Bank Earnings Preview: Citigroup (C), JPMorgan (JPM), Wells Fargo (WFC)

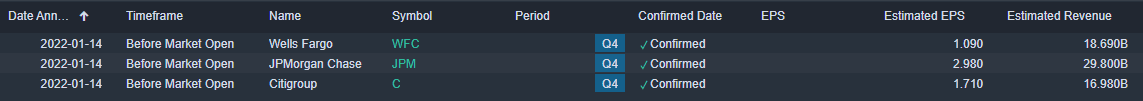

- Bank earnings season kicks off on Friday with JPMorgan, Wells Fargo and Citigroup.

- The financial sector is one of the best performers so far this year.

- XLF is up 6% year to date.

- Mergers & acquisitions, IPO and loan data is all strong for 2021.

Bank stocks kick off earnings season as they normally do with a decent slate lined up for Friday, January 14. Citigroup (C), Wells Fargo (WFC) and JPMorgan (JPM) will get things rolling nicely as they all report before Friday's market open. The environment so far in 2022 is more cautious with riskier assets lagging and the growth versus value rotation being talked up in favour of value.

The Fed has more or less penciled in a March rate hike, and investors have come to terms with this and remained enthusiastic over equity investments. Bank stocks traditionally are favoured in inflationary environments due to their margin growth capabilities once rate hikes are forthcoming. Commercial banks make the most money on the spread between deposits and lending rates. The higher rates go, the wider this spread can be pushed.

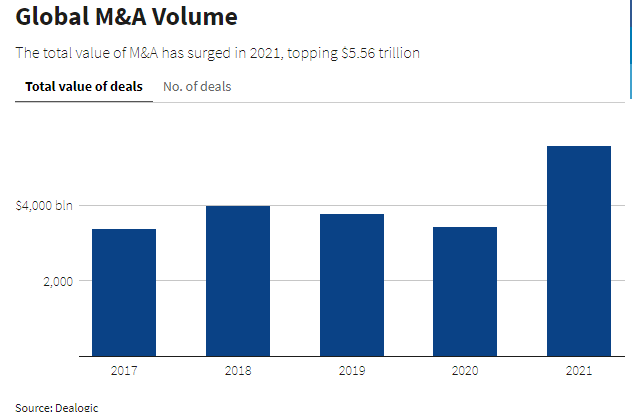

Widening our analysis to enter the investment banking sphere sees further catalysts for the sector in our view. 2021 marked a high point in deal activity in terms of M&A and IPOs. While 2022 is not expected to quite reach those heights, it should still be very healthy on a 10-year average. Interest rates will rise but are still at historically low levels. Credit remains cheap, and private equity will still be looking for potential accretive deals. Cash on deposit will remain a poor option for 2022, so corporates will increase corporate activity. That can be in the form of M&A or stock buybacks if no suitable target can be found.

Source: Reuters, via Dealogic

Indeed Reuters reports that M&A activity hit a 15-year high in 2021.

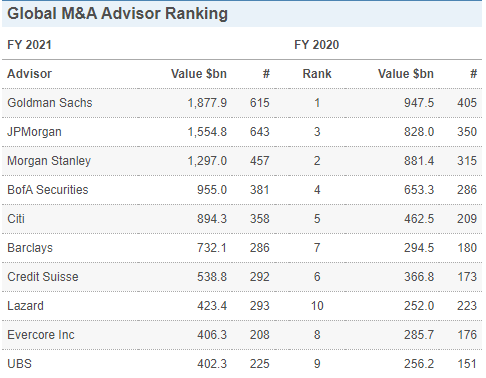

Source: Wall Street Journal, via Dealogic

From the above, we can see the top masters of the universe coined it again. Goldman (GS), Citi (C) and JPMorgan (JPM) have nearly doubled their M&A activity YoY. It is a similar story for IPO activity below.

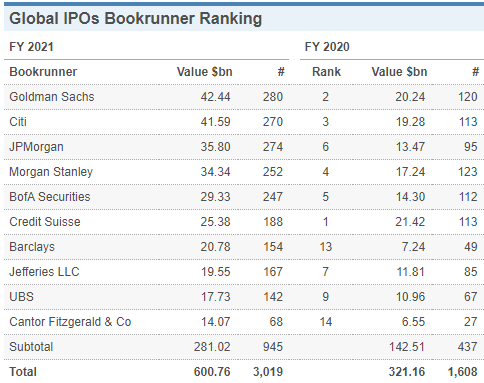

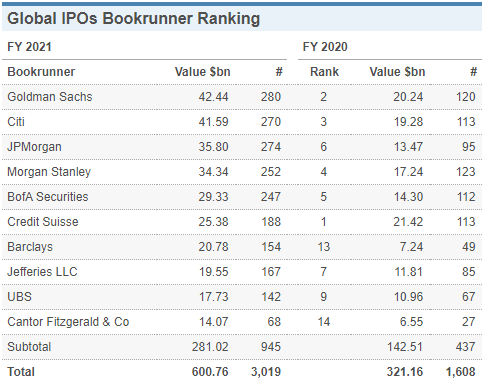

Source: Wall Street Journal, via Dealogic

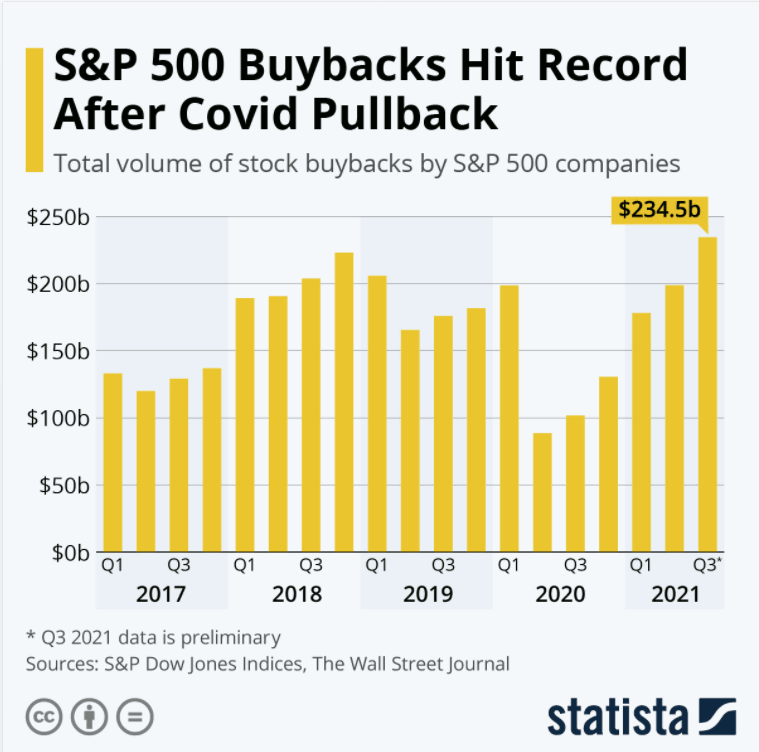

Stock buybacks are already at record levels. Investment banks mandated to carry out buybacks earn juicy fees for the buyback as well as notable market share. Stock buybacks reached a record level in 2021 and look set to continue that trend for 2022.

With the stockmarket remaining at elevated levels, demand to cash in from unlisted companies should see the IPO pipeline remain strong for 2022. The easy listing capability and access to huge pools of capital for a minimal amount of profit will see many start-up companies take the IPO route in 2022. Investor appetite may wane slightly compared to last year but will still be strong. Notably in sectors of choice, such as EVs, cannabis and tech.

Source: Wall Street Journal via Dealogic

Again the big beasts in the banking world have more than doubled their IPO deal activity in 2021 versus 2020.

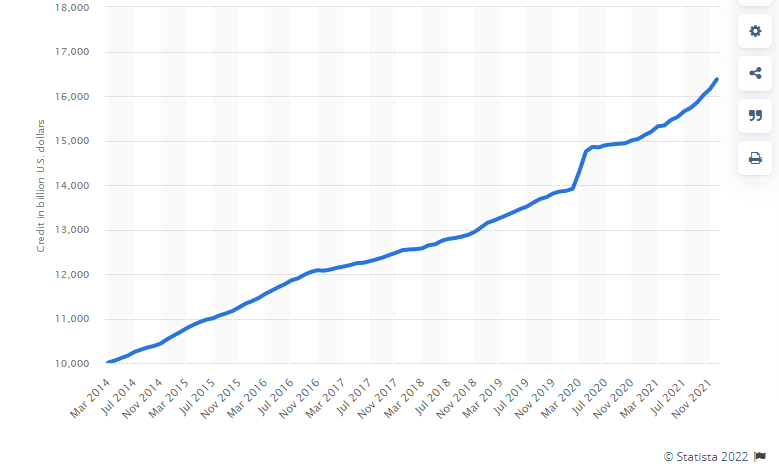

Commercial loan activity continues to grow strongly with demand for credit near a 10-year high. With interest rates rising and credit demand strong, we expect commercial banking activities to grow in robust fashion in 2022.

Source: Statista. Value of loans of all commercial banks in the US.

The background remains positive for commercial and investment banking activity. We, therefore, expect banks to perform confidently for the year ahead as one of our top sector picks.

