BOXL Stock Price: Boxlight Corp opens lower despite Samsung cooperation, a buying opportunity?

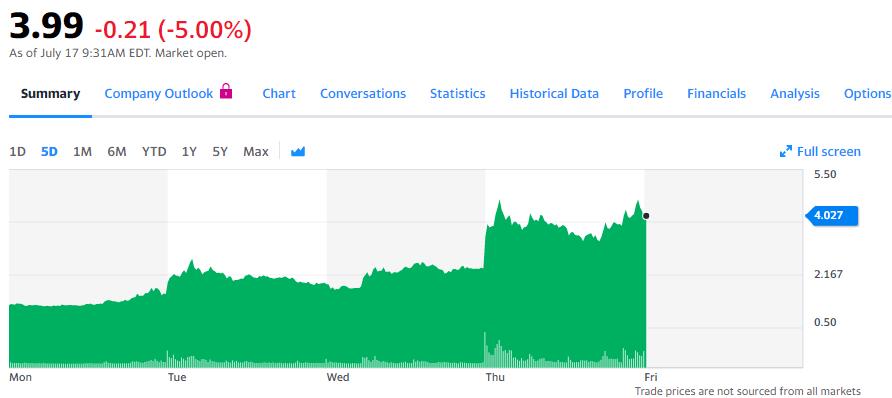

- NASDAQ: BOXL has kicked off Friday's trading with a drop below the $4 mark.

- Boxlight Corp is reportedly cooperating with Samsung, providing it ample room for growth.

- The education sector is growing amid the coronavirus crisis.

NASDAQ: BOXL has kicked off Friday's trading just below $4, down from the closing price of $4.20 recorded on Thursday. Nevertheless, Boxlight Corp – which was a penny stock last week – is up over 12 times from its 52-week low of $0.33.

Is it a buying opportunity?

The Lawrenceville, Georgia- based firm focuses on education and more specifically – distance learning. As COVID-19 is raging around the world – including in Boxlight's home state – reopening schools is running into concerns about spreading the disease and high costs of hygiene and social distancing.

The firm developed a product for helping instructors, called EOS Distance Teaching Essentials, that help those on the other side and not only the kids. The product received an award and so did another one called MySTEMKits. Providing children with STEM skills is essential for the modern world, especially one where physical studying becomes challenging.

BOXL Stock News

The recent surge in NASDAQ: BOXL comes from Samsung. The giant South Korean conglomerate has prepared a presentation in which it advocates for using BOXL.

$BOXL This is huge pic.twitter.com/nrx2Y1kMO7

— TC Investing (@TC_Investments) July 16, 2020

Samsung's spotlights drew attention to NASDAQ: BOXL and may trigger further buying. Even after the recent surge, Boxlight's market capitalization is only around $133 million – minuscule in comparison to its sector. Will bargain-seekers jump on it?

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.