Australia’s Unemployment Rate steadies at 4.1% in September vs. 4.2% expected

Australia’s Unemployment Rate came in at 4.1% in September, slightly below the market consensus of 4.2%, according to the official data released by the Australian Bureau of Statistics (ABS) on Thursday. The Unemployment Rate was stable compared with the previous month's figure, which was downwardly revised from 4.2% to 4.1%.

Furthermore, the Australian Employment Change arrived at 64.1K in September from 42.6K in August (revised from 47.5K), compared with the consensus forecast of 25.0K.

The participation rate in Australia rose to 67.2% in September, compared to 67.1% in August. Meanwhile, Full-Time Employment increased by 51.6K in the same period from -5.9K (revised from -3.1K) in the previous reading. The Part-Time Employment increased by 12.5K in September versus 48.5K (revised from 50.6K) prior.

Bjorn Jarvis, ABS head of labour statistics, said with the key highlights noted below

With employment rising by around 64,000 people and the number of unemployed falling around 9,000, the unemployment rate remained at 4.1 per cent, where it has generally been over the past six months.

Employment has risen by 3.1 per cent in the past year, growing faster than the civilian population growth of 2.5 per cent. This has contributed to the increase in the employment-to-population ratio by 0.1 percentage point, and 0.4 percentage points over the past year, to a new historical high of 64.4 per cent.

The record employment-to-population ratio and participation rate shows that there are still large numbers of people entering the labour force and finding work in a range of industries, as job vacancies continue to remain above pre-pandemic levels.

