BB Stock Forecast BlackBerry Ltd: Results dissapoint, valuation stretched

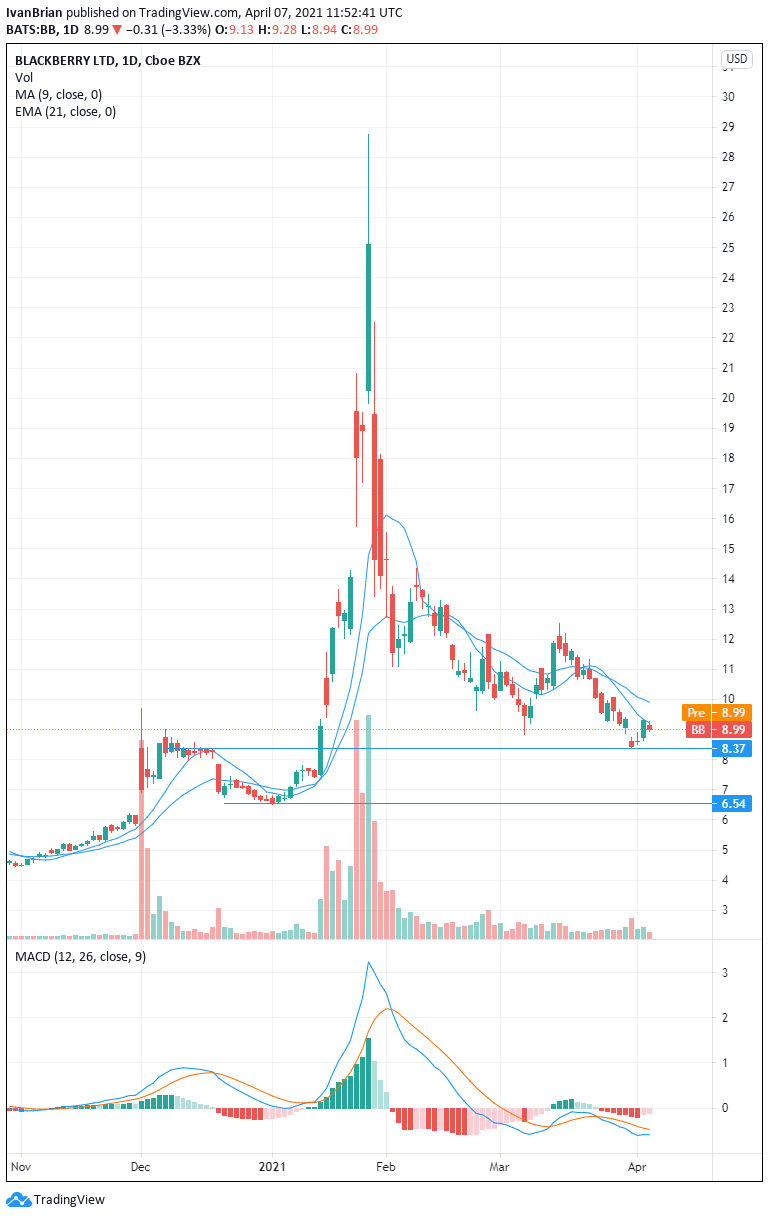

- BlackBerry shares have been steadily declining after the retail fizz of January.

- BB shares peaked at $28.77 in January but now below $9!

- BlackBerry results disappointed investors and missed analyst estimates.

"BB to the moon" was a familiar cry in the early stages of 2021 as the stock was one of the most popular buys with the retail investment community. GameStop, AMC and BB were probably the three most popular meme stocks in January and February. While the underlying fundamentals of each company made them questionable long-term investments, the retail argument was simpler. Find stocks that are overly shorted and create a self-fulfilling short squeeze. The move was brilliantly executed but saw many stocks stretched way too far on a fundamental valuation basis. BlackBerry has been falling steadily since February and recent results only added to the decline.

Stay up to speed with hot stocks' news!

Does BlackBerry stock pay dividends

Eh, nope. The honest answer is it does not have enough money to pay a dividend. So this part of the investment criteria is out of the way. Is there anything else investible here? After all, BlackBerry was the phone of choice for the savvy finance professional a mere ten to fifteen years ago before failing to move with the times and adapt to the smartphone revolution.

BlackBerry results

BB released Q4 results after the close on March 30. Results missed expectations and were highly disappointing. Revenue missed the $245 million estimate by $30 million and EPS was $0.03. GAAP results, which are stricter and more comparable, showed the situation was slightly worse.

BlackBerry blamed licensing problems for the miss as it looks to offload some of its licensing activities. The official Q4 release read:

"During the quarter BlackBerry entered into an exclusive negotiation with a North American entity for the potential sale of part of the patent portfolio relating primarily to mobile devices, messaging and wireless networking. The Company has limited its patent monetization activities due to the ongoing negotiations. If the Company had not been in negotiations during the quarter, we believe that licensing revenue would have been higher."

Overall everything about BlackBerry is screaming do not invest right now. The share price is obviously reflecting this sentiment, and even the usually bullish retail crowd appears to have deserted BlackBerry.

Technically, support at $8.37 is key and a break of this brings us to target $6.54. A break above moving average resistance would help change the short-term picture back in favour of the bulls who would then target $10. Overall though, a classic bearish trend is in place – lower highs and lower lows.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.