Source: Benzinga Pro

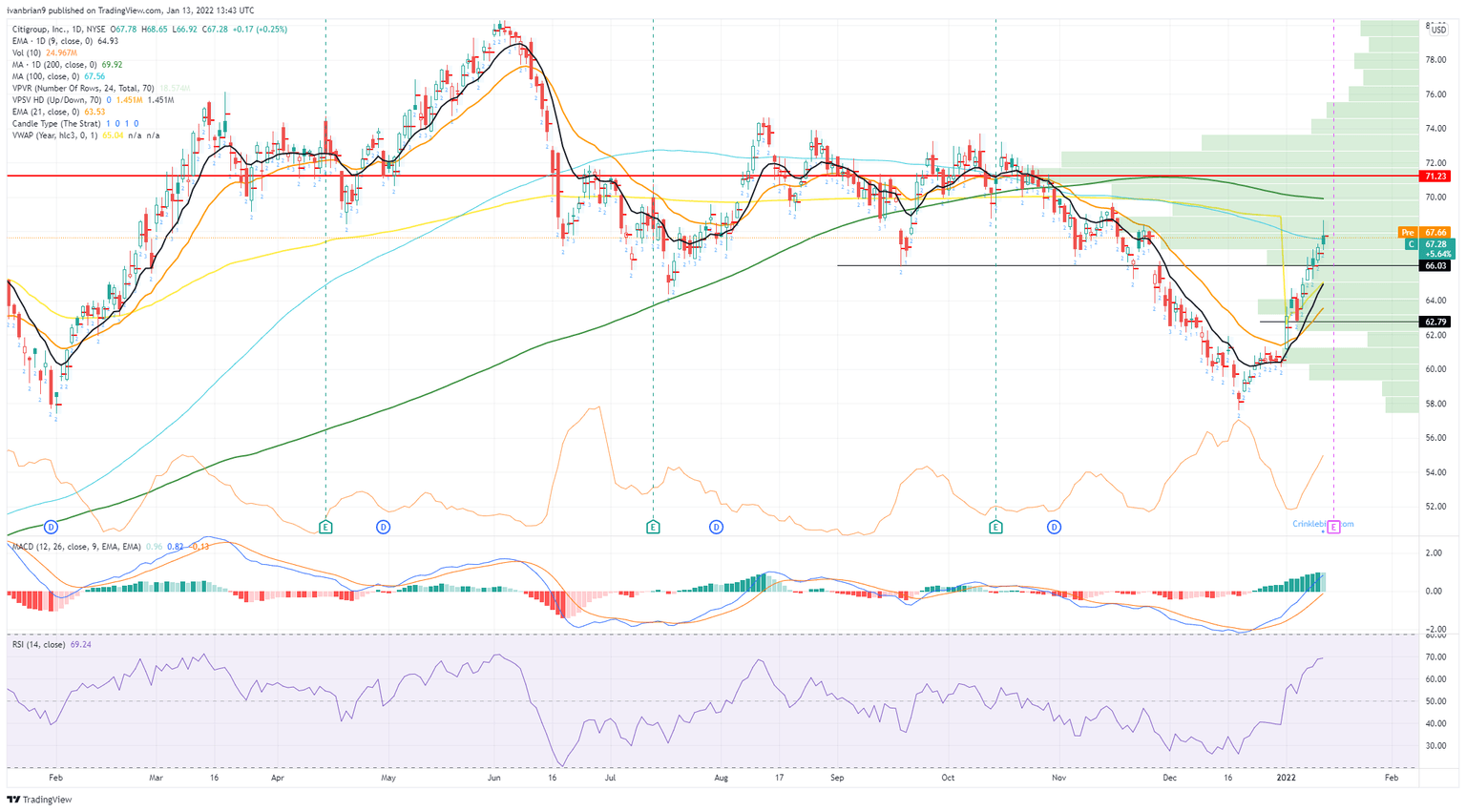

Citigroup (C) stock forecast

Citigroup (C) is expected to post earnings per share of $1.71 on revenue of just under $17 billion for Q4 2021. Citi has beaten earnings estimates on the top and bottom lines repeatedly. In fact, the last miss on revenue was a small 1% miss in Q4 last year and then it is back to 2019 before revenue missed estimates again.

Earnings per share (EPS), meanwhile, is even more impressive with 2015 seeing the last miss. However, we must exercise caution. While we have outlined a very bullish case for the banking sector above, this is a long-term view for 2022. Citi stock has already priced in much of this earnings upside. Citi stock is up 11% so far for 2022, so momentum will be hard to sustain unless earnings show a strong beat. We would ideally like to see revenue well ahead as revenue growth has slowed.

Source: Trefis.com

Technically, we remain bullish on the chart above $62.79. This is the pullback test after the strong move on January 3.

