AUD/USD Price Analysis: Bears need to contemplate monthly support

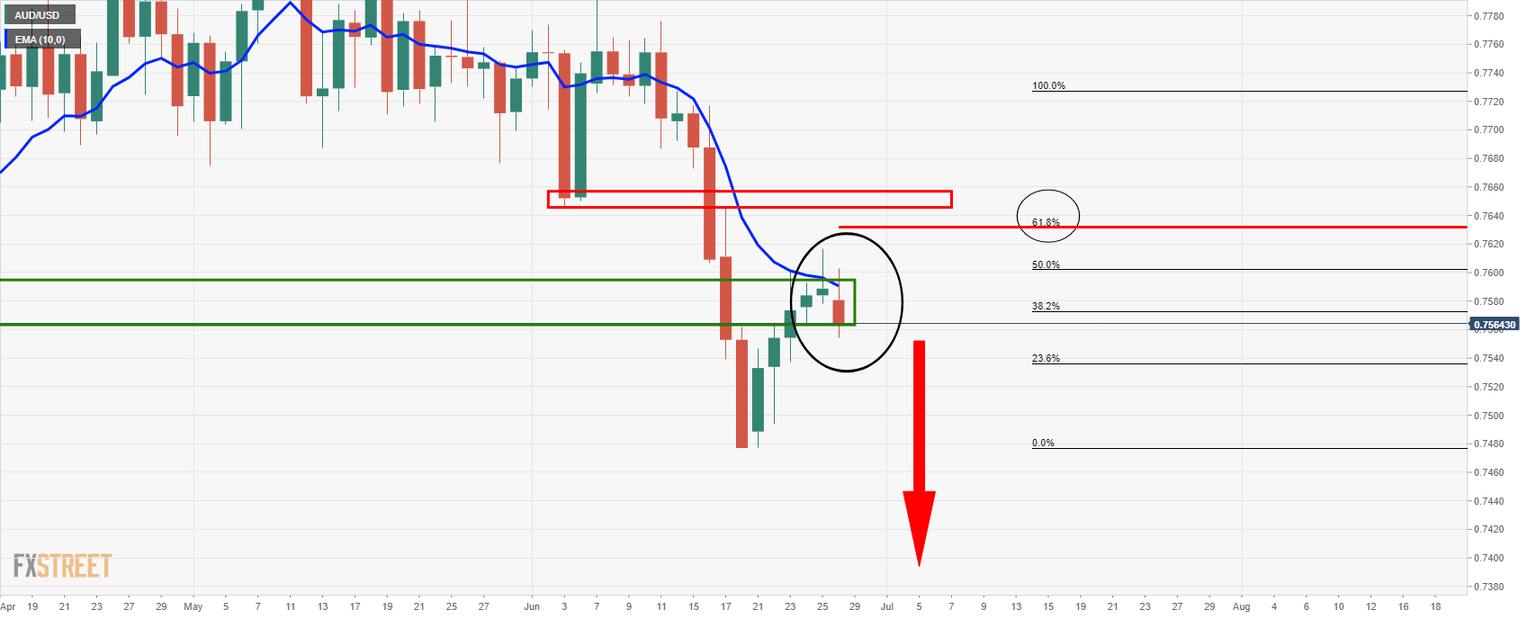

- AUD/USD bears seeking a bearish structure on the lower time frames for a daily downside extension.

- Monthly support is a significant obstacle to the bear's playbook.

As per the prior analysis, AUD/USD Price Analysis: 61.8% Fibo wasn't to be, bears up the ante, there are prospects for a downside continuation from a daily perspective, and also a weekly,.

However, scanning out over to the monthly chart, it should be noted that there is also a significant support structure that could still well hold.

Prior daily and 4-hour analysis

The price has been pressured by the 10-day EMA and would be now expected to continue its southerly trajectory in the form of a fresh bearish daily impulse.

4-hour chart

Monthly chart and significant support

While there are strongly bearish probabilities, especially taking into account the weekly bearish chart patterns, the monthly support cannot be ignored.

Daily chart and monthly support

Weekly bearish patterns

However, scanning out the weekly chart, the first bearish scenario comes with the failed reverse head and shoulders:

Also, we have a double top as a result.''

''A downside continuation would be expected in the sessions ahead with prior structure at 0.7365/0.7410 as a target area.''

While selling from support is not an ideal playbook, when considering the bearish conditions across other multiple time frames, reduced risk could be an option applied to a trade set-up on the 4-hour chart to limit possible losses should monthly support prevent a downside continuation.

In any case, a constructive breakeven scenario should be considered at the earliest opportunity post entry and prior to meeting the first level of monthly support at 0.7530.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.