AUD/USD Price Analysis: Bulls battle with 20-EMA around 0.6650

- Bulls are hopeful amid a significant recovery in the risk-on impulse.

- The DXY is expected to remain on the tenterhooks ahead of the Fed minutes release.

- The RSI (14) is oscillating in a 40.00-60.00 range, which indicates a consolidation ahead.

The AUD/USD pair has witnessed a firmer rebound after a minor correction to near 0.6636 in the Tokyo session. The asset is gaining strength as the U dollar index (DXY) is on the verge of testing the 107.00 support amid optimism in the global markets.

Meanwhile, the 10-year US Treasury yields have dropped below 3.76% amid anxiety ahead of the release of the Federal Open Market Committee (FOMC) minutes. This will provide a detailed reasoning behind the announcement of the fourth consecutive 75 basis points (bps) rate hike.

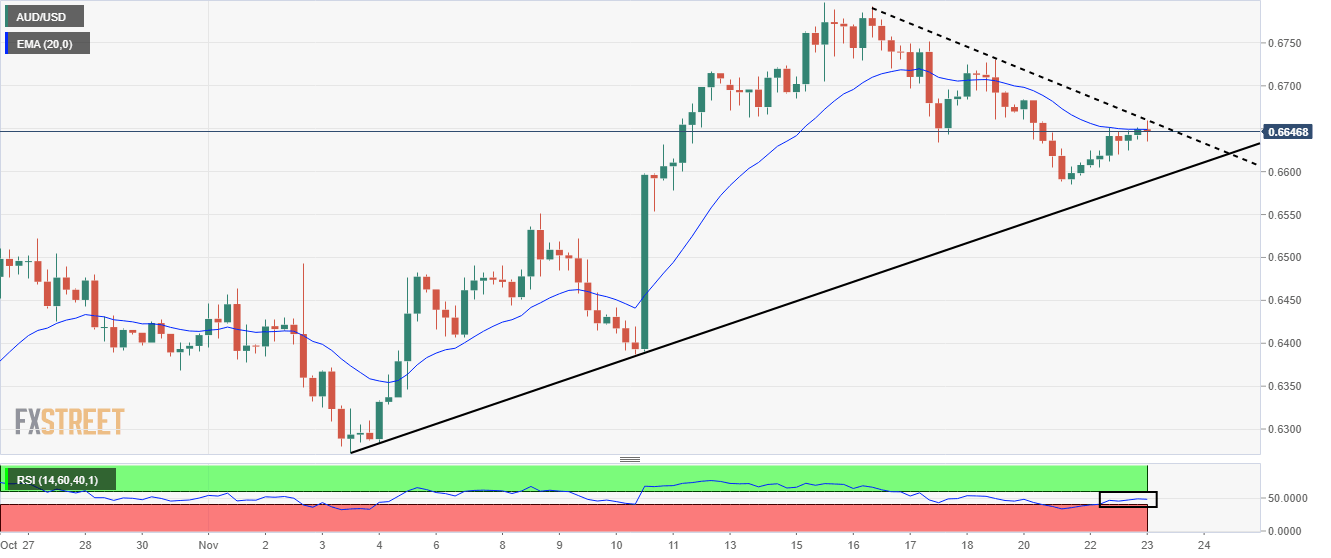

On a four-hour scale, the asset has displayed a mean reversion to the 20-period Exponential Moving Average (EMA) at around 0.6650. The major could display a rangebound structure as the upside is capped by the downward-sloping trendline placed from November 16 high at 0.6793 while the downside is supported by the upward-sloping trendline plotted from November’s low at 0.6272.

The Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range, which indicates a consolidation ahead.

Should the asset oversteps Monday’s high at 0.6685, Aussie bulls will get strengthened and will drive the asset towards November 17 high at 0.6751, followed by November’s high around 0.6800.

On the contrary, the Greenback bulls could be supported if the asset surrenders Monday’s low at 0.6585. This will drag the asset towards November 8 high and low at 0.6551 and 0.6444 respectively.

AUD/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.