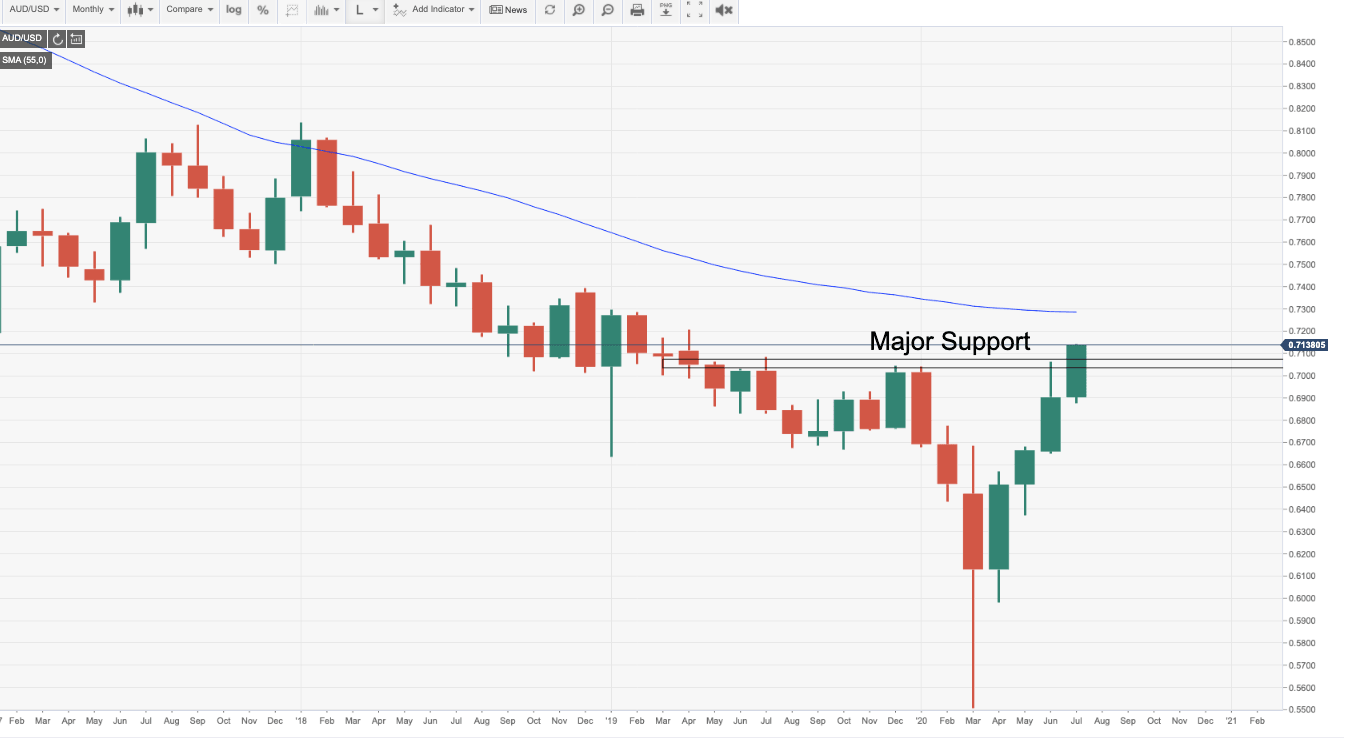

AUD/USD: The party that never ends, fresh monthly highs to the 0.7140's

- AUD/USD bulls take on fresh multi-month highs with a target of the 55-month moving average.

- All steam ahead following the RBA's lack of urgency to weaken the currency while DXY bleeds out and the euro runs higher.

- Risk-on markets are supporting the commodity complex and commodity-FX.

AUD/USD has steamed on ahead throughout the sessions as the commodity complex bounces, the DXY continues to crumble and while there is a reluctance fro the Reserve Bank of Australia to immediately intervene in the markets to weaken the currency.

At the time of writing, AUD/USD has traded at a new high for the session and the highest levels since April 2019 – 0.7141.

AUD/USD has climbed from a low of 0.7011 on the day and is now up some 1.75% at 0.7138.

Board Minutes followed up by the Governor’s speech give the green light to bulls

The bulls party-on following an initial catalyst in the RBA's July Board Minutes followed up by the Governor’s speech.

The speech and the Minutes present unified cases for steady policy while still leaving the door slightly ajar for further stimulus if absolutely necessary.

The theme around the economic outlook from both the July Board Minutes and the Governor’s speech, which was delivered 90 minutes after the release of the Minutes, is best summarised by the conclusion in the Minutes 'Economic conditions had stabilised and the down turn had been less severe than earlier expected,'

analysts at Westpac explained.

The Board concluded, “However the nature and speed of the economic recovery remained highly uncertain”, but, concluded that there was “no need to adjust the package of policy measures in Australia in the current environment”.

This, essentially, gave the markets the green light to continue to buy up the AUD for its current account surplus properties and being the cleanest bill of health in the risk-on currencies.

Certainly, the Governor was particularly enthusiastic in his admiration for a low AUD, yet there is still no sense of urgency on display, yet.

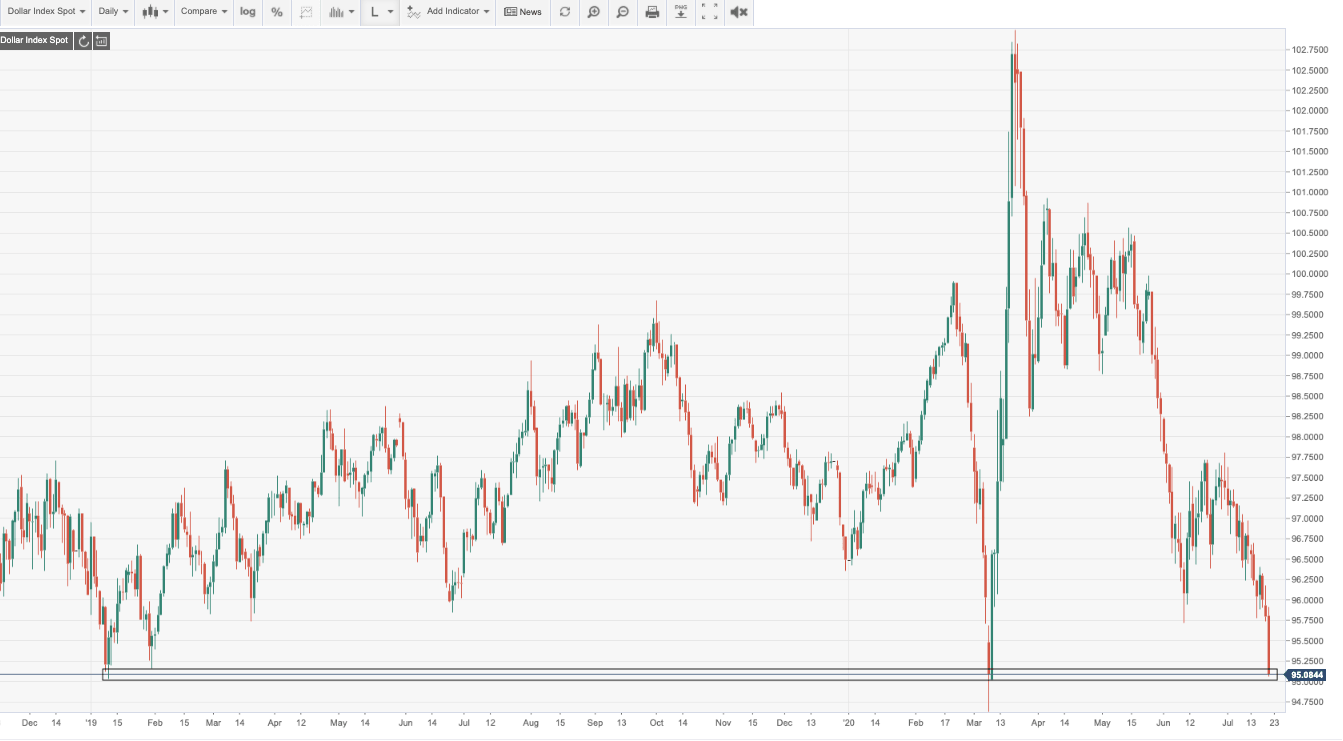

Meanwhile, the US dollar continues to bleed out and has presented its self in the DXY in the form of a fresh bearish impulse, taking on the lowest levels for the year and to match the Jan 2019 lows down at the 95 figure.

DXY daily chart meltdown

This was an eventuality forecasted in this week's outlook for EUR/USD here: The Chart of the Week: EUR/USD to complete a reverse H&S prior to next leg higher?

Of the fundamentals considered, indeed, the euro has shot higher to a 1/12 year high on the back of the coronavirus deal.

To top off the bullish environment, US equities have followed the Asian lead today and have scored fresh recovery highs.

Commodities are also bid up, with copper and iron ore on the march.

"For industrial metals, the story has been one of a series of cascading drivers supporting prices — from a sharp V-shaped recovery in demand, to a supportive supply-side narrative," analysts at TD Securities explained.

Today, commodity demand growth remains resilient — our real-time commodity demand indicator is finally implying a continued firming in growth, helping to support base metal prices, which may prompt a round of CTA short covering,

AUD/USD levels

The bulls are now into majorly bullish territories.

With the December and June highs now behind us, a target of 0.7284, the 55-month moving average, cones into view.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.