AUD/USD Price Forecast: Momentum builds as price holds above 0.6600

- AUD/USD extends gains after RBA Minutes flagged the risk of future rate hikes if inflation remains persistent.

- Expectations of Fed easing into 2026 keep the US Dollar on the defensive, supporting the Aussie.

- Technical indicators favour the upside, with AUD/USD trading above key moving averages.

The Australian Dollar (AUD) extends gains against the US Dollar (USD) on Tuesday after the Reserve Bank of Australia’s Meeting Minutes showed policymakers discussed the risk that interest rates may need to rise if inflation remains persistent. At the time of writing, AUD/USD trades around 0.6688, its highest level since September 17.

Elsewhere, the US Dollar remains on the defensive as expectations that the Federal Reserve (Fed) could ease monetary policy further into 2026 continue to weigh on the Greenback, allowing higher-beta currencies like the Aussie to stay supported.

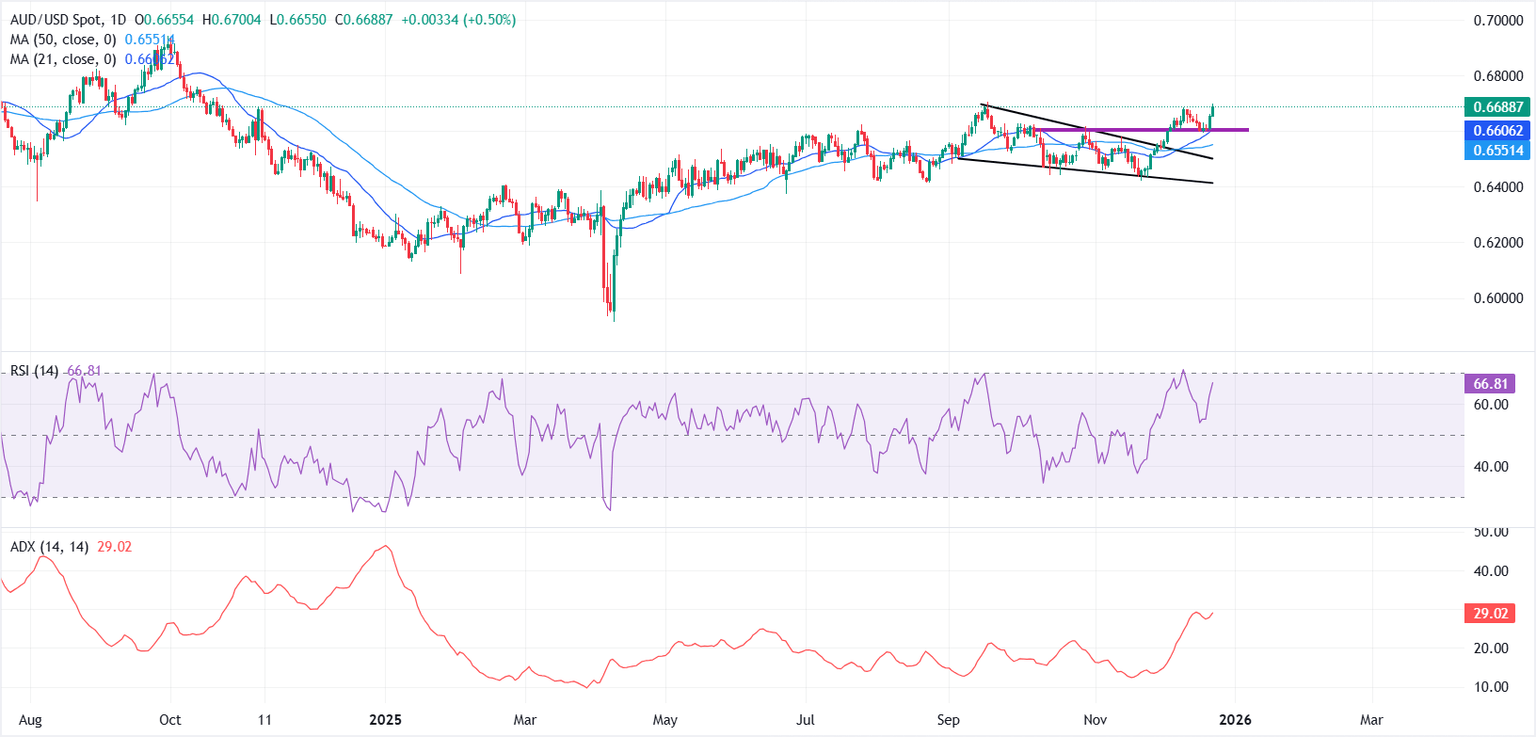

From a technical perspective, AUD/USD remains well supported after staging a clean break above a falling wedge pattern on the daily chart. The pair is trading comfortably above its key moving averages, reinforcing the broader bullish structure.

Momentum indicators also favour the upside, with the Relative Strength Index (RSI) holding near 67, while the Average Directional Index (ADX) has climbed above 29, pointing to strengthening trend conditions.

Immediate resistance is seen near 0.6707, the September 17 peak and the highest level since October 2024. A sustained break above this level would open the door toward the 0.6800 psychological handle, with scope for further upside if bullish momentum continues to build.

On the downside, the 0.6600 psychological level serves as initial support, aligning closely with the 21-day Simple Moving Average (SMA). A break below 0.6600 could expose the 50-day SMA near 0.6550. A daily close below the 50-day SMA would weaken the near-term bullish bias and could trigger a deeper pullback toward the 0.6500 and 0.6450 support zones.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.