Citi (C) chart, daily

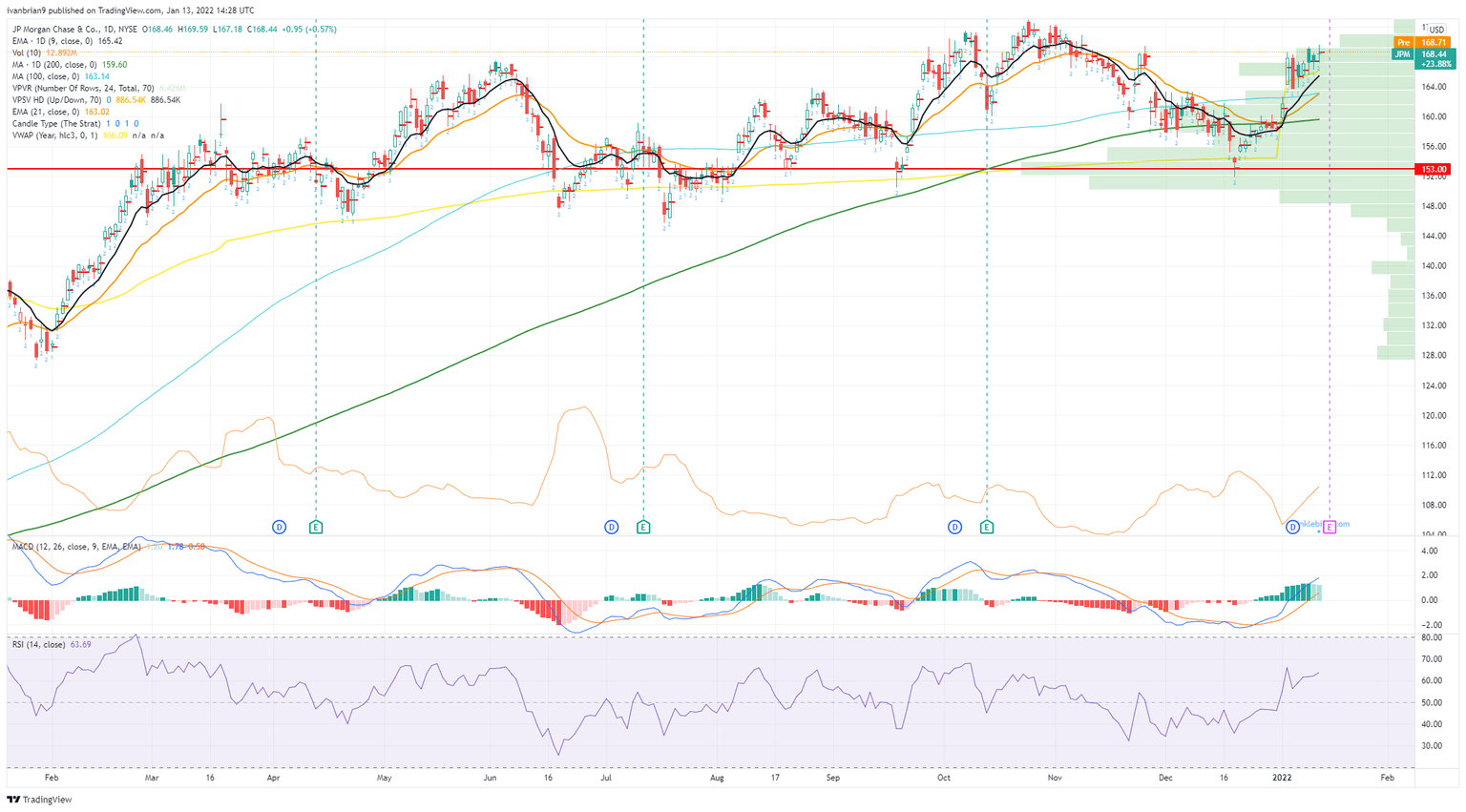

JPMorgan (JPM) stock forecast

Again for JPMorgan, we predict a beat on top and bottom lines, but we must caution against jumping in too quickly. The stock has not reacted well to previous earnings announcements despite strong beats. Just as with Citigroup, there is a strong run-up into earnings, so the beat will need to be significant in our view to maintain this momentum. JPMorgan is expected to post earnings per share of $2.98 and revenue of $29.8 billion. Again revenue growth is not impressive with this result if matched, meaning a modest gain of 2% yearly and a fall in EPS.

JPMorgan (JPM) chart, daily

Again the breakout in January, similar to Citi, needs to hold for the short-term trend to remain bullish. This pivot is at $164.

