AUD/USD Price Analysis: Heads south towards 0.7050, with bear cross in play

- AUD/USD is off the lows but remains vulnerable after rejection at higher levels.

- Escalating fears over the Omicron covid variant contagion hits the aussie.

- Bearish crossover and RSI keep the downside open towards 0.7050.

AUD/USD is reversing a brief dip below 0.7100 but the bearish bias remains intact amid a broadly firmer US dollar and the prevalent risk-off market profile.

Fears over the rapid spread of the Omicron covid variant worldwide, with the Australian state of New South Wales (NSW) reporting a spike in covid cases, weigh heavily on the high-beta currencies such as the aussie dollar. Further, mixed NAB Business Survey added to the pain in the aussie.

Markets will likely remain cautious ahead of Wednesday’s Fed policy decision and Thursday’s Australian employment data.

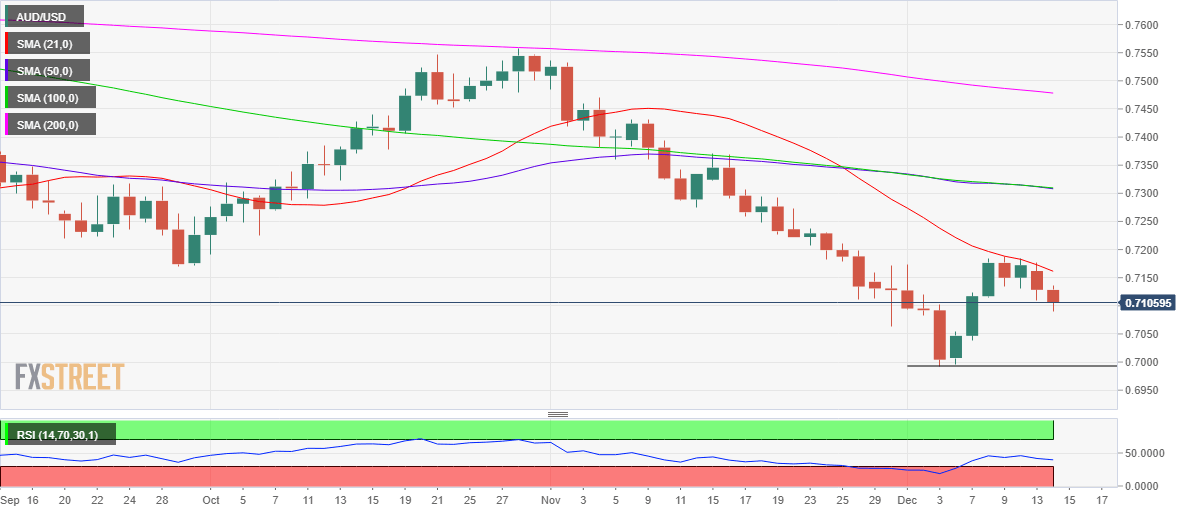

Looking at AUD/USD’s daily chart, the pair is extending the previous pullback after facing rejection once again at the bearish 21-Daily Moving Average (DMA), now at 0.7161.

The 14-Day Relative Strength Index (RSI) is inching lower below the midline, allowing room for more declines.

The downside bias is also backed by the bear cross confirmed on the daily time frame on Monday. The 50-DMA pierced through the 100-DMA from above, flashing the bearish signal.

The next relevant support is seen at the 0.7050 psychological level if the daily lows of 0.7090 cave in.

AUD/USD: Daily chart

On the flip side, buyers will need acceptance above the 21-DMA cap to extend the recovery from yearly lows of 0.6993 reached a week ago.

Further up, the recent range highs around 0.7185 could come into play, opening doors for a rally towards 0.7250.

AUD/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.