AUD/USD stays bullish despite Powell hawkish tilt, Aussie PMI eyed

- AUD/USD climbs to 0.6913, rebounding from a daily low of 0.6894, despite hawkish hints from Fed Chair Powell.

- Traders eye upcoming US ISM Manufacturing PMI and nonfarm payroll data, with an expected increase of 146K in September payrolls.

- Aussie’s Judo Bank Manufacturing PMI expected to contract.

The Aussie Dollar ended September on a higher note, posting gains of over 0.22% against the Greenback, even though Federal Reserve Chairman Jerome Powell was slightly ‘hawkish’ in a speech. The AUD/USD trades at 0.6913 after bouncing off daily lows of 0.6894.

AUD/USD posts 0.22% gains as markets eye US economic data and Fed rate cuts

Wall Street printed minimal gains on Monday as investors shrugged off Fed Chair Powell's remarks that they will lower rates “over time.” Powell said, “This is not a committee that feels like it’s in a hurry to cut rates quickly,” adding that incoming data will guide them.

On the data front, the Chicago PMI increased 0.5% from 46.1 to 46.6 in September. The employment sub-component index rose 5.0 points, snapping two straight months of declines.

Other Fed speakers crossed the wires. Atlanta’s Fed President Raphael Bostic said he’s open to a 50-basis-point rate cut if job data warrants it. Meanwhile, Chicago’s Fed Austan Goolsbee stated he sees a case for extensive US interest rate cuts based on the economy's stance.

Aside from this, traders should be eyeing the release of ISM Manufacturing PMI data on Tuesday. However, the spotlight will be on nonfarm payroll data for September, which is expected to increase by 146K vs. 142K in August. The unemployment rate is foreseen at 4.2%, unchanged compared to the previous reading.

On the Aussie side, the Judo Bank Manufacturing PMI for September in its final reading is foreseen to contract further, from 48.5 to 46.7, according to the consensus. For August, other data, like Building Permits and Retail Sales, are foreseen to show weakening signs.

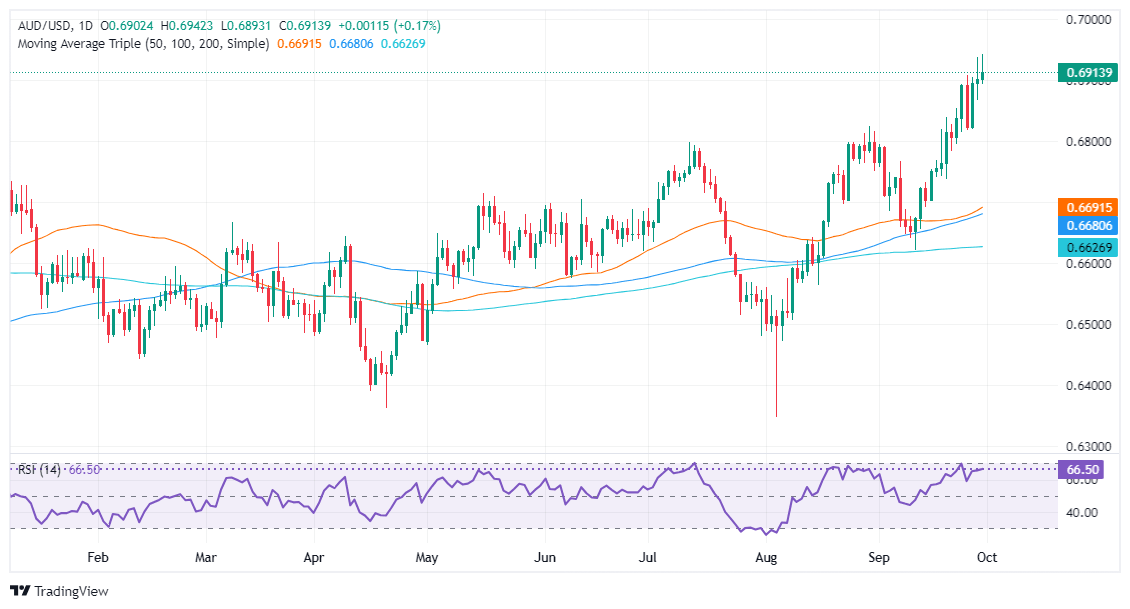

AUD/USD Price Forecast: Technical outlook

The AUD/USD is upward biased, though printing a doji and a shooting star back-to-back candlesticks hints that the pair could drop from current levels.

Momentum suggests the pair could consolidate, as the Relative Strength Index (RSI) turned flat at bullish territory.

Hence, the AUD/USD first resistance would be the year-to-date (YTD) high at 0.6942, followed by the 0.7000 figure. Conversely, a drop below 0.6900 will expose the September 27 low of 0.6867, followed by the September 25 low of 0.6817.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.