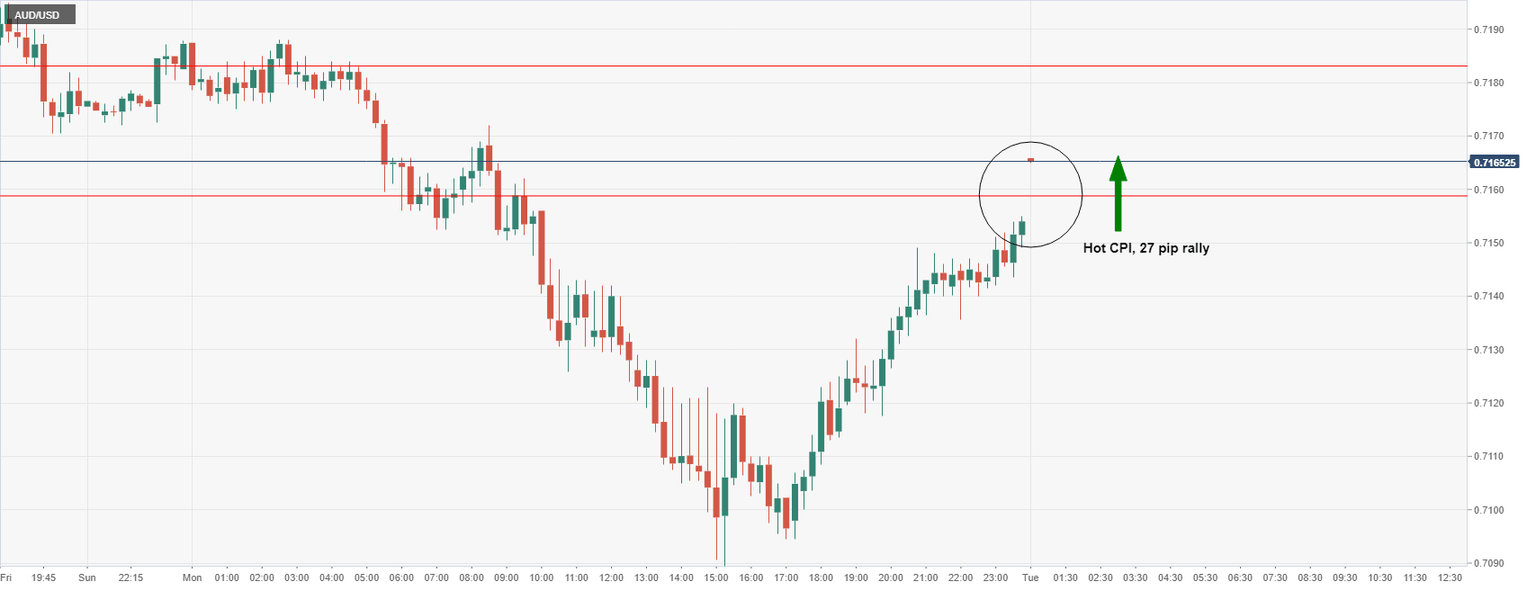

AUD/USD has moved higher on the data as follows:

(15-min chart)

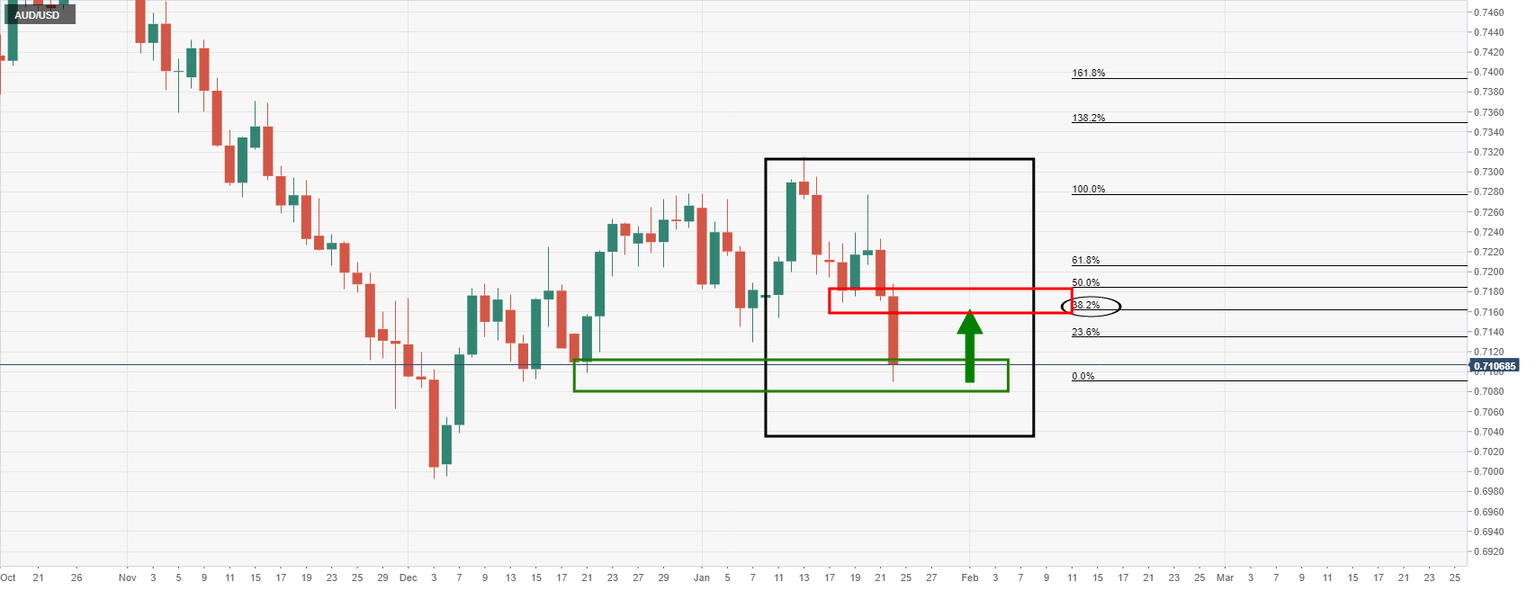

The move falls in line with prior analysis for a test of the M-formation's neckline:

(Daily charts)

AUD/USD prior analysis

It was stated overnight in a prior article that ''AUD/USD's M-formation on the daily chart is a compelling chart pattern for the week ahead. A reversion towards 0.7150/60 would be expected...''

About Consumer Price Index (CPI)

It is published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

Author

FXStreet Team

FXStreet