AUDJPY Price Analysis: Plunges from monthly highs, struggles to reclaim the 100-DMA

- AUD/JPY retraces from weekly highs, set to end the week with minimal losses of 0.07%.

- Japanese authorities intervened in the FX market to bolster the Japanese yen.

- AUD/JPY Price Forecast: From the daily, the pair is neutral-to-upwards, but short term, is range-bound, so caution is warranted.

The AUD/JPY seesawed in a wide range following Japanese authorities’ intervention in the FX markets. The risk-perceived cross pair hit a daily high at around 95.73 before plunging toward its daily low at 93.08. At the time of writing, the AUD/JPY is trading at 93.80, below its opening price by 0.49%.

AUD/JPY Price Forecast

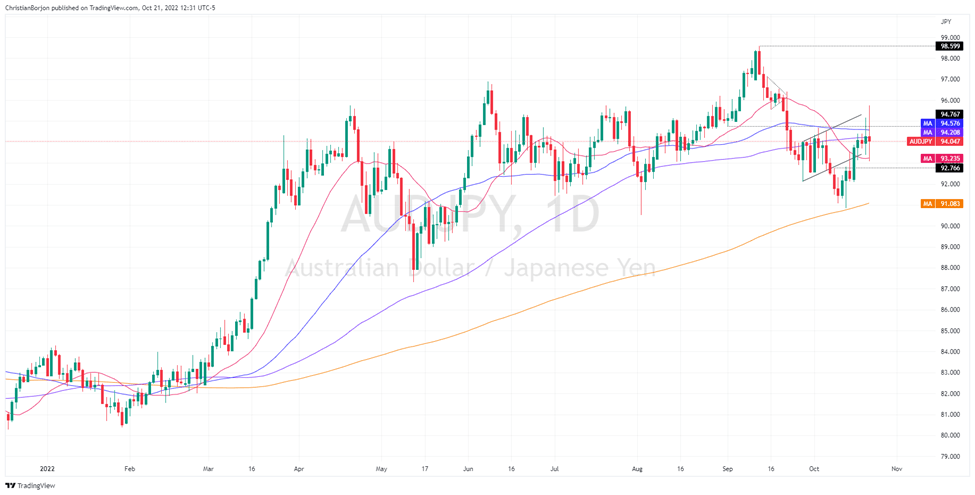

Friday’s session was volatile, and the AUD/JPY shifted its bias from neutral upwards to neutral, as flashed by the daily chart. When the pair fell from daily highs, it hurdled the 50 and 100-day Exponential Moving Averages (EMAs), each at 94.57 and 94.20, exposing the 20-day EMA. Worth noting that the AUD/JPY pierced the latter around 93.22 but rebounded towards current exchange rates, keeping the pair range-bound.

Due to market participants bracing for the weekend, the lack of catalyst might keep the AUD/JPSD trading within the boundaries imposed by the daily EMAs. Therefore, key resistance lies at the 100 and 50-EMAs at 94.20 and 94.57, ahead of the 95.00 figure. On the flip side, the AUD/JPY first support would be the 20-day EMA at 93.22, ahead of the weekly low at 93.08.

AUD/JPY Daily Chart

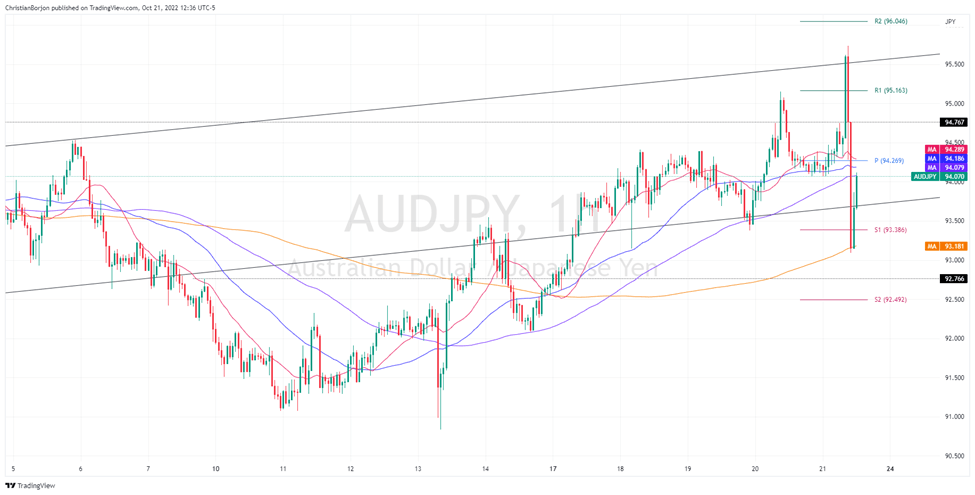

Short term, the AUD/JPY hourly chart, lacks direction, so traders better be on the sidelines until the dust settles. For the restless ones, the AUD/JPY first resistance is the daily pivot point at 94.27, followed by the 95.00 figure, ahead of the R2 pivot level at 95.16. On the flip side, the AUD/JPY key support levels would be the 94.00 figure, followed by the S1 daily pivot at 93.86, ahead of the 200-EMA at 93.18.

AUD/JPY Hourly Chart

AUD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.