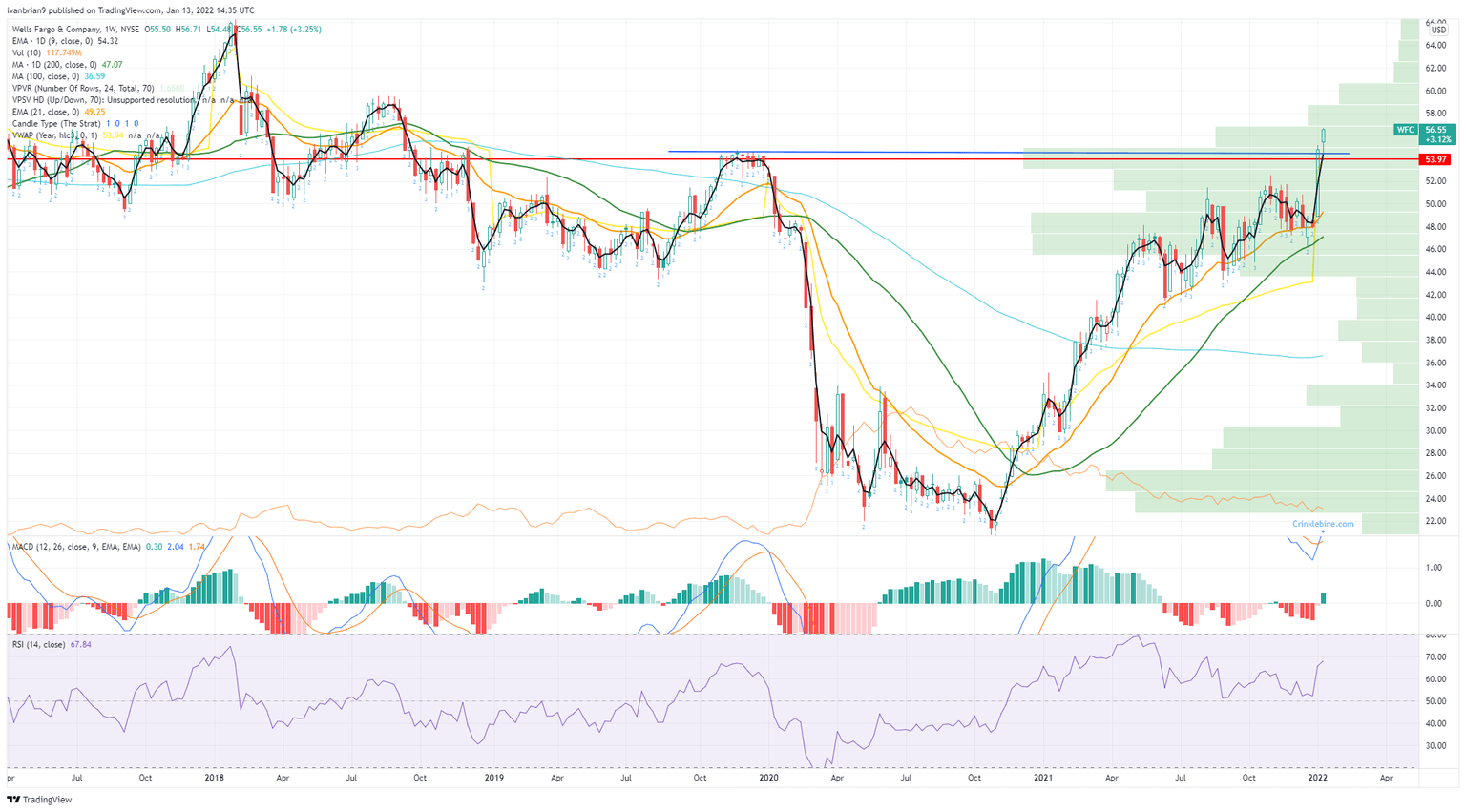

Wells Fargo (WFC) stock forecast

Wells Fargo (WFC) is expected to post earnings per share of $1.09 on revenue of $18.69 billion. These numbers if matched would show a near 10% gain in EPS growth but again revenue staying more or less flat. However, revenue growth versus Q4 last year would be solid circa 4%. Wells is the more retail-orientated with less exposure than Citi or JPMorgan to investment banking but should still benefit from an accommodative macro background. Notably, Wells (WFC) stock has also spiked this year and is up 17% year to date. The stock has recently broken above key resistance at $54.43 and needs to hold here to remain bullish in our view.

Wells Fargo (WFC) chart, weekly

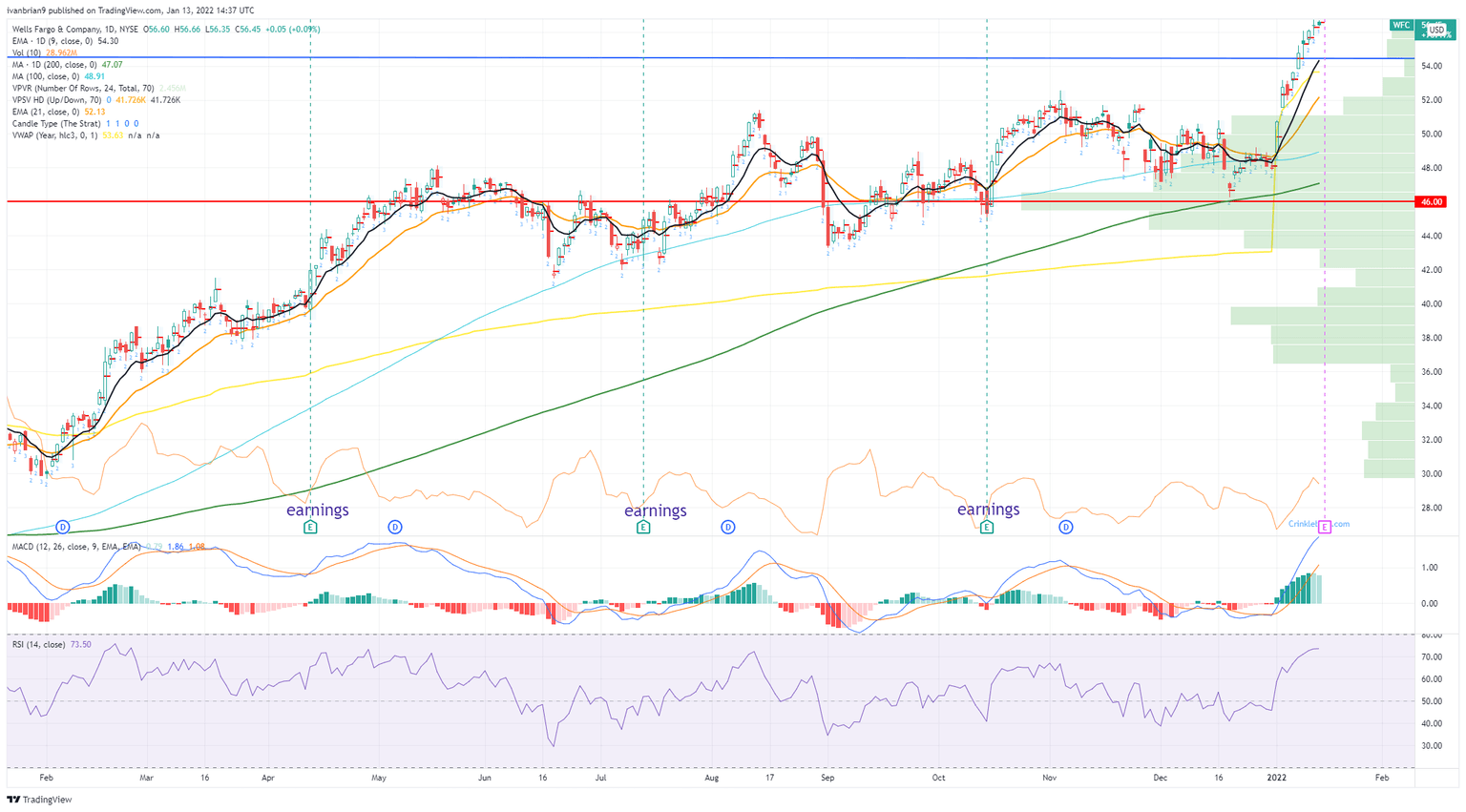

Returning to the daily chart, we can see WFC stock reactions to earnings have been more positive than is the case for Citi (C) and JPMorgan (JPM).

Wells Fargo (WFC) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.