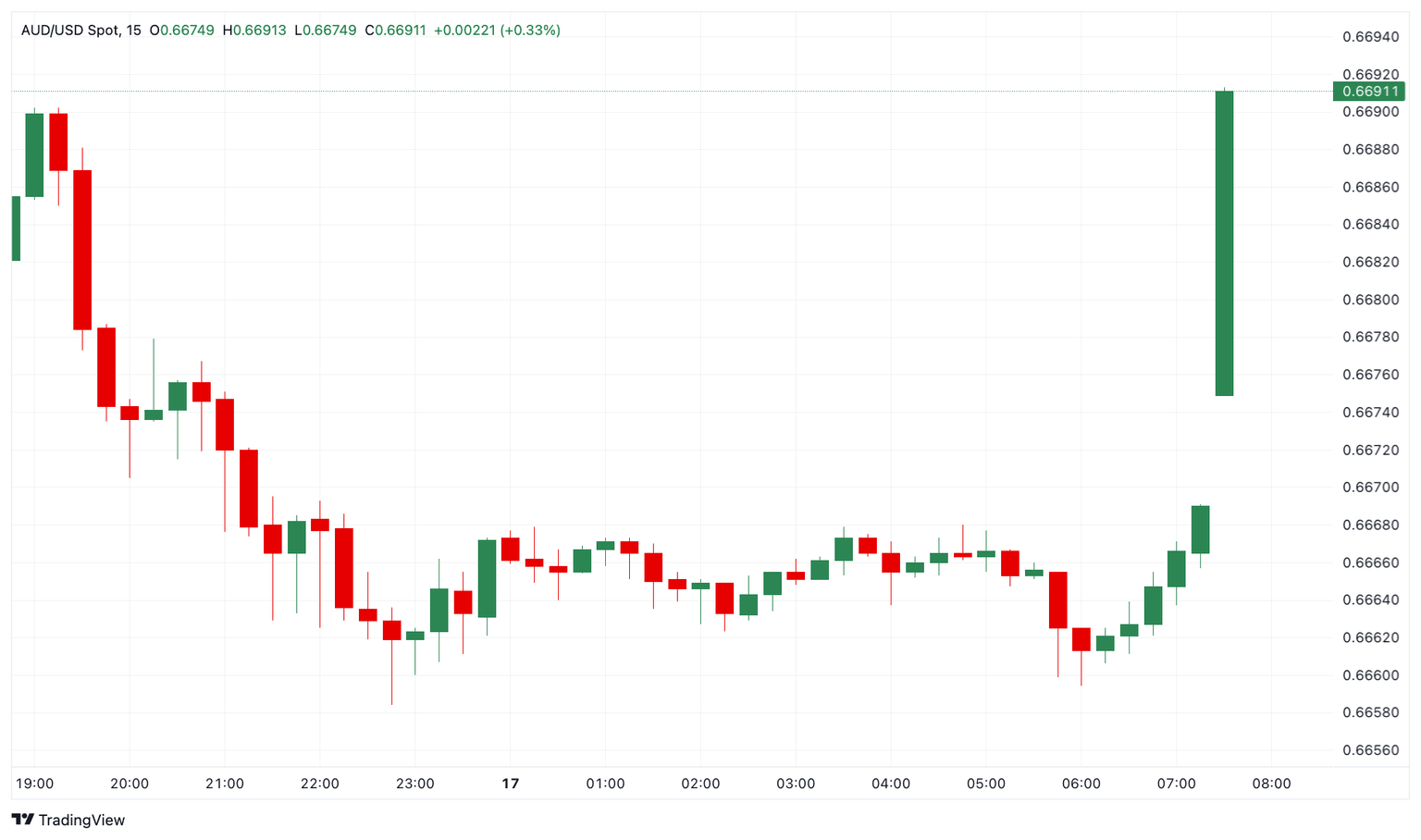

AUD/USD reaction to the Australia Employment report

The Australian Dollar attracts some buyers in an immediate reaction to the upbeat Australian Employment report. The AUD/USD pair is trading at 0.6691, adding 0.37% on the day.

(This story was corrected on October 17 at 05:55 GMT to say, in the headline and first paragraph, that Australia's unemployment rate remained steady, not declined.)

Australian Dollar price in the last 7 days

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies in the last 7 days. Australian Dollar was the strongest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.74% | 0.58% | 0.31% | 0.36% | 0.26% | 0.12% | 0.61% | |

| EUR | -0.74% | -0.15% | -0.43% | -0.37% | -0.46% | -0.64% | -0.13% | |

| GBP | -0.58% | 0.16% | -0.27% | -0.22% | -0.31% | -0.48% | 0.03% | |

| CAD | -0.31% | 0.42% | 0.27% | 0.05% | -0.04% | -0.21% | 0.29% | |

| AUD | -0.36% | 0.37% | 0.22% | -0.07% | -0.12% | -0.26% | 0.24% | |

| JPY | -0.26% | 0.45% | 0.31% | 0.03% | 0.08% | -0.16% | 0.33% | |

| NZD | -0.12% | 0.62% | 0.47% | 0.19% | 0.25% | 0.17% | 0.51% | |

| CHF | -0.61% | 0.14% | -0.02% | -0.29% | -0.24% | -0.34% | -0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

This section below was published at 20:30 GMT on Thursday as a preview of the Australia Employment report

- The Australian Unemployment Rate is foreseen stable at 4.2% in September.

- Employment Change is expected at 25K, focus will be on the details.

- AUD/USD is technically bearish, so any data-inspired spike may attract sellers.

The Australian Bureau of Statistics (ABS) will release the monthly employment report at 00:30 GMT on Thursday. The country is expected to have added 25K new positions in September, while the Unemployment Rate is foreseen stable at 4.2%. The Australian Dollar (AUD) has weakened against the US Dollar (USD) ahead of the event, with the AUD/USD pair trading below the 0.6700 mark.

The ABS reports Employment Change separating full-time from part-time positions. According to its own definitions, full-time jobs imply working 38 hours per week or more and usually include additional benefits, but they mostly represent consistent income. On the other hand, part-time employment generally means higher hourly rates but lacks consistency and benefits. That’s why full-time jobs have more weight than part-time ones when setting the directional path for the AUD.

Back in August, the monthly employment report showed that Australia managed to create 50.6K part-time jobs while losing 3.1K full-time positions, resulting in a net Employment Change of 47.5K. The Unemployment Rate, in the meantime, stayed at 4.2%.

Australian Unemployment Rate seen steady in September

As previously noted, financial markets anticipate the Unemployment Rate to be at 4.2%. If that’s the case, it will be the third consecutive reading at such a level. Job creation, in the meantime, is foreseen to have grown at a solid pace.

However, market players will be more attentive to details. The strong headline figure from August showed that most jobs created were part-time, while the country lost full-time positions. That’s usually bad news for the economy, regardless of the total. Still, it could be seen as good news regarding monetary policy updates.

The creation of part-time positions, generally understood to have lower wages and fewer benefits than their counterparts, is usually seen as a weakness in the labor market.

The Reserve Bank of Australia (RBA) is in no rush to trim the interest rate. The Official Cash Rate (OCR) has been steady at 4.35% for almost a year now, as the labor market has remained tight. Indeed, it helped bring headline inflation down towards the RBA’s goal to between 2% and 3%, with core inflation still high. Besides easing inflation, the RBA requires a looser job sector to ease the monetary policy.

With that in mind, the sharp increase in part-time jobs in August sparked a bit of hope among those expecting the RBA will soon start lowering the OCR. But a swallow does make a summer. A one-stand macroeconomic report signaling in the “right” direction is not enough. However, if September employment figures point in the same direction, there is a good chance market players will start pricing in an interest rate cut. Three reports in a row will be heaven for doves.

In the meantime, RBA Governor Michele Bullock repeated after the September meeting that underlying inflation remains too high and that the time to trim interest rates has not yet come. At the time being, market players are betting the central bank will deliver a rate cut in February 2025.

When will the Australian employment report be released, and how could it affect AUD/USD?

The ABS will publish the September employment report early on Thursday. As previously stated, Australia is expected to have added 25K new job positions in the month, while the Unemployment Rate is foreseen at 4.2%. Finally, the Participation Rate is expected to hold at 67.1%.

Generally speaking, a strong report will boost the AUD, even if the larger increase comes from part-time jobs. Any weak underlying subcomponent will likely fuel hopes of rate cuts, but not enough to trigger an AUD sell-off. The opposite case is also valid, with soft figures putting pressure on the Aussie.

Ahead of the announcement, the AUD/USD pair trades a handful of pips below the 0.6700 mark and is technically bearish.

Valeria Bednarik, Chief Analyst at FXStreet, notes: “The AUD/USD pair is trading below the 61.8% Fibonacci retracement of the 0.6621-0.6941 rally at 0.6743, meaning there is a good chance the pair will soon test the bottom of the range. The bearish case is also being supported by technical indicators, as the Momentum and the Relative Strength Index (RSI) head firmly south well below their midlines in the daily chart, reflecting persistent selling interest. At the same time, the pair is currently battling with a directionless 100 Simple Moving Average (SMA) while the 20 SMA gains bearish traction over 100 pips above the current level.”

Bednarik adds: “AUD/USD may surge towards the aforementioned Fibonacci resistance level with an upbeat report, but given the dominant trend, sellers may take their chances around it once the dust settles. Near-term support comes at 0.6670 en route to the 0.6620 price zone. A break below the latter should favor a near-term extension towards a strong static support area surrounding the 0.6570 mark.”

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Economic Indicator

Unemployment Rate s.a.

The Unemployment Rate, released by the Australian Bureau of Statistics, is the number of unemployed workers divided by the total civilian labor force, expressed as a percentage. If the rate increases, it indicates a lack of expansion within the Australian labor market and a weakness within the Australian economy. A decrease in the figure is seen as bullish for the Australian Dollar (AUD), while an increase is seen as bearish.

Read more.Next release: Thu Oct 17, 2024 00:30

Frequency: Monthly

Consensus: 4.2%

Previous: 4.2%

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) publishes an overview of trends in the Australian labour market, with unemployment rate a closely watched indicator. It is released about 15 days after the month end and throws light on the overall economic conditions, as it is highly correlated to consumer spending and inflation. Despite the lagging nature of the indicator, it affects the Reserve Bank of Australia’s (RBA) interest rate decisions, in turn, moving the Australian dollar. Upbeat figure tends to be AUD positive.

Author

FXStreet Team

FXStreet