Australian Dollar remains tepid as US Dollar advances ahead of ISM PMI

- The Australian Dollar declines after the release of key economic data on Thursday.

- ABS reported a trade surplus of 5,589 million for June, against the expected 5,000 million and prior of 5,773 million.

- China’s Manufacturing PMI came in at 49.8 for July, below the expected 51.5 and prior 51.8 readings.

The Australian Dollar (AUD) inches lower against the US Dollar (USD) following the release of better-than-expected Trade Balance data on Thursday. The Australian Bureau of Statistics (ABS) reported a trade surplus of 5,589 million for June, surpassing the anticipated 5,000 million but still below the previous reading of 5,773 million.

The latest inflation report released on Wednesday has reduced expectations that the Reserve Bank of Australia (RBA) will implement another rate hike at its policy meeting next week. Economists have warned that additional interest rate increases could jeopardize Australia’s economic recovery. Markets now see approximately a 50% chance of an RBA rate cut in November, much earlier than previous forecasts for a move in April next year. These developments are putting pressure on the Australian Dollar.

China’s Caixin Manufacturing Purchasing Managers Index (PMI) posted a reading of 49.8 for July, falling short of the expected reading of 51.5 and the previous reading of 51.8. Since both nations are close trade partners, changes in the Chinese economy can significantly impact the Australian market.

The downside of the AUD/USD pair may be limited, as the US Dollar faces challenges following the Federal Reserve's decision to keep rates unchanged in the 5.25%-5.50% range at its July meeting on Wednesday. Traders will look for further direction from the US economic data including ISM Manufacturing PMI and weekly Initial Jobless Claims, which are scheduled for release later on Thursday.

Daily Digest Market Movers: Australian Dollar declines after key economic data

- The Judo Bank Australia Manufacturing PMI edged up to 47.5 in July 2024 from 47.2 in June, signaling a sixth consecutive month of deterioration in manufacturing sector conditions, though at a slightly slower pace.

- During a press conference, Federal Reserve Chair Jerome Powell stated that a rate cut in September is "on the table." Powell added that the central bank will closely monitor the labor market and remain vigilant for signs of a potential sharp downturn, per Reuters.

- The ABS reported on Wednesday that the Monthly CPI rose by 3.8% in the year to June, easing from the 4% posted in May. The quarterly CPI rose 1% QoQ and up 3.8% YoY in the second quarter of the year. The RBA Trimmed Mean CPI, the central bank’s preferred gauge, rose by 3.9% YoY in Q2, against the expected and previous reading of 4.0%.

- China's NBS Manufacturing PMI posted a reading of 49.4 for July, slightly above the expected 49.3 but below the prior 49.5. Meanwhile, the Non-Manufacturing PMI came in at 50.2 as expected.

- Australia's Building Permits (MoM) fell by 6.5% in June, exceeding market expectations of a 3.0% decline. This follows a 5.7% increase in May. On a year-over-year basis, Building Permits declined by 3.7%, compared to the previous year's decline of 8.5%.

- National Australia Bank (NAB) anticipates that the Reserve Bank of Australia's (RBA) cash rate will remain stable at 4.35% until May 2025, according to a recent economic outlook. Looking ahead, the NAB Economics team predicts a decline to 3.6% by December 2025, with further decreases expected in 2026.

- In a media release on Monday, the Australian Prudential Regulation Authority (APRA) warned that arrears rates are increasing slowly. Following their latest quarterly assessment of domestic and international economic conditions, APRA announced that they will keep macroprudential policy settings on hold. These comments reflect their ongoing evaluation of both domestic and global economic environments.

