The Chart of the Week: EUR/USD to complete a reverse H&S prior to next leg higher?

- EUR/USD has broken a key layer of resistance in its plight for higher grounds.

- The charts are offering something for both the bears and bulls at this juncture, however.

Last week, the euro was the top performer as the US dollar deteriorated over the concerns related to skyrocketing coronavirus cases in the U.

A deteriorating economic outlook backdrop for the US, pertaining to the high levels on unemployment and consumer confidence which shrunk again in July, is weighing on the US dollar.

US dollar crumbles

This has given rise to a bid in the euro as the DXY crumbles away:

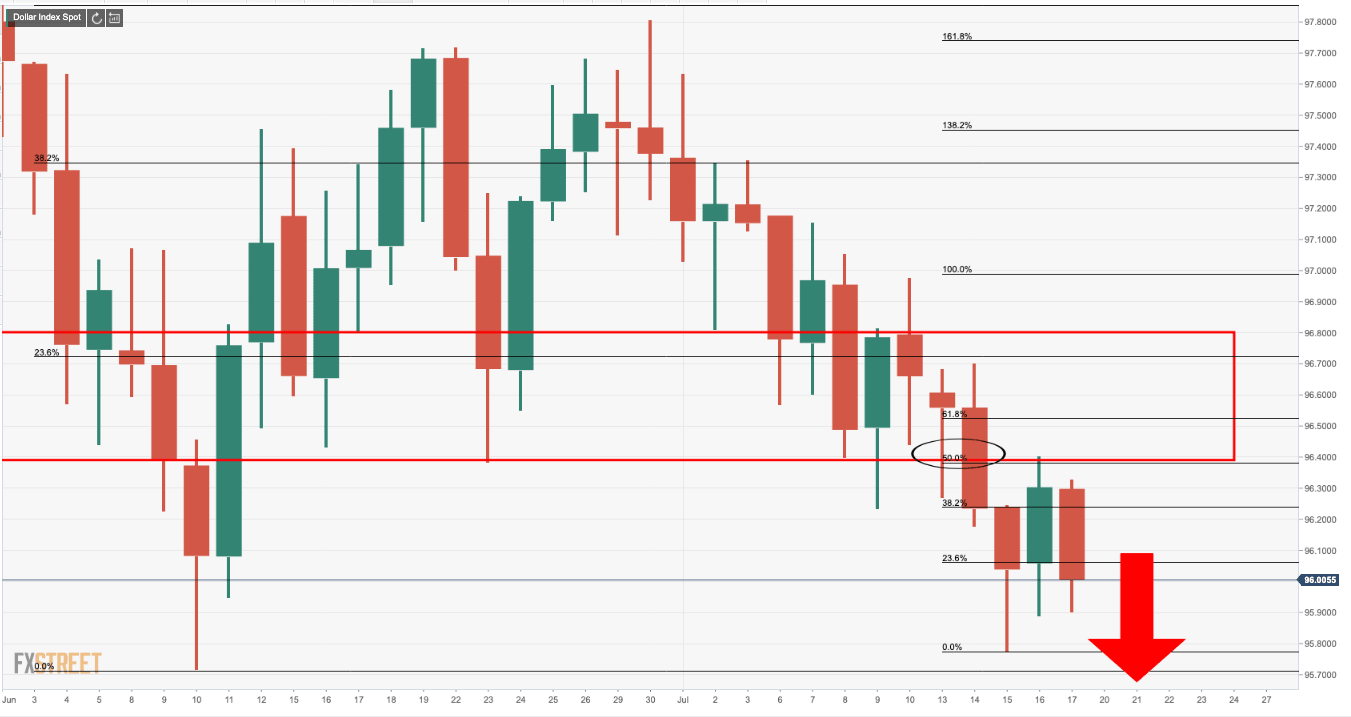

DXY completed a 50% mean reversion of prior daily bearish impulse:

EUR/USD enters back into the barroom brawl

Meanwhile, the open for the EU/USD, however, pertaining to the weekend news that there has been no deal struck at the EU summit, could prove to be slightly painful for longs that have held in-the-money-positions over the weekend.

Bulls were able to capitalise on the euro rallying from last week's test of long term structural support as follows, making fresh daily highs for a bullish foothold:

From a daily perspective, the charts remain structurally bullish as a retest of old resistance, new support, has held-up, so far:

4HR Reverse H&S in the making?

However, the pair has dropped back into a consolidation area, or otherwise known as the barroom brawl where there is no clear bias.

If there is a bearish open this week, it will serve well to fit the above analysis as profit-taking ensues.

A break of the 4 HR head and shoulders head and support structure will open up the case for the downside to resume once again and invalidate the bullish outlook.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.