AUD/USD rises after RBA holds rates, attention shifts to FOMC Minutes

- AUD/USD rises after the Reserve of Australia leaves its benchmark interest rate at 3.85%.

- The FOMC Meeting Minutes come into focus as investors search for clues about when the Fed may cut rates.

- AUD/USD fails to gain traction above 0.6550, with prices fluctuating near 0.6530 at the time of writing.

The Australian Dollar (AUD) is strengthening against the US Dollar (USD) on Tuesday, following the Reserve Bank of Australia's (RBA) decision to hold the cash rate steady at 3.85%.

The pair bounced on the surprise hawkish tilt, allowing AUD/USD to recover some lost ground following a 1% decline on Monday.

At the time of writing, AUD/USD is trading near 0.6530 with attention shifting to the June Federal Open Market Committee (FOMC) Meeting Minutes, scheduled for release on Wednesday.

AUD/USD firms on RBA surprise rate hold, with attention shifting to the FOMC Minutes

Although markets had expected the RBA to cut interest rates, Governor Michele Bullock defended the decision: “We're never going to go back from the level of prices now, but we can at least stop them from rising as quickly.”

Bullock added that “Betrayal would be to let inflation get out of hand.”

While inflation has cooled, the board isn’t ready to declare victory. Bullock also made it clear that more data, especially the next quarterly Consumer Price Index (CPI), will be key before the bank makes its next move.

For AUD/USD, the takeaway was immediate.

Although the Federal Reserve (Fed) has maintained its benchmark rate steady between 4.25% and 4.50%, rate cuts are already priced in for this year. The big question has been when the US will begin rate cuts.

According to the CME FedWatch Tool, investors are currently assigning a 62.9% chance of a 25-basis-point cut in September.

The FOMC Minutes are expected to provide deeper insight into policymakers’ views on inflation, monetary policy, and the outlook for interest rates. These details may also help refine market expectations around the timing of potential rate cuts.

Any surprises in the Minutes could shift those odds and spark renewed volatility in the AUD/USD pair.

AUD/USD battles to break 0.6550 resistance

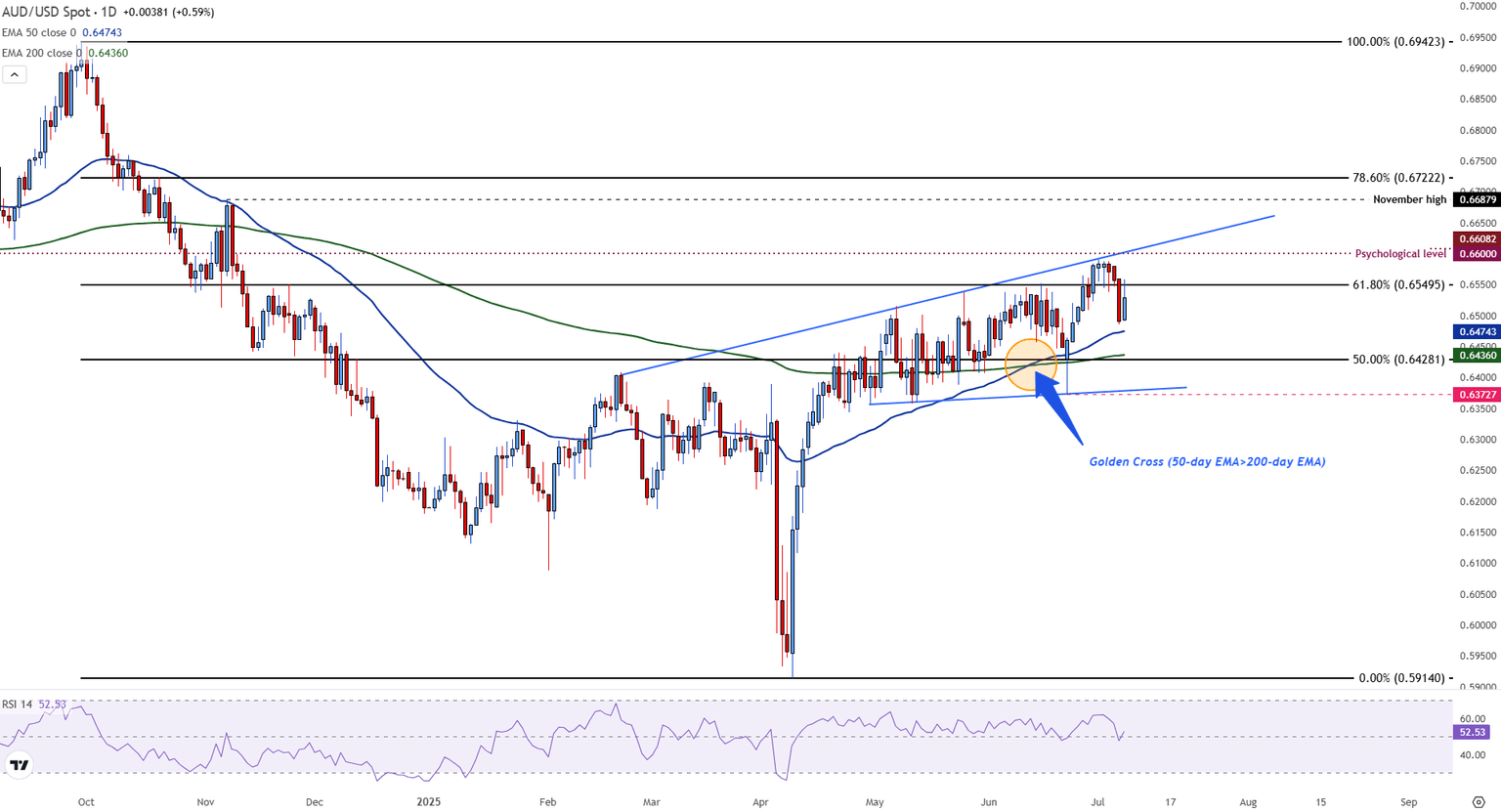

The AUD/USD currency pair is currently trading below the 61.8% Fibonacci retracement level of the decline from September to April, which provides resistance around 0.6550. The rejection at the upper boundary of the rising wedge on the daily chart, along with the failure to break above the psychological barrier of 0.6600, raised expectations for a bearish reversal last week.

Despite this, positive momentum is still supported by the 50-day and 200-day Exponential Moving Averages (EMA), currently positioned at 0.6475 and 0.6436, respectively. The formation of a Golden Cross occurs when the 50-day EMA rises above the 200-day EMA, indicating a potential larger uptrend.

AUD/USD daily chart

The Relative Strength Index (RSI) reading of 52 indicates neutral momentum with a slight positive trend.

If there is a sustained break and hold above the Exponential Moving Averages (EMAs), along with a test of the 0.6600 level, this could set a target toward the November highs at 0.6689 and the 78.6% retracement level at 0.6722.

On the other hand, if prices break below the wedge support around 0.6372, it would signify a significant shift in market structure, potentially leading to a further decline toward the 0.6200 zone.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Next release: Wed Jul 09, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.