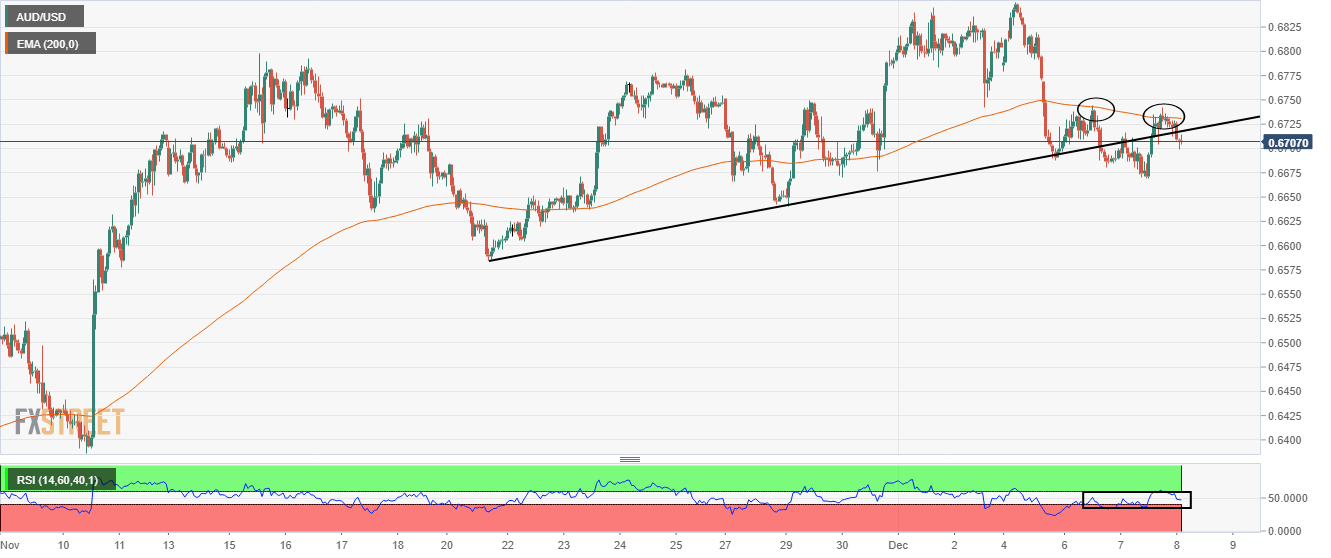

AUD/USD Price Analysis: Struggles to sustain above 0.6700 as 200-EMA caps upside

- The 200-EMA around 0.6730 is acting as a major barricade for the Australian Dollar.

- A failure in sustaining above the upward-sloping trendline from 0.6585 has strengthened the US Dollar.

- A recovery in risk-off mood is weighing pressure on the Aussie asset.

The AUD/USD pair is aiming to hold its rebound move above the round-level support of 0.6700 in the Asian session. The Aussie strength is sensing supply as the US Dollar Index (DXY) has extended its recovery to near 105.32.

Meanwhile, S&P500 futures are facing selling pressure again, portraying a rebound in the risk aversion theme. The 10-year US Treasury yields have resurfaced to near 3.45% as the risk-off is regaining traction.

On an hourly scale, the Aussie asset is failing to sustain above the upward-sloping trendline placed from November 21 low at 0.6585. Also, the 200-period Exponential Moving Average (EMA) at 0.6732 has acted as major resistance for the Australian Dollar.

The Relative Strength Index (RSI) (14) has failed to enter the bullish range of 60.00-80.00, which indicates that investors are capitalizing on less-confident rallies for parking smart money into the downside trend.

For further downside, a decisive move below Wednesday’s low at 0.6668 will drag the Aussie asset towards November 29 low at 0.6640 and November 21 low at 0.6585.

Alternatively, a break above Tuesday's high at 0.6744 will drive the major towards the round-level resistance at 0.6800, followed by Monday’s high around 0.6850.

AUD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.