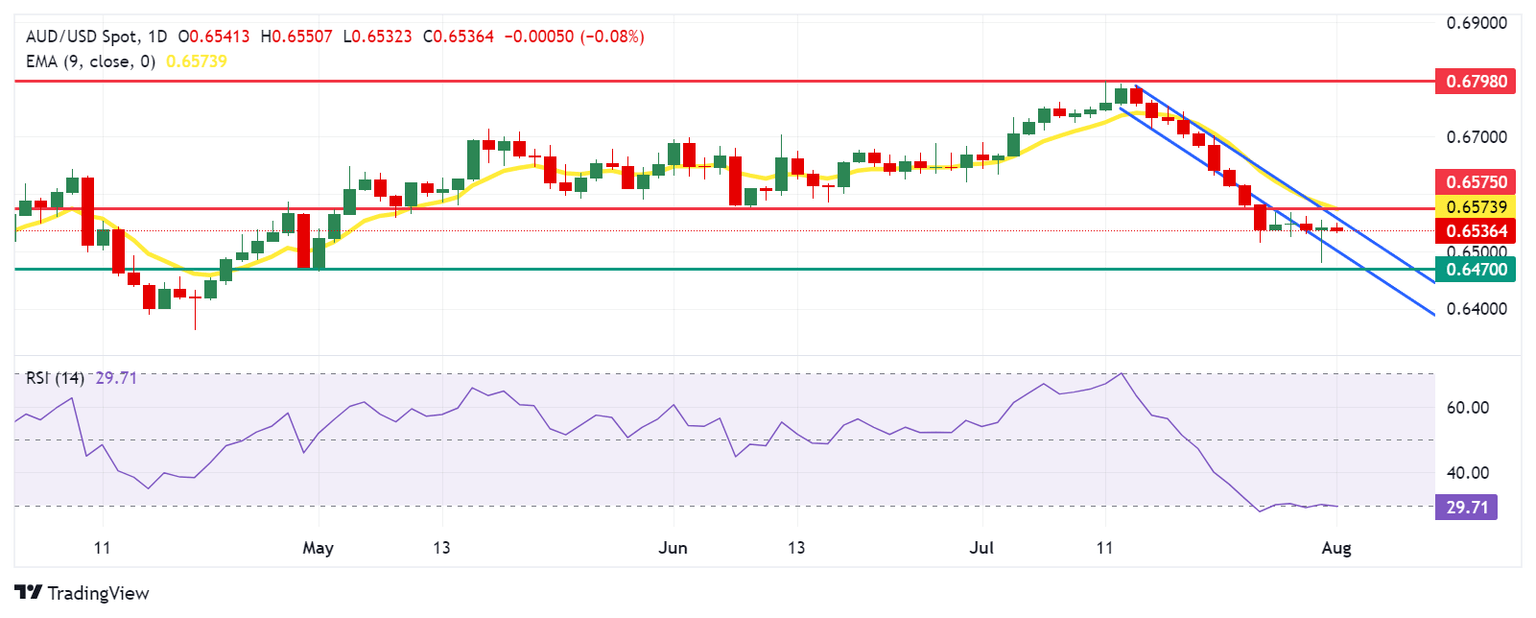

Technical Analysis: Australian Dollar trades around 0.6550

The Australian Dollar trades around 0.6540 on Thursday. The daily chart analysis shows that the AUD/USD pair consolidates within a descending channel, indicating a bearish bias. The 14-day Relative Strength Index (RSI) is near the oversold 30 level, suggesting a potential upward correction might be imminent.

Immediate support for the AUD/USD pair is around the lower boundary of the descending channel at 0.6500. A break below this level could pressure the pair to test the throwback support at approximately 0.6470.

On the upside, the upper boundary of the descending channel at 0.6555 serves as the immediate resistance, followed by the “throwback support turned resistance” at 0.6575 and the nine-day Exponential Moving Average (EMA) at 0.6581. A break above this resistance could drive the AUD/USD pair toward a six-month high of 0.6798.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | 0.05% | -0.09% | 0.00% | 0.12% | -0.06% | -0.09% | |

| EUR | 0.01% | 0.07% | -0.11% | 0.00% | 0.14% | -0.02% | -0.07% | |

| GBP | -0.05% | -0.07% | -0.17% | -0.05% | 0.08% | -0.09% | -0.13% | |

| JPY | 0.09% | 0.11% | 0.17% | 0.12% | 0.24% | 0.00% | -0.00% | |

| CAD | -0.00% | -0.01% | 0.05% | -0.12% | 0.13% | -0.05% | -0.08% | |

| AUD | -0.12% | -0.14% | -0.08% | -0.24% | -0.13% | -0.18% | -0.21% | |

| NZD | 0.06% | 0.02% | 0.09% | -0.01% | 0.05% | 0.18% | -0.03% | |

| CHF | 0.09% | 0.07% | 0.13% | 0.00% | 0.08% | 0.21% | 0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

ISM Manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The indicator is obtained from a survey of manufacturing supply executives based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that factory activity is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu Aug 01, 2024 14:00

Frequency: Monthly

Consensus: 48.8

Previous: 48.5

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) provides a reliable outlook on the state of the US manufacturing sector. A reading above 50 suggests that the business activity expanded during the survey period and vice versa. PMIs are considered to be leading indicators and could signal a shift in the economic cycle. Stronger-than-expected prints usually have a positive impact on the USD. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are watched closely as they shine a light on the labour market and inflation.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.