AUD/JPY Price Analysis: Breaks to a five-week high above 96.00, on risk-on mood

- AUD/JPY climbs to a five-week high following the Federal Reserve's decision to hold rates steady.

- Wall Street rally and upbeat market sentiment benefit risk-perceived currencies like the Aussie Dollar.

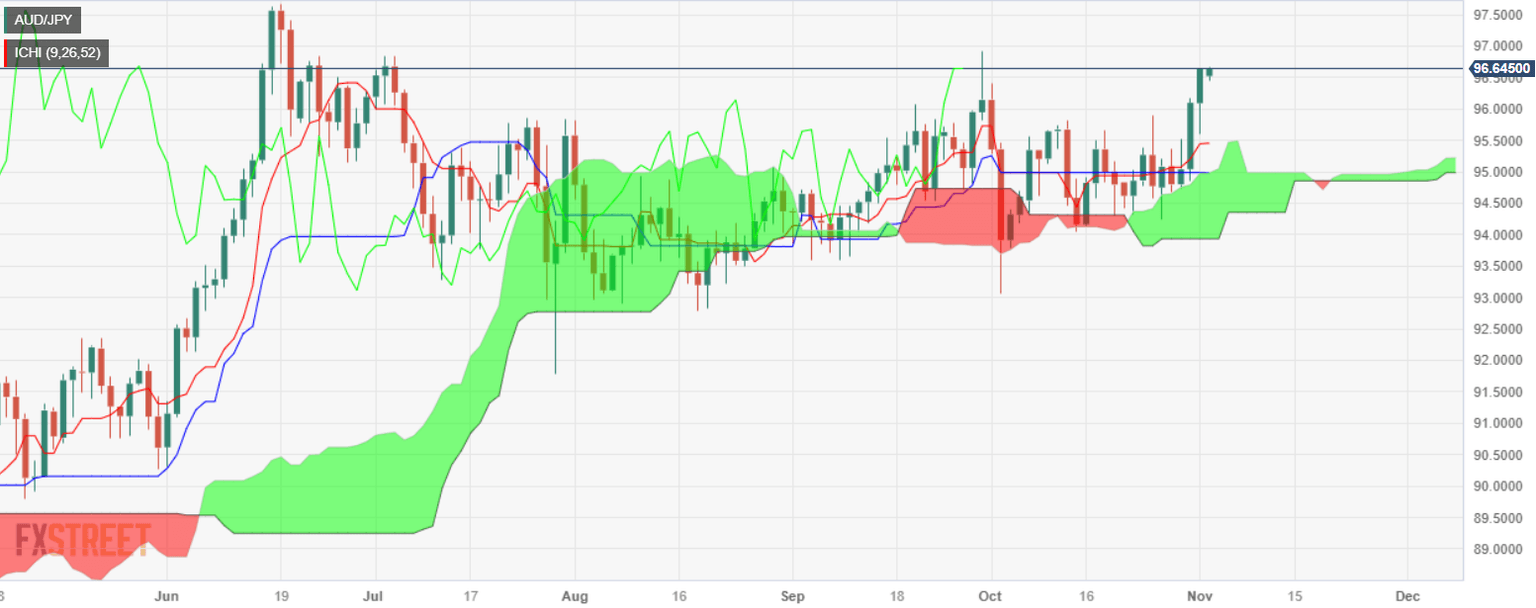

- From a technical perspective, AUD/JPY is neutral to upward biased, with potential resistance at 96.92 and 97.00 marks.

The AUD/JPY climbs amid an upbeat sentiment, reached a five-week high of 96.54 late on Wednesday session after the US Federal Reserve (Fed) held the Federal Fund Rates (FFR) at around 5.25%-5.50%, unchanged compared to the last two meetings. The pair is trading at 96.50, with buyers eyeing the September 29 high at 96.92.

Wall Street rallied on Wednesday, portraying an upbeat market sentiment. Risk-perceived currencies like the Aussie Dollar (AUD) benefit in that scenario, seen as the main driver of Wednesday’s price action.

From a technical perspective, the AUD/JPY is neutral to upward biased, with buyers eyeing a break of the latest pivot high at 96.92, the September 29 high. Once that level gives way, up next would be the 97.00 mark, along with the year-to-date (YTD) high at 97.67, ahead of the 98.00 figure.

On the other hand, for sellers, the AUD/JPY must drop below the Tenkan-Sen at 95.45 so they can remain hopeful of seeing lower prices. If that level is breached, the next support level emerging would be the Senkou Span A at 95.20, followed by the 95.00 figure.

AUD/JPY Price Action – Daily chart

AUD/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.