BBBY Stock Forecast: Bed Bath & Beyond plummets as AMC, GameStop continue to sink

- NASDAQ:BBBY fell by 16.23% during Monday’s trading session.

- The aftermath of Ryan Cohen selling his stake in BBBY is not a pretty one.

- AMC begins listing its preferred shares that are trading under the ticker symbol APE.

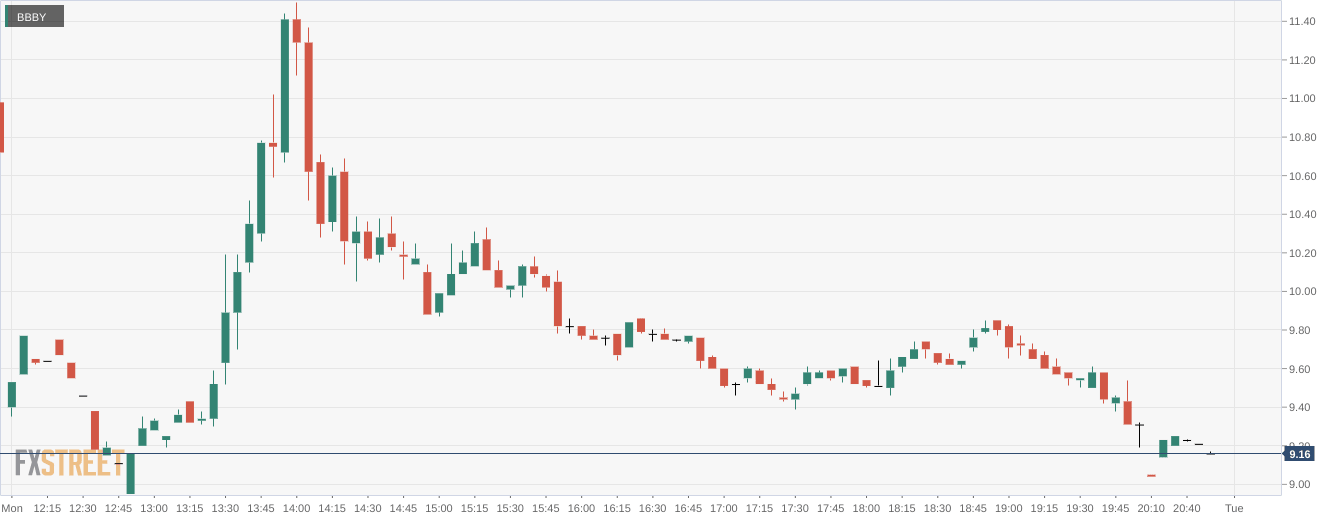

NASDAQ:BBBY has seen its improbably short squeeze run come to an end and many retail traders have been left holding the bag. On Monday, shares of BBBY tumbled by a further 16.23% and closed the trading session at a price of $9.24. Stocks pulled way back on Monday, erasing much of the recent summer rally. Investors seem apprehensive ahead of the Fed’s key Jackson Hole Symposium that will be held later this week. Overall, the Dow Jones tumbled by 643 basis points, while the S&P 500 and the NASDAQ slumped by 2.14% and 2.55% respectively during what was the worst trading day for stocks since June.

Stay up to speed with hot stocks' news!

The surprisingly abrupt end to the Bed Bath and Beyond meme stock is still resonating with meme stock traders. GameStop (NYSE:GME) Chairman Ryan Cohen sold his stake and all of his call options in the midst of a short squeeze, and took most of the profits. This obviously didn’t sit well with most traders, many of whom are still left holding the bag of a business that certainly does not have a favorable future. Almost all of the gains made from the short squeeze for BBBY have now been lost.

BBBY stock price

In other meme stock news, AMC (NYSE:AMC) debuted its controversial preferred shares that are trading under the ticker symbol NYSE:APE. While many Apes believed that this would save the stock, others saw the underlying dilution that this would cause. Shares of AMC tumbled by 41.92% and APE shares fell by 13.67% during its first day of trading.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet