Breaking: AUD/USD falls after China says to end 'strategic economic dialogue' with Australia

China has decided to "indefinitely suspend" all activities under the China-Australia Strategic Economic Dialogue, the country’s state planner, the National Development and Reform Commission, said in a statement explaining the decision on Thursday.

The NDRC said: "Recently, some Australian Commonwealth Government officials launched a series of measures to disrupt the normal exchanges and cooperation between China and Australia out of Cold War mindset and ideological discrimination.”

“Sino-Australia trade relations have deteriorated in recent months with China restricting or banning imports of Aussie goods including lobsters, wines, beef and coal,” per Reuters.

AUD/USD erodes over 50-pips in a matter of minutes

AUD/USD came under fresh selling pressure on the above news, falling over 50-pips from near-daily highs of 0.7758 to hit fresh daily lows of 0.7702.

The spot was last seen trading at 0.7715, down 0.385% on the day.

AUD/USD technical analysis

AUD/USD hourly chart

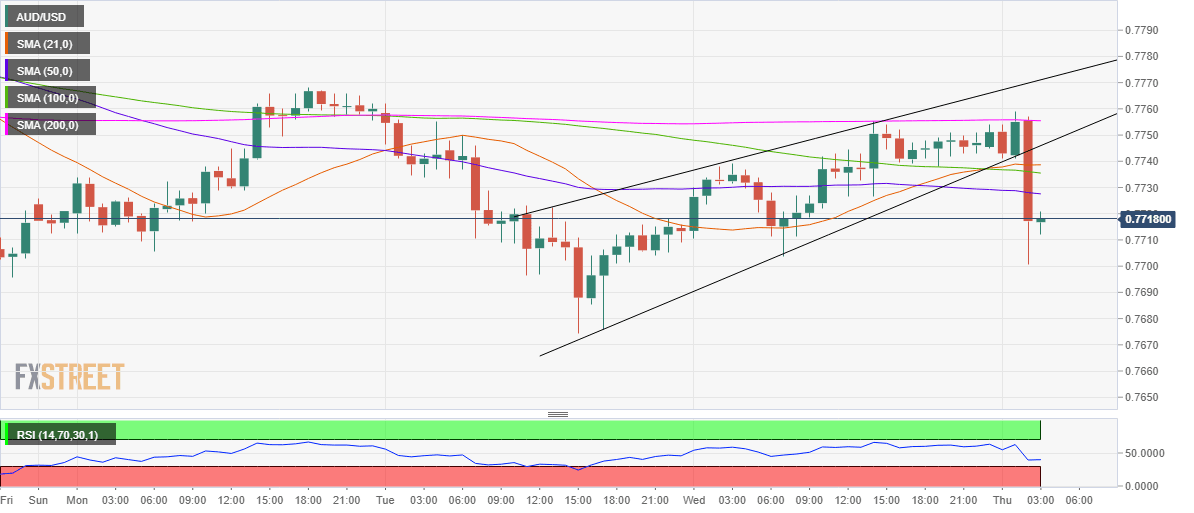

The negative news triggered a rising wedge breakdown on the hourly chart, with the Relative Strength Index (RSI) turning outrightly bearish.

The price has cut through all the major hourly moving averages (HMAs), exposing the critical 0.7700 support, below which Tuesday’s low of 0.7676 could be tested.

On the flip side, recapturing the 50-HMA at 0.7730 is critical to extending the recovery in the aussie.

AUD/USD additional levels to consider

Author

FXStreet Team

FXStreet