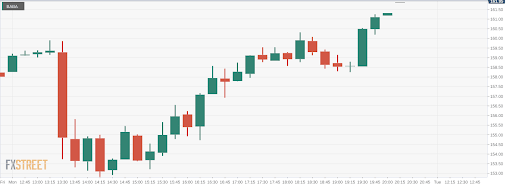

BABA Stock News: Alibaba Group Holding soars as government crackdown eases

- NYSE:BABA jumped by 6.61% on Tuesday alongside a broader Chinese stock rally.

- AliBaba wasn’t the only ADR to rebound on Tuesday as many of its competitors also surged.

- JD.Com and PinDuoDuo reported their second quarter earnings recently.

NYSE:BABA has finally put together back to back positive sessions as the stock is now up nearly 10% over the past two days. On Tuesday, shares of BABA had their single largest gain in several months as the stock jumped by 6.61% and closed the session at $171.70. The stock is still down nearly 50% from its 52-week high price of $319.32, but investors must be relieved that it appears to have finally found a bottom. One catalyst that has helped Chinese stocks recover is the fact that the country seems to have curbed the recent COVID-19 Delta Variant breakout.

Stay up to speed with hot stocks' news!

The Chinese government relented on its recent crackdown, and issued regulatory clarity that was met with enthusiasm from investors. After months of probes and investigations into antitrust and data sharing policies, it seems as though the CCP is finally starting to take the pressure off of its big tech companies. Alongside AliBaba, we saw JD.com (NASDAQ:JD) gain 14.44%, PinDuoDuo (NASDAQ:PDD) surge by 22.25%, and Tencent (TCEHY) climb by 9.49% during Tuesday’s session. This is not to say that the Chinese stocks are out of the danger zone yet, but Tuesday’s action potentially signalled that the end may be near for the recent correction.

BABA stock price target

On Tuesday, PinDuoDuo reported its second quarter earnings and investors were pleased to see a surprise profit for the quarter. Revenues missed the mark but still represented an impressive 89% growth year over year, as well as a 30% spike in monthly active users. JD.Com also reported its earnings late last week, and it was able to beat Wall Street estimates on revenues and earnings per share. JD.Com also reported its highest ever monthly active user growth, and has led to the stock’s tidy rebound over the last two sessions.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet