Australian Dollar maintains position ahead of Michigan Consumer Sentiment Index

- The AUD/USD pair appreciates as US data reinforce the likelihood of an aggressive Fed rate cut next week.

- The US Producer Price Index rose above expectations, driven by higher service costs.

- Fed is expected to deliver a 25-basis points interest rate cut at its September meeting.

The AUD/USD extends its upside for the third successive session on Friday as economic data from the United States (US) reinforced the possibility that the Federal Reserve (Fed) could lower interest rates by 50 basis points next week.

The US Labor Department reported that Initial Jobless Claims for the previous week increased as anticipated, surpassing the previous week’s figures. Additionally, US factory inflation rose above expectations, driven by higher service costs. Investors shift their focus to the Michigan Consumer Sentiment Index, which is scheduled for Friday.

According to the CME FedWatch Tool, markets are fully anticipating at least a 25 basis point (bps) rate cut by the Federal Reserve at its September meeting. The likelihood of a 50 bps rate cut has sharply increased to 41.0%, up from 14.0% a day ago.

The Australian Dollar (AUD) received support as the Reserve Bank of Australia (RBA) Governor Michele Bullock has maintained a hawkish outlook, saying last week that it is too soon to consider rate cuts as inflation remains too high.

Daily Digest Market Movers: Australian Dollar extends upside due to improved risk sentiment

- The US Producer Price Index (PPI) rose to 0.2% month-on-month in August, exceeding the forecasted 0.1% increase and the previous 0.0%. Meanwhile, core PPI accelerated to 0.3% MoM, against the expected 0.2% rise and July’s 0.2% contraction.

- US Initial Jobless Claims rose slightly higher for the week ended September 6, increasing to the expected 230K from the prior 228K reading.

- The former Reserve Bank of Australia (RBA) Governor Bernie Fraser criticized the current RBA Board for being overly focused on inflation at the expense of the job market. Fraser suggested that the Board should lower the cash rate, warning of "recessionary risks" that could have severe consequences for employment.

- Australia’s Consumer Inflation Expectations eased to 4.4% in September, down slightly from August's four-month high of 4.5%. This decline highlights the central bank's efforts to balance bringing inflation down within a reasonable timeframe and maintaining gains in the labor market.

- The US Consumer Price Index dipped to 2.5% year-on-year in August, from the previous reading of 2.9%. The index has fallen short of the expected 2.6% reading. Meanwhile, headline CPI stood at 0.2% MoM.

- US core CPI ex Food & Energy, remained unchanged at 3.2% YoY. On a monthly basis, core CPI rose to 0.3% from the previous 0.2% reading.

- The first US presidential debate between former President Donald Trump and Democratic nominee Kamala Harris in Pennsylvania was won by Harris, according to a CNN poll. The debate began with a critical focus on the economy, inflation, and economic policies.

- On Wednesday, Sarah Hunter, the Reserve Bank of Australia's (RBA) Assistant Governor for Economics, remarked that high interest rates are suppressing demand, which is expected to lead to a mild economic downturn. Hunter also pointed out that the labor market remains tight relative to full employment levels, with employment growth projected to continue, though slower than population growth, according to Reuters.

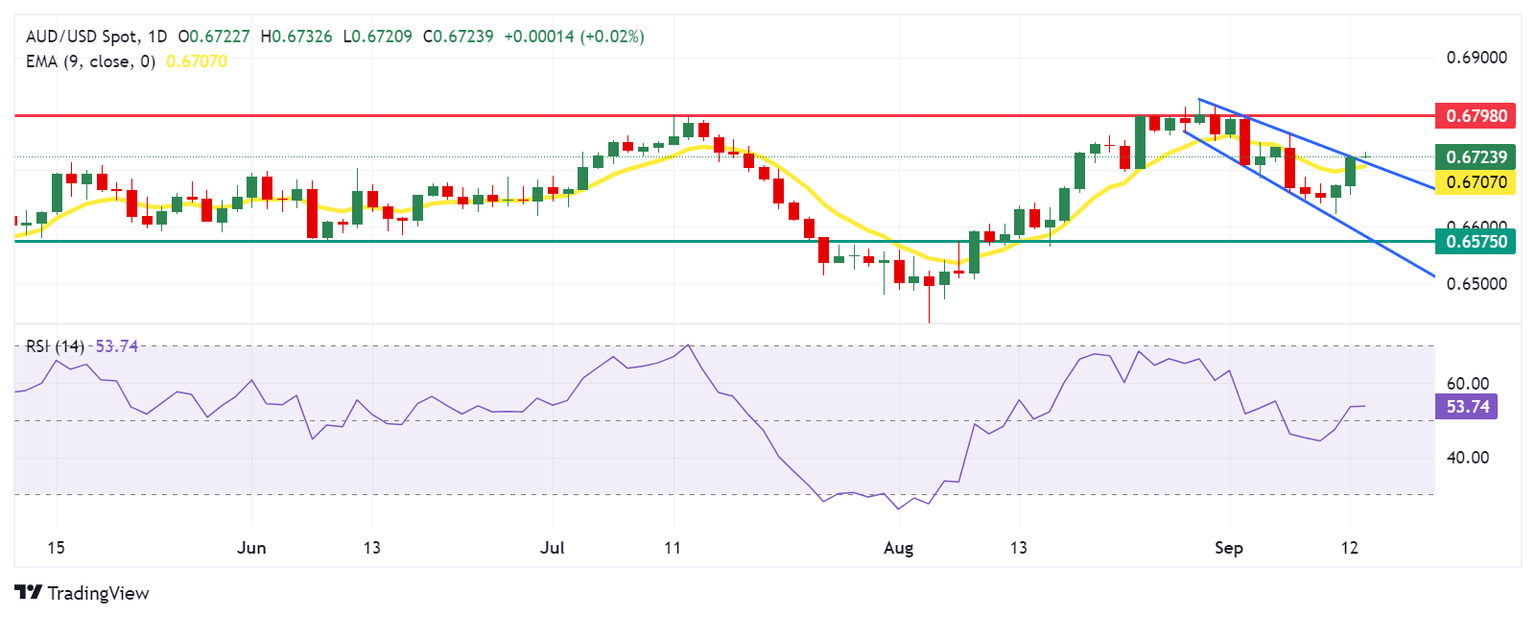

Technical Analysis: Australian Dollar moves above 0.6700, nine-day EMA

The AUD/USD pair trades near 0.6730 on Friday. Technical analysis of the daily chart indicates that the pair has broken above the descending channel, signaling a weakening bearish bias. Additionally, the 14-day Relative Strength Index (RSI) has moved above the 50 level, suggesting a shift in momentum from a bearish to a bullish trend.

On the upside, the AUD/USD pair may explore the region around its seven-month high of 0.6798, aligned with a psychological level of 0.6800.

On the downside, the AUD/USD pair could find immediate support around the upper boundary of the descending channel near 0.6720, followed by the nine-day Exponential Moving Average (EMA) at 0.6707 level.

A return to the descending channel would reinforce the bearish bias and lead the pair to navigate the region around the lower boundary of the descending channel around 0.6600, followed by the throwback support zone near 0.6575.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.15% | -0.72% | -0.00% | 0.00% | -0.04% | -0.22% | |

| EUR | 0.08% | -0.08% | -0.66% | 0.06% | 0.07% | 0.10% | -0.14% | |

| GBP | 0.15% | 0.08% | -0.56% | 0.12% | 0.15% | 0.20% | -0.06% | |

| JPY | 0.72% | 0.66% | 0.56% | 0.73% | 0.73% | 0.75% | 0.52% | |

| CAD | 0.00% | -0.06% | -0.12% | -0.73% | -0.02% | 0.07% | -0.21% | |

| AUD | -0.00% | -0.07% | -0.15% | -0.73% | 0.02% | 0.05% | -0.21% | |

| NZD | 0.04% | -0.10% | -0.20% | -0.75% | -0.07% | -0.05% | -0.26% | |

| CHF | 0.22% | 0.14% | 0.06% | -0.52% | 0.21% | 0.21% | 0.26% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Sep 13, 2024 14:00 (Prel)

Frequency: Monthly

Consensus: 68

Previous: 67.9

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.