AUD/USD Price Analysis: Bears eye the daily chart's W-formation near 0.7235

- AUD/USD bulls are throwing in the towel as per the hourly chart.

- The bears can target the daily W-formation's neckline.

AUD/USD has risen sharply as the US dollar plummets below critical daily support. However, the W-formation is compelling, especially with the DXY now stabilising at deeper support as follows:

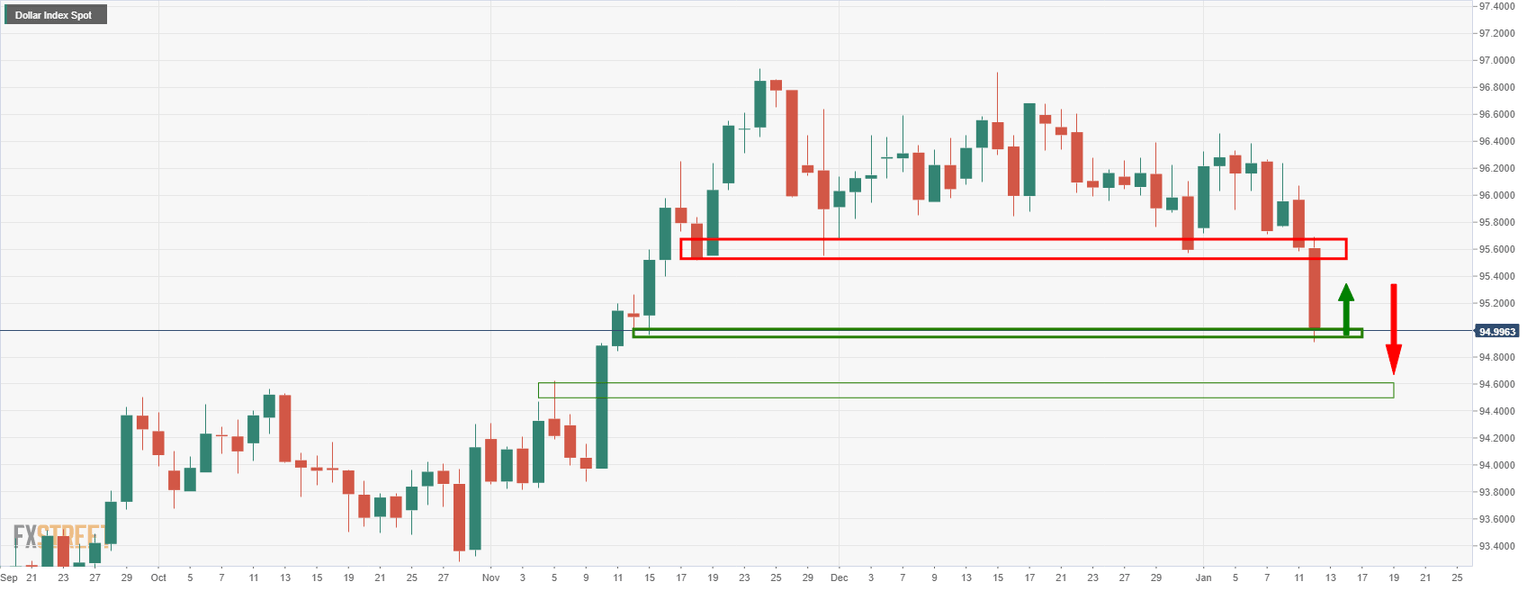

DXY daily chart

There are prospects f a bullish correction in the US dollar for the sessions ahead.

