AUD/USD Price Analysis: Bulls stay in charge but face a wall of daily resistance

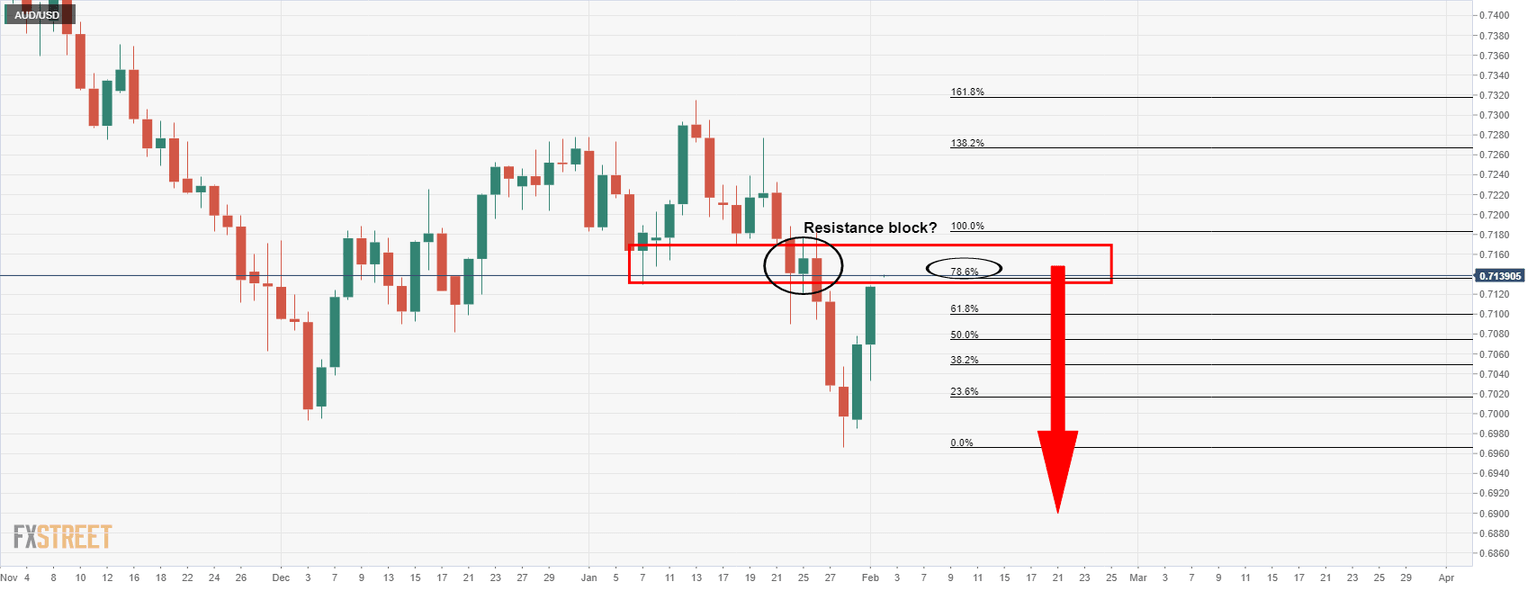

- AUD/USD is trapped at a wall of daily resistance.

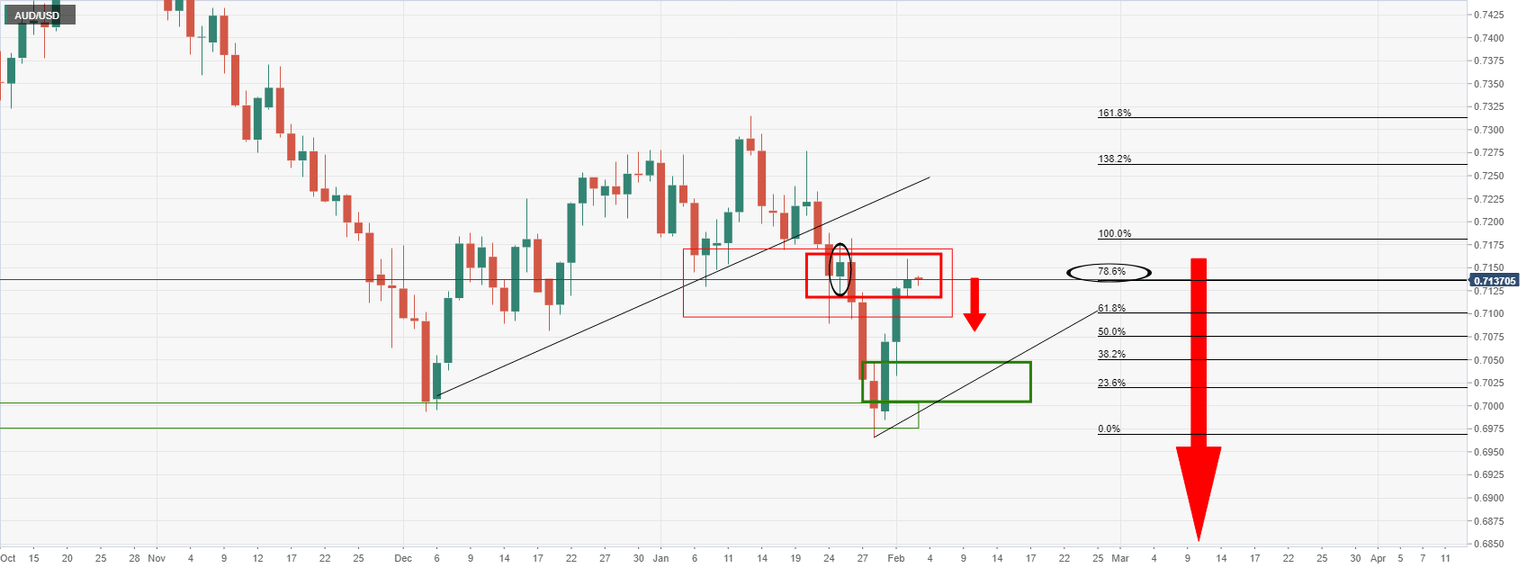

- Traders need to see a shift out of H4 resistance ad support.

The day ahead will be key for AUD/USD that is technically overstretched, relatively so, with US Treasury yields rising across the curve after major central banks on Thursday said that there is considerable concern regarding the inflation environment.

''This should see local rates markets open to some selling pressure before the Reserve Bank of Australia Statement of Monetary Policy,'' analysts at ANZ Bank said. Therefore, the focus is on the resistance that the Aussie is facing on the daily chart as follows:

AUD/USD prior analysis

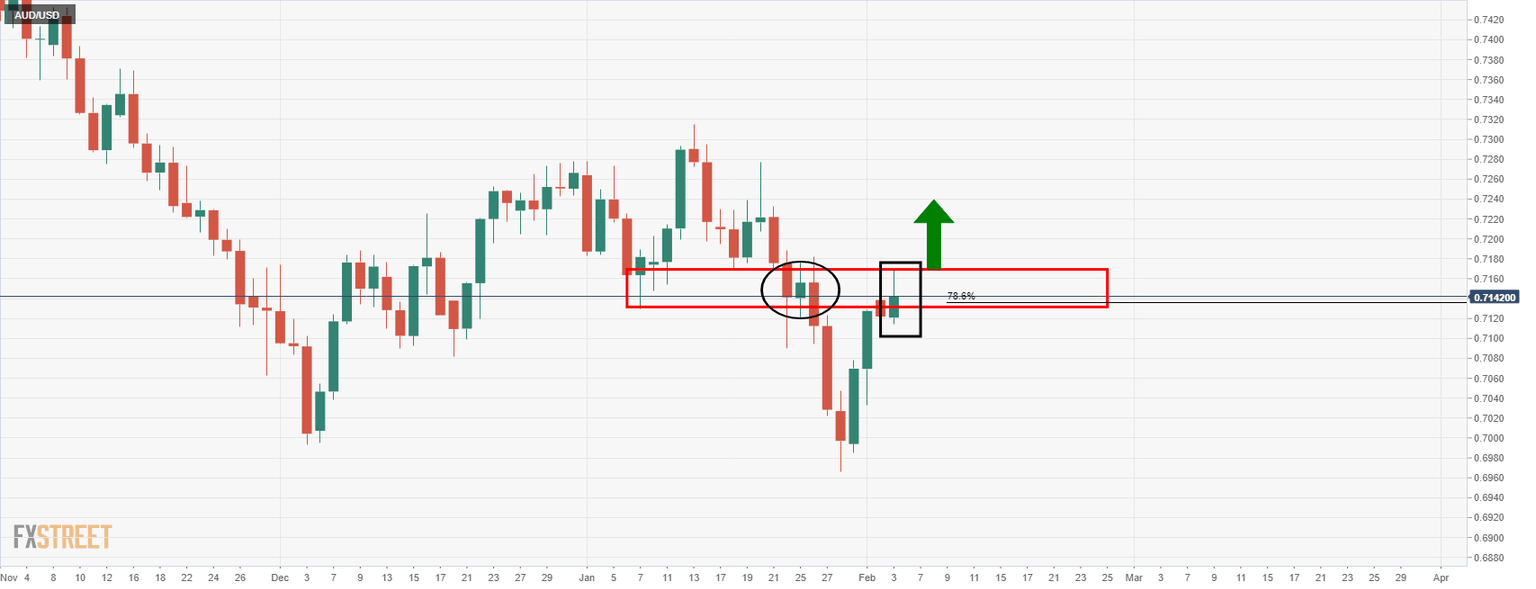

In the prior analysis, AUD/USD Price Analysis: Bears are on the lookout for an opportunity in the deceleration of the bullish daily correction, the resistance was noted as follows:

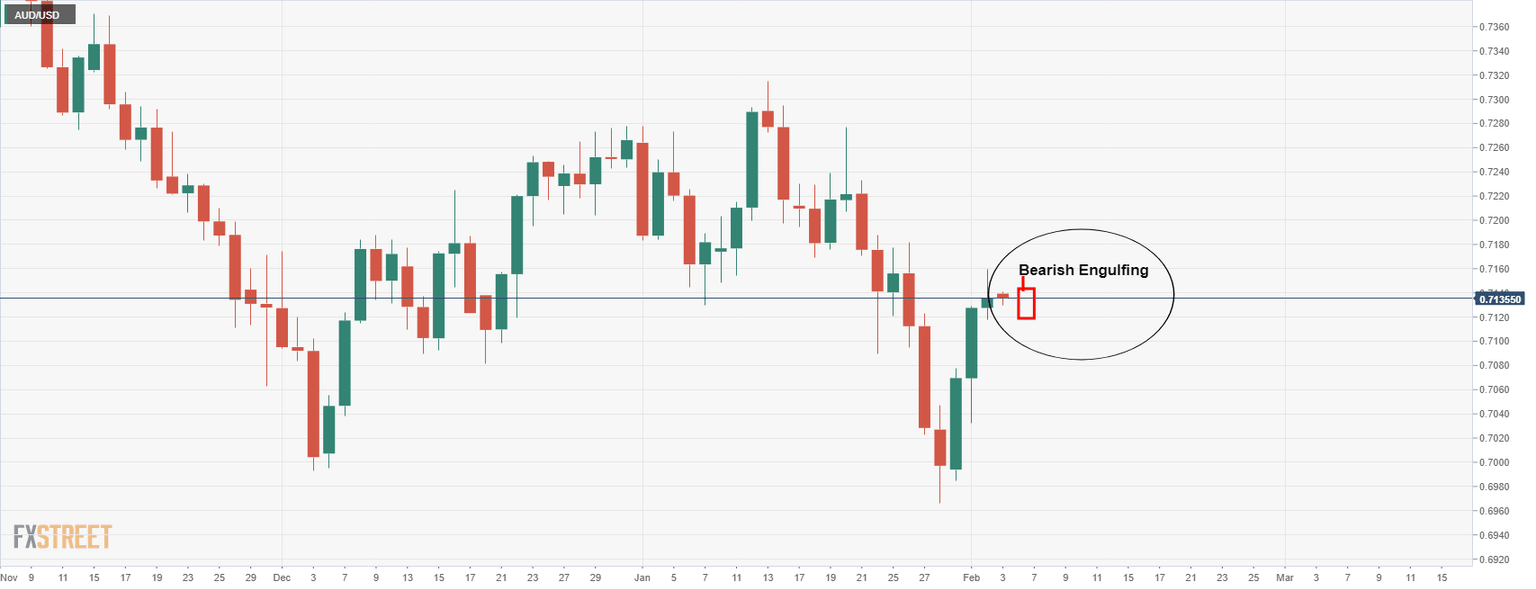

Bears were in anticipation of a Dijo close followed by a Bearish Engulfing as follows:

AUD/USD live market

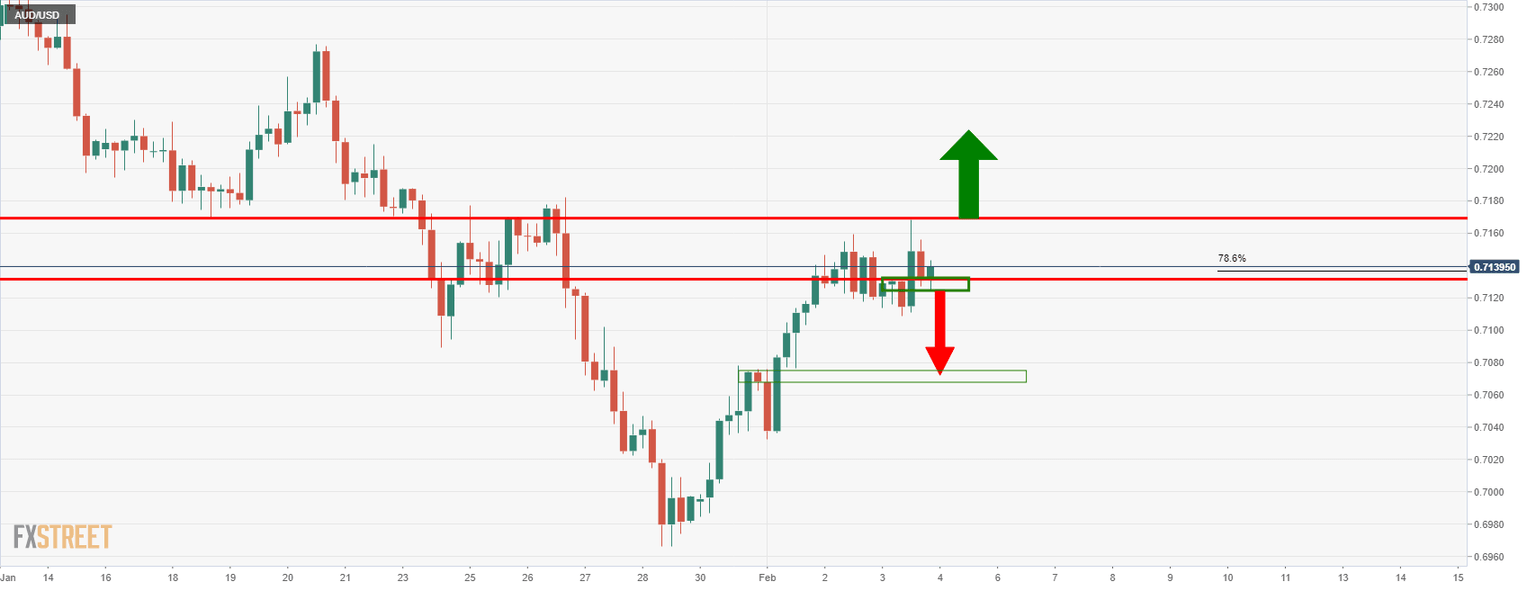

Instead, we have seen a Bullish Engulfing which means there is nothing for traders to do on the downside, for now.

AUD/USD H4

The price is consolidated at this juncture and there needs to be a break of H4 structure, one way or the other before a trend would be offering trader's an opportunity.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.