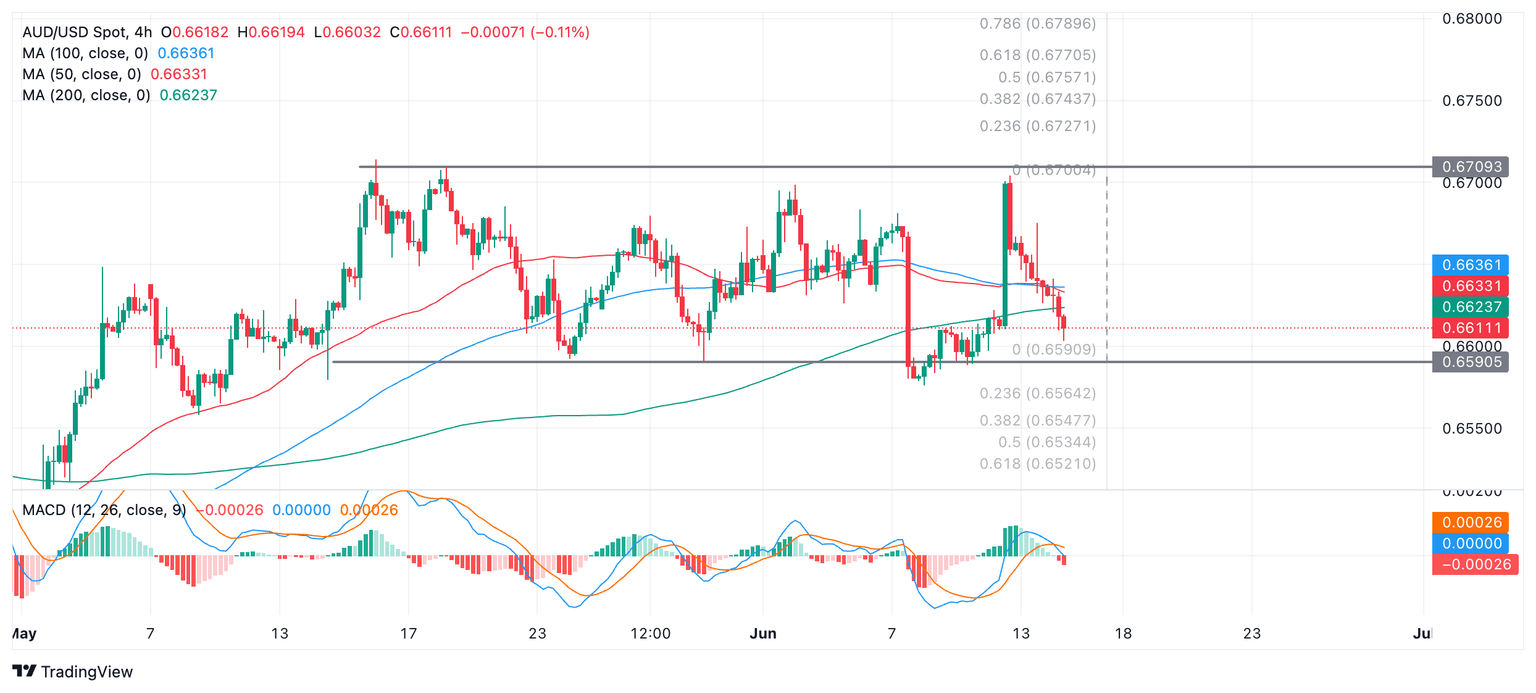

AUD/USD Price Analysis: Sideways trend continues unfolding

- AUD/USD is in a down-leg within a narrow trading range.

- The pair is probably in a sideways trend with the odds favoring an extension of that trend.

- A decisive break above or below the top or bottom of the range would generate follow-through targets.

AUD/USD is trading in a range between 0.6590 and 0.6709. At the moment price is unfolding in a down-leg within that range.

AUD/USD 4-hour Chart

AUD/USD is in a sideways short-term trend, with the odds favoring an extension of the range-bound mode, given “the trend is your friend”.

AUD/USD would need to decisively break out of the range to signal a change to a more directional trend. An upside break is marginally more likely than a downside break because the trend prior to the formation of the range was bullish and so the breakout is slightly more likely to be higher.

A decisive break above the ceiling of the range would indicate an extension higher to a conservative target at 0.6770; a decisive break below the range floor would indicate a follow-through to at least 0.6521.

A decisive break would be one in which a longer-than-average candle broke through the level and closed near its high or low, or three successive candles of the same color broke cleanly through the range top or bottom.

The targets are generated using the technical analysis method of extrapolating the height of the range by a Fibonacci 0.618 ratio higher (for an upside break) or lower (for a downside break). A more generous target would come from extrapolating the full height of the range.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.