Biden's Rescue Plan: We need to move fast

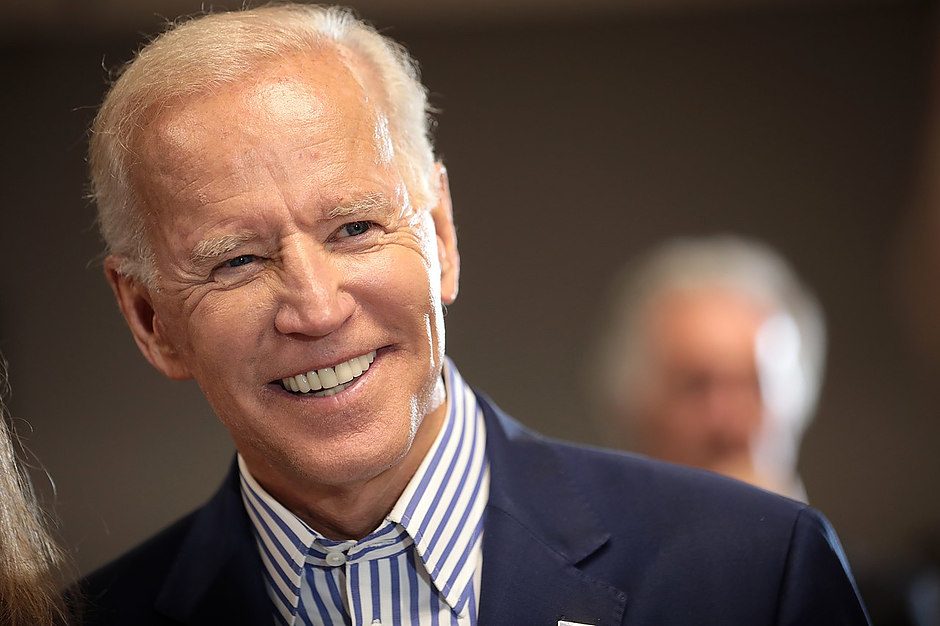

The US President-elect is addressing the nation on how his administration will turn the page on the COVID-19 crisis and begin to recover as a nation.

The details were mostly already known, as follows:

Outline of the plan

- Plan will include $2000 direct payments.

- Includes more vaccines and virus testing.

- Will include aid for state and local governments.

- An extension of supplemental federal unemployment benefits.

- More help for renters.

- Money for schools to open.

Additional information

-

$350 billion to states for front line workers, $50 billion in expanded testing, $160 billion for national vaccine program.

-

$1tln in direct support for households

- Circa $440 bn for business, most-impacted communities

- Stimulus checks to be topped up by $1,400 (so $2,000 in total, the initial $600 + $1,400)

- Supplemental unemployment benefit to $400 / week (its currently $300) and extended to September 2021

- The national minimum wage of $15, an end to tipped minimum wage.

- Biden will attempt to get his "American Rescue Plan" passed through Congress in the first weeks of his administration.

Live comments

''Debt situation will be more stable if we seize the moment''.

''$2000 is going to go a long way to ease that pain''.

"We need about $400 billion of funding from Congress to make all of what I've just said happen."

Biden says plans 100m vaccine shots in first 100 days.

Market implications

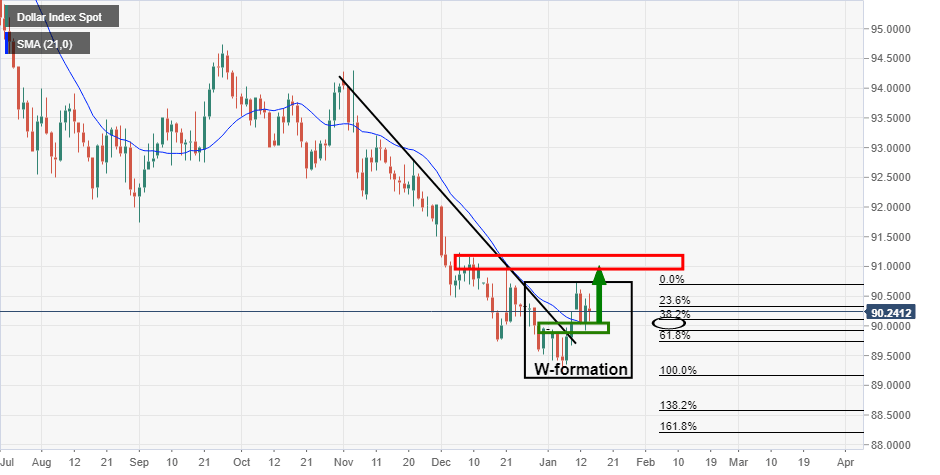

Dollar Index sees little action as US President-elect Joe Biden unveils coronavirus rescue plan

The US dollar has corrected the W-formation's bullish impulse to the neckline of the pattern. The price would be now expected to hold at this confluence level and then continue higher.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.