AUD/USD Price Forecast: Recovers above 0.6200 as US Dollar gives up gains

- AUD/USD bounces back above 0.6200 as the US Dollar surrenders its intraday gains.

- US Trump’s decision to delay tariffs on Canada and Mexico has resulted in a decline in USD’s risk premium.

- China has retaliated with tariffs on the US, which would take place from February 10.

The AUD/USD pair rebounds sharply above the round-level figure of 0.6200 in Tuesday’s North American session. The Aussie pair recovers as the US Dollar (USD) gives up its intraday gains on the back of United States (US) President Donald Trump’s decision to push the order to impose 25% tariffs on Canada and Mexico on hold for 30 days. This scenario has resulted in a decline in the risk-premium of the US Dollar, given its safe-haven feature.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, drops to near 108.50 after a short-lived recovery move to near 109.00.

However, Trump’s decision to put 10% tariffs on China has come into effect, which keeps fears of a trade war intact. In retaliation, China has also announced tariffs on the US, which will be executed in February. This has negatively impacted the Australian Dollar’s (AUD) outlook, given that the currency is a proxy for China’s economic status.

Investors expect that an absence of immediate execution of tariffs by China suggests that the economy is continuing to negotiate with Trump.

This week, the major trigger for the US Dollar will be the US Nonfarm Payrolls (NFP) data for January, which will be released on Friday. Market participants expect the official employment data to influence speculation for the Federal Reserve’s (Fed) monetary policy guidance.

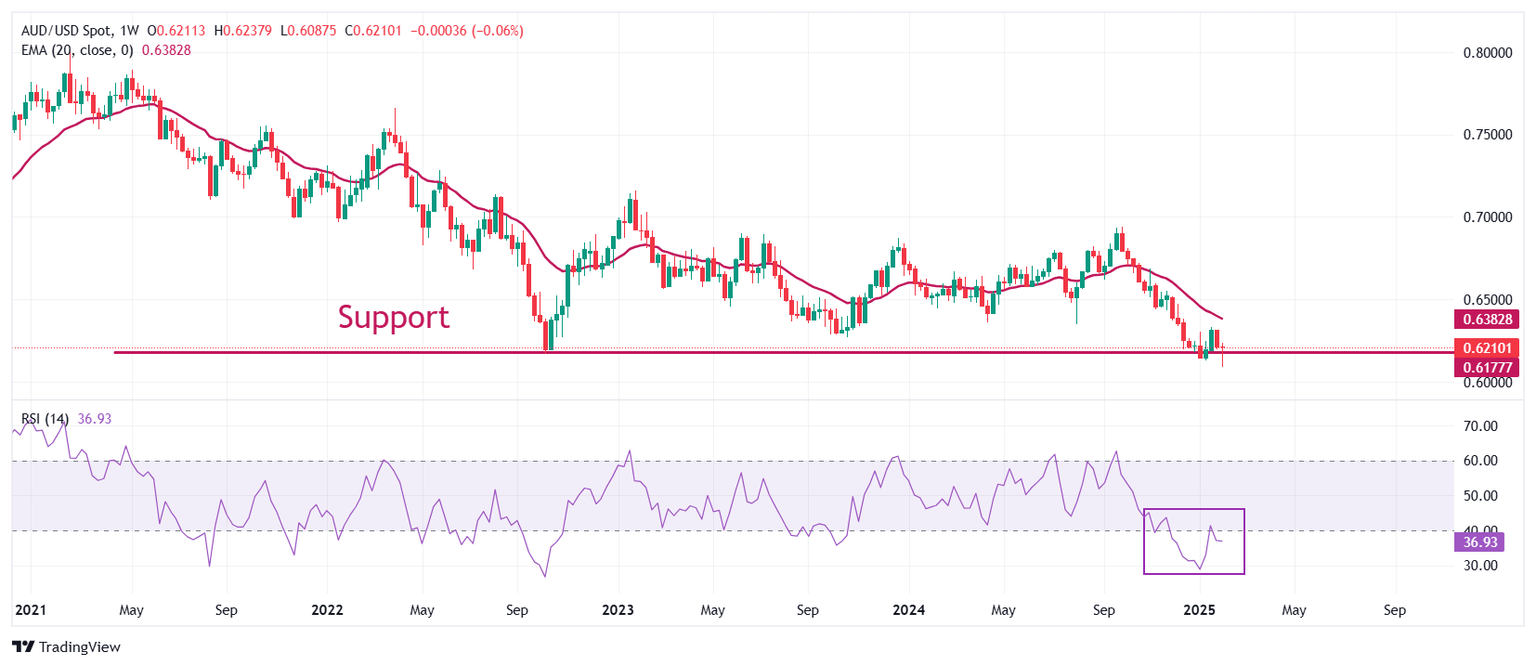

AUD/USD posts a fresh four-year low around 0.6100. The 20-week Exponential Moving Average (EMA) near 0.6375 slopes downwards, suggesting that the overall trend is bearish. The 14-week Relative Strength Index (RSI) oscillates inside the 20.00-40.00 range, indicating a strong bearish momentum.

More downside would appear if the pair breaks below the immediate support of 0.6100, which would let it towards the psychological support of 0.6000 and 26 March 2020 low of 0.5870.

On the flip side, a sustenance move above the January 13 high of 0.6330 will open doors to the round-level resistance of 0.6400 and the December 5 high of 0.6456

AUD/USD weekly chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.