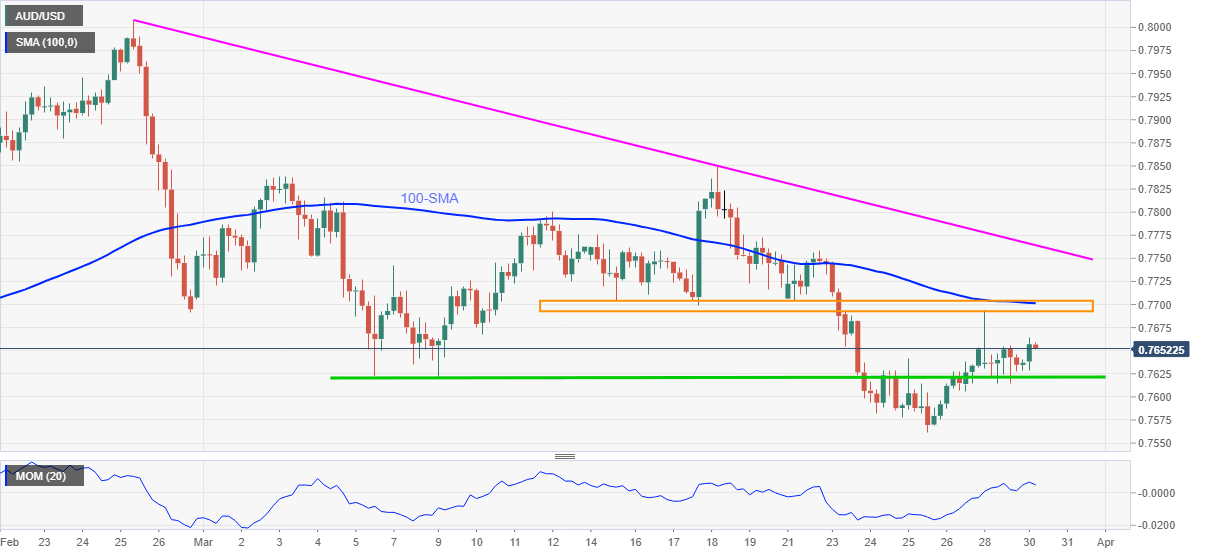

AUD/USD Price Analysis: Eases from intraday top below 0.7700

- AUD/USD trims intraday gains, stays below key hurdles.

- Fortnight-old horizontal area, monthly resistance line test recovery moves.

- Bears need to break 0.7557 for confirmation, monthly top adds to the upside barriers.

AUD/USD steps back from 0.7664 while trimming intraday gains to 0.24% ahead of Tuesday’s European session. In doing so, the quote fades upside momentum before hitting the key barriers to the north.

Among them, a horizontal area between 0.7690 and 0.7705, comprising 100-SMA, becomes the first challenge to the AUD/USD buyers.

Following that, a one-month-long falling resistance line and the monthly top, respectively around 0.7765 and 0.7850 will be important to watch.

On the contrary, the early month lows surrounding 0.7620 and the 0.7600 round-figure can entertain AUD/USD sellers during the fresh pullback.

However, any further weakness will have to break a horizontal region comprising lows marked since December 28, around 0.7562-57.

Overall, AUD/USD remains in the consolidation mode and hence short-term sellers are welcomed.

AUD/USD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.