Australian Dollar stalls rebound as US-China trade war fears mount

- The Australian Dollar grapples to gain ground amid rising fears of the US-China trade war.

- China slapped a 15% tariff on US coal and LNG imports, along with an additional 10% tariff on crude Oil.

- Trump would suspend his tariffs after both countries agreed to send 10,000 soldiers to the US border to prevent drug trafficking.

The Australian Dollar (AUD) struggles as US-China trade war fears increase after China retaliated against the new 10% US tariff that came into effect on Tuesday. China’s Commerce Ministry announced that it will impose a 15% tariff on US coal and liquefied natural gas (LNG) imports, along with an additional 10% tariff on crude Oil, farm equipment, and certain automobiles. Additionally, to "safeguard national security interests," China is implementing export controls on tungsten, tellurium, ruthenium, molybdenum, and related products.

The AUD/USD pair faced challenges as market volatility remains a concern as investors closely watch developments in the ongoing trade war between the US and China, Australia’s key trading partner. Trump stated on Monday afternoon that he would likely speak with China within the next 24 hours. He also warned, "If we can't reach a deal with China, the tariffs will be very, very substantial."

President Trump stated that he would suspend steep tariffs on Mexico and Canada after their leaders agreed to deploy 10,000 soldiers to the US border to combat drug trafficking. The tariffs on Mexico and Canada have been postponed for at least 30 days. This decision comes just two days after Trump imposed 25% tariffs on Mexican and Canadian goods and 10% tariffs on imports from China.

According to the Financial Times, Chinese exporters are intensifying their efforts to offshore production in response to Trump’s tariffs. Manufacturers in China are accelerating plans to relocate production to other countries, including the Middle East, to avoid US tariffs. Other tactics being considered include passing the increased costs onto US consumers and exploring alternative markets.

The AUD may lose its ground due to the increased likelihood that the Reserve Bank of Australia (RBA) could consider a rate cut in February. The RBA has maintained the Official Cash Rate (OCR) at 4.35% since November 2023, emphasizing that inflation must “sustainably” return to its 2%-3% target range before any policy easing. A Westpac's note suggests that confidence in the RBA starting to cut rates at its February 18 Board meeting is expected to remain steady this week. Westpac continues to forecast 100 basis points of rate cuts in 2025, while market expectations are slightly more conservative.

Australian Dollar appreciates due to improved risk sentiment

- The US Dollar Index (DXY), which measures the US Dollar’s value against six major currencies, stabilizes around 108.70 at the time of writing after giving up most of its gains in the previous session.

- The White House announced late Monday that US President Donald Trump signed an executive order to initiate the creation of a government-owned investment fund, according to Reuters. This fund could allow the US to profit from TikTok if an American buyer is secured. TikTok has until early April to find an approved partner or purchaser. Trump is pushing for the US to acquire a 50% stake in the company.

- In a radio interview, Federal Reserve Bank of Chicago President Austan Goolsbee, as reported by Reuters, mentioned that due to uncertainties, the Fed will likely need to be more cautious and prudent when considering rate cuts. He highlighted the risks that inflation could rise again.

- Data released by the Institute for Supply Management (ISM) on Monday showed that the Manufacturing PMI rose to 50.9 in January from 49.3 in December. This reading came in better than the estimation of 49.8.

- The US Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, rose 0.3% MoM in December, up from 0.1% in November. On an annual basis, PCE inflation accelerated to 2.6% from the previous 2.4%, while core PCE, which excludes food and energy, remained steady at 2.8% YoY for the third straight month.

- Fed Chair Jerome Powell emphasized during the post-meeting press conference that the central bank would need to see “real progress on inflation or some weakness in the labor market” before considering any further adjustments to monetary policy.

- US Treasury Secretary Scott Bessent warned Key Square Capital Management partners a year ago that “tariffs are inflationary and would strengthen the US Dollar—hardly a good starting point for a US industrial renaissance.” However, according to the Financial Times (FT), Bessent last week advocated for new universal tariffs on US imports, proposing an initial 2.5% rate that would gradually increase.

- President Trump announced his threat on X (formerly Twitter) to levy 100% tariffs on BRICS nations if they attempt to introduce an alternative currency to challenge the US dollar in international trade.

- Australia’s Retail Sales declined by 0.1% month-on-month in December 2024, marking the first drop in nine months, although the decline was less severe than the anticipated 0.7% contraction. The annual sales increased by 4.6% compared to December 2023. On a seasonally adjusted basis, sales rose 1.0% QoQ in the December quarter of 2024.

- China's Caixin Manufacturing Purchasing Managers' Index (PMI) declined to 50.1 in January, down from 50.5 in December. The reading fell short of market expectations, which had anticipated a steady 50.5.

- ANZ, CBA, Westpac, and now National Australia Bank (NAB) all anticipate a 25 basis point (bps) rate cut from the Reserve Bank of Australia (RBA) in February. Previously, the NAB had forecasted a rate cut in May but has now moved its projection forward to the February RBA meeting.

- The Reserve Bank of Australia released its January 2025 Bulletin, featuring a detailed analysis of how monetary policy changes influence interest rates in the economy and how fluctuations in interest rates impact economic activity and inflation.

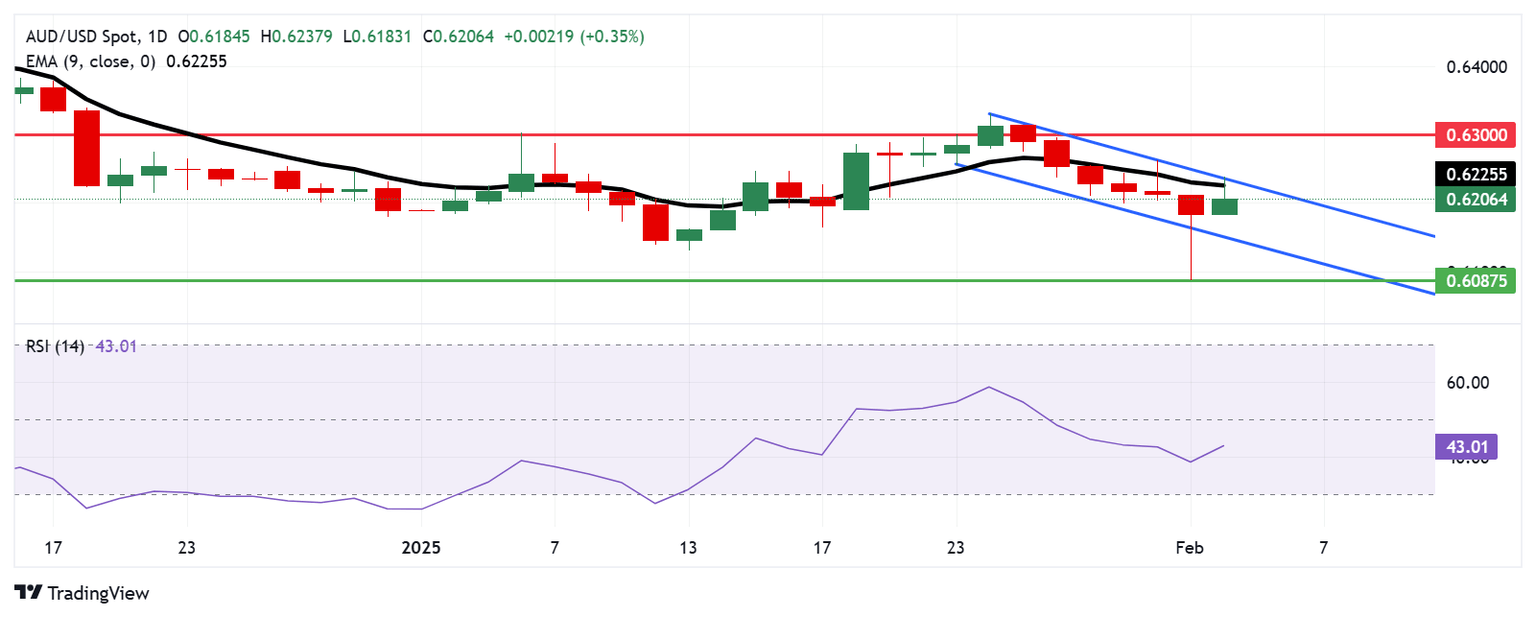

Australian Dollar tests nine-day EMA barrier near descending channel’s upper boundary

AUD/USD hovers around 0.6210 on Tuesday, trading within the descending channel pattern on the daily chart, signaling a bearish bias. However, the 14-day Relative Strength Index (RSI) has rebounded toward the 50 level, signaling weakening downside momentum. A breakout above the channel and a sustained move above the 50 mark on the RSI could indicate a shift toward a bullish bias.

On the downside, the AUD/USD pair could test the descending channel’s lower boundary at the 0.6150 level. A break below the channel would guide the pair to navigate the region around 0.6087, the lowest since April 2020, recorded on February 3.

The AUD/USD pair is testing its initial barrier at the nine-day Exponential Moving Average (EMA) of 0.6225, aligned with the upper boundary of the descending channel.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.01% | 0.04% | 0.34% | -0.62% | -0.12% | -0.02% | 0.01% | |

| EUR | -0.01% | 0.03% | 0.34% | -0.63% | -0.13% | -0.02% | -0.00% | |

| GBP | -0.04% | -0.03% | 0.29% | -0.66% | -0.17% | -0.06% | -0.03% | |

| JPY | -0.34% | -0.34% | -0.29% | -0.96% | -0.46% | -0.37% | -0.33% | |

| CAD | 0.62% | 0.63% | 0.66% | 0.96% | 0.50% | 0.60% | 0.64% | |

| AUD | 0.12% | 0.13% | 0.17% | 0.46% | -0.50% | 0.11% | 0.16% | |

| NZD | 0.02% | 0.02% | 0.06% | 0.37% | -0.60% | -0.11% | 0.03% | |

| CHF | -0.01% | 0.00% | 0.03% | 0.33% | -0.64% | -0.16% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.