Bajaj Finance Elliott Wave technical analysis [Video]

![Bajaj Finance Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/General-Stocks_1_XtraLarge.png)

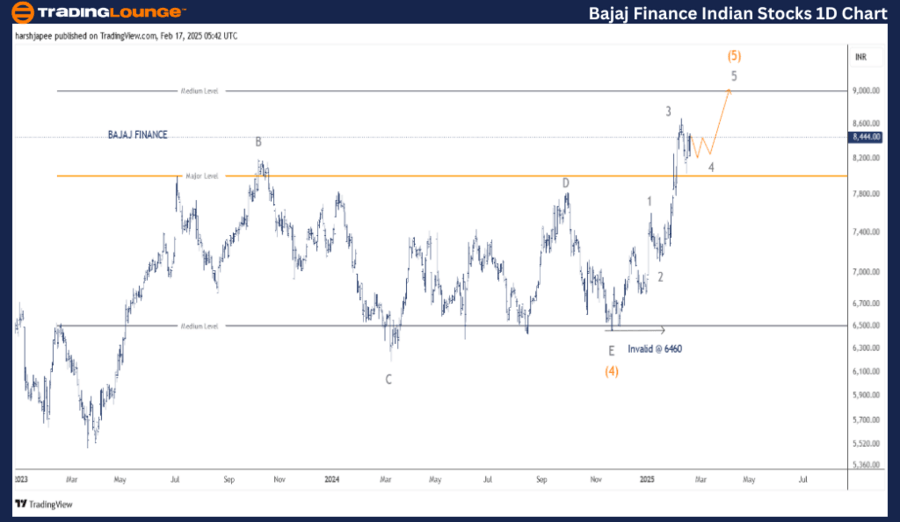

Bajaj Finance Elliott Wave technical analysis

-

Function: Larger Degree Trend Higher (Intermediate Degree Orange).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Minor Wave 3 Grey.

-

Details: Minor Wave 3 Grey is advancing higher against 6460.

-

Invalidation point: 6460.

Bajaj Finance daily chart technical analysis and potential Elliott Wave counts

The BAJAJ FINANCE daily chart shows that bulls are driving prices higher towards at least 9000 levels, marking the completion of the larger degree uptrend (Intermediate Wave (5) Orange).

A potential Minor Wave 4 could be forming as an expanded flat or triangle before the final push higher. Previously, Intermediate Wave (4) ended around 6460 in November 2024, following a multi-year triangle that started in March 2023. Since then, Intermediate Wave (5) has been unfolding as an impulse, with the stock still having one more leg towards the 9000–9200 zone.

Bajaj Finance Elliott Wave technical analysis

-

Function: Larger Degree Trend Higher (Intermediate Degree Orange).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Minor Wave 3 Grey

-

Details: Minor Wave 3 Grey is advancing higher against 6460, potentially completing at 8665 or near completion. If correct, a triangle Wave 4 could be developing before Wave 5 pushes higher towards 9000 levels.

-

Invalidation Point: 6460.

Bajaj Finance four-chart technical analysis and potential Elliott Wave counts

The BAJAJ FINANCE 4H chart highlights sub-waves within Intermediate Wave (5) Orange following the completion of Wave (4) as a triangle near 6460 in November 2024.

The thrust of Wave (5) is unfolding as an impulse, with a projection to break through the 9000 level swiftly.

- Minor Wave 1 formed as a leading diagonal, terminating around 7600.

- Wave 2 was a sharp correction, ending near 7120.

- Wave 3 pushed higher to 8665.

If this structure holds, Wave 4 may form a triangle before the final push. Prices must stay above 7600 for bulls to maintain the impulse wave.

Conclusion

BAJAJ FINANCE continues to progress higher within Minor Wave 3 of Intermediate Wave (5), aiming for 9000 levels in the coming sessions.

Bajaj Finance Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.