BBBY Stock Forecast: Bed Bath & Beyond slumps as early rally is erased by the closing bell

- NASDAQ:BBBY fell by 9.29% during Tuesday’s trading session.

- Retail traders are still hoping for another BBBY short squeeze.

- AMC, APE, GME all slump as Monday’s gains were erased.

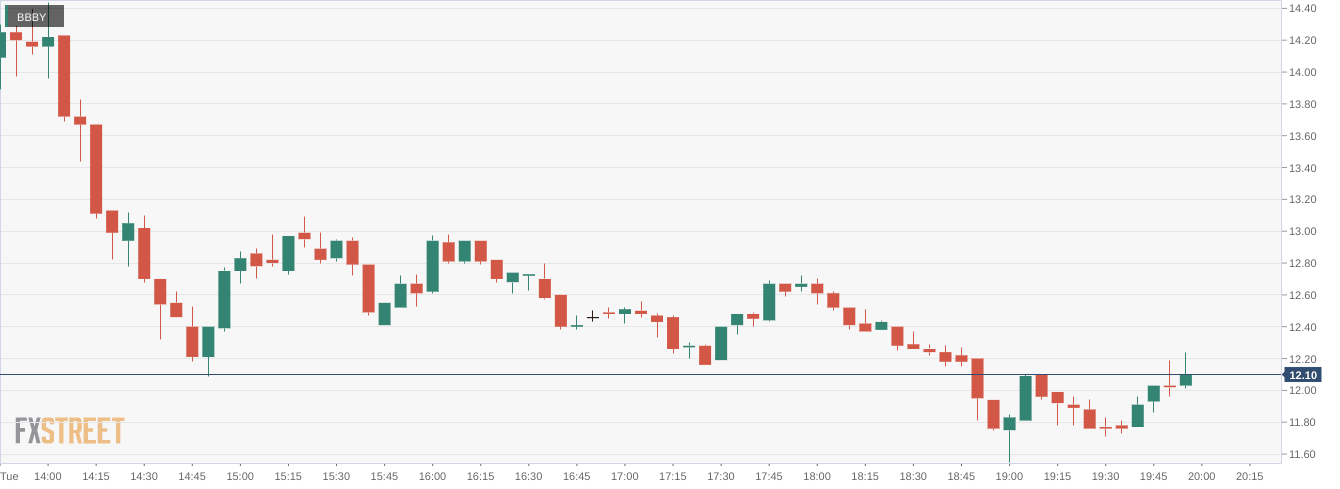

NASDAQ:BBBY could not extend its momentum from Monday’s session, as the home furnishing retailer prepares to deliver its turnaround plan on Wednesday. Shares of BBBY slumped lower by 9.29% on Tuesday and closed the trading day at a price of $12.11. Stocks extended their slide as all three major indices closed lower for the third consecutive day. The fallout from Chairman Powell’s Jackson Hole speech continued, buoyed by new economic data that suggests the US economy might be stronger than we think. Investors are anticipating that the Fed will continue its hawkish stance on lowering inflation. Overall, the Dow Jones dropped by 308 basis points, while the S&P 500 and the NASDAQ fell by 1.10% and 1.12% respectively during the session.

Stay up to speed with hot stocks' news!

Retail traders continue to look for a short squeeze opportunity with Bed Bath and Beyond. Even though GameStop (NYSE:GME) Chairman Ryan Cohen has sold his stake, it seems that meme stock traders continue to have interest. On Tuesday a staggering 106 million shares were traded, which is up from its recent daily average of 39 million shares. Whether another short squeeze happens or not is anyone’s guess, but the sentiment from retail traders cannot be denied.

BBBY stock price

Other meme stocks were falling alongside BBBY on Tuesday, as the entire sector succumbed to the market sell off. Shares of AMC (NYSE:AMC) and APE (NYSE:APE) fell by 2.11% and 14.05% respectively. This brings the ‘true value’ of AMC’s stock down to about $14.47 per share. GameStop was also trading lower as the stock fell by 5.42% which pushed the price below the $30.00 threshold.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet