AUD/USD rebounds as RBA defies rate cut forecasts, US Dollar stalls

- AUD/USD recovers as the Reserve Bank of Australia surprises markets with an interest rate hold.

- Trade uncertainty limits US Dollar strength, supporting the Australian Dollar.

- AUD/USD eyes 0.6550 resistance as Golden Cross supports broader uptrend.

The Australian Dollar (AUD) is making a recovery against the US Dollar (USD) on Tuesday, following the Reserve Bank of Australia's (RBA) decision to maintain its main interest rate at 3.85%.

Following a 1% decline on Monday, the Australian central bank's announcement provided a boost to the AUD/USD, which is currently trading near 0.6530 at the time of writing.

According to a Reuters poll released on Friday, 31 out of 37 economists anticipated that the central bank would announce a third consecutive 25-basis-point rate reduction on Tuesday.

Against these widely anticipated and largely priced-in expectations, markets continued to digest the positive US jobs data released last Thursday.

So far this year, a healthy labour market has allowed the Federal Reserve (Fed) to maintain rates between 4.25% and 4.50%.

The most recent NFP exhibited a healthy US labor market, which decreased wagers on the Fed reducing rates in July.

This higher demand for US yields, positive for yield differentials between Australia and the US, followed.

However, a surprising hawkish move by the RBA served as a bullish trigger for AUD/USD on Tuesday.

AUD/USD eyes 0.6550 resistance as Golden Cross supports broader uptrend

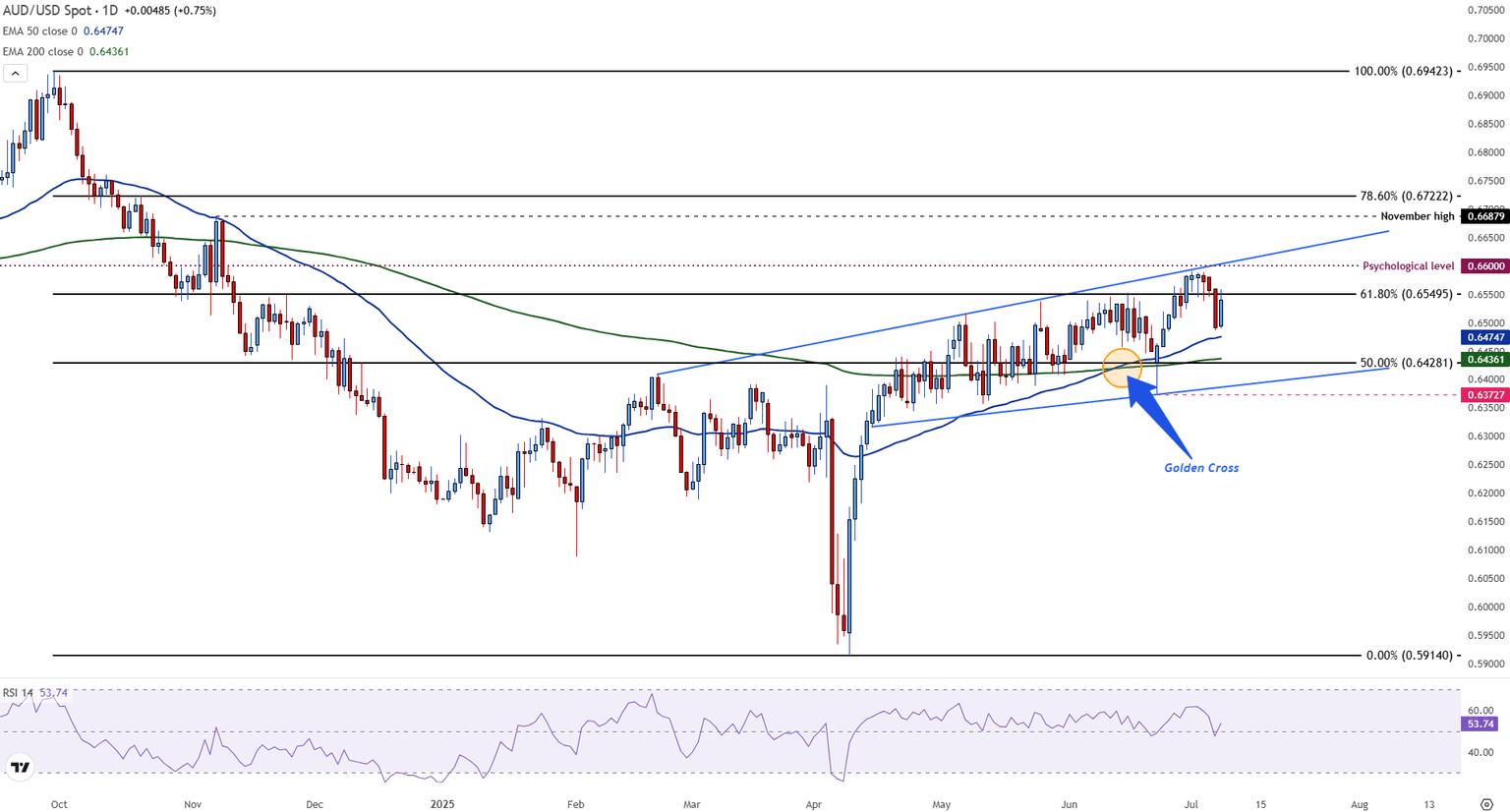

AUD/USD is currently heading toward the 61.8% Fibonacci retracement of the September–April sell-off, providing resistance around 0.6550. Prices remain within a rising wedge on a daily timeframe.

The rejection around the upper wedge and below the psychological 0.6600 barrier raised expectations of a bearish reversal last week. However, positive momentum remains supported by the 50 and 200-day Exponential Moving Averages (EMAs), currently plotted at 0.6475 and 0.6436, respectively.

These moving averages have formed a Golden Cross (a bullish technical pattern that forms when the 50-day EMA rises above the 200-day EMA), indicating a larger uptrend.

AUD/USD daily chart

A reading of 54 on the Relative Strength Index (RSI) suggests neutral momentum with a slight positive slant.

A break and hold above the EMAs on a sustained basis and a test of the 0.6600 round number could potentially form a target toward the high of November at 0.6689 and the 78.6% retracement at 0.6722.

However, a break below wedge support around 0.6372 would be a major shift in market structure, exposing prices to another leg lower toward the 0.6200 zone.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.