BOE's Bailey: Negative rates are a controversial issue, GBP/USD leaps to 1.36

Further comments are flowing from the Bank of England (BOE) Governor Andrew Bailey, as he now speaks on the topic of negative interest rates.

Key quotes

Negative rates are a controversial issue.

There are a lot of issues with negative rates.

No country has used negative rates in 'retail' end of the financial market.

There are good reasons to think we're in a world of low rates for a long period of time.

Outlook for interest rates hinges on productivity growth.

Too soon to reach any conclusion about the need for future stimulus.

Expects plenty of further evidence in the next few weeks.

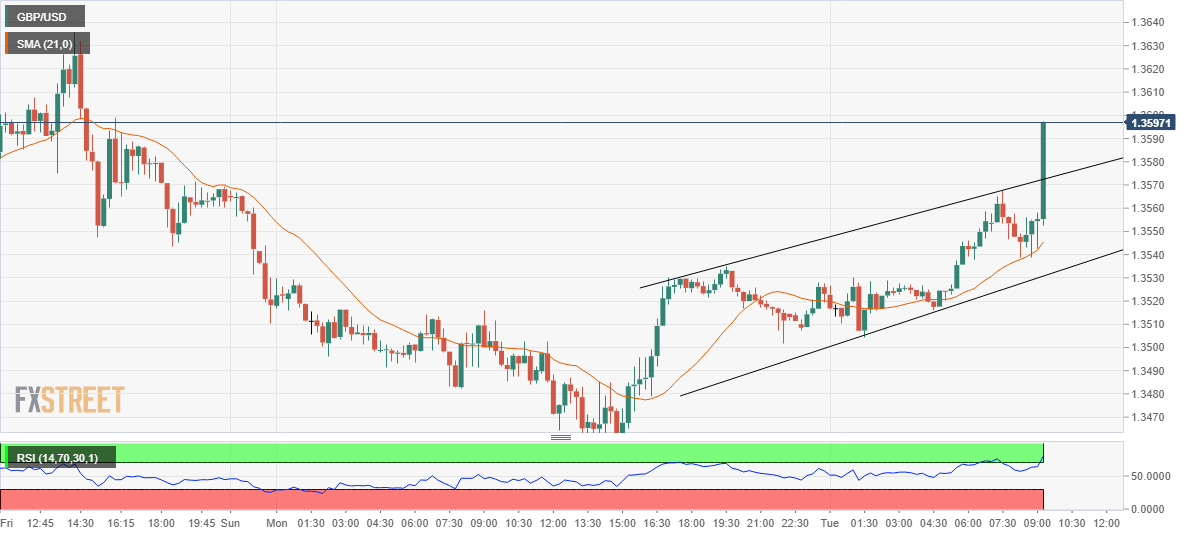

GBP/USD looks to recapture 1.3600

The pound picked up fresh bids, driving GBP/USD back towards the daily highs of 1.3568, as Bailey downplays negative rates expectations.

Goldman Sachs analysts bet 4-to-1 odds on a surprise move of a Bank of England (BOE) rate cut next month.

“The possibility of a 10-basis-points rate cut taking the Bank rate to zero suggests positive risk-reward” in betting on lower OIS rates at the February meeting,” analysts at Goldman Sachs noted.

GBP/USD: 15-minutes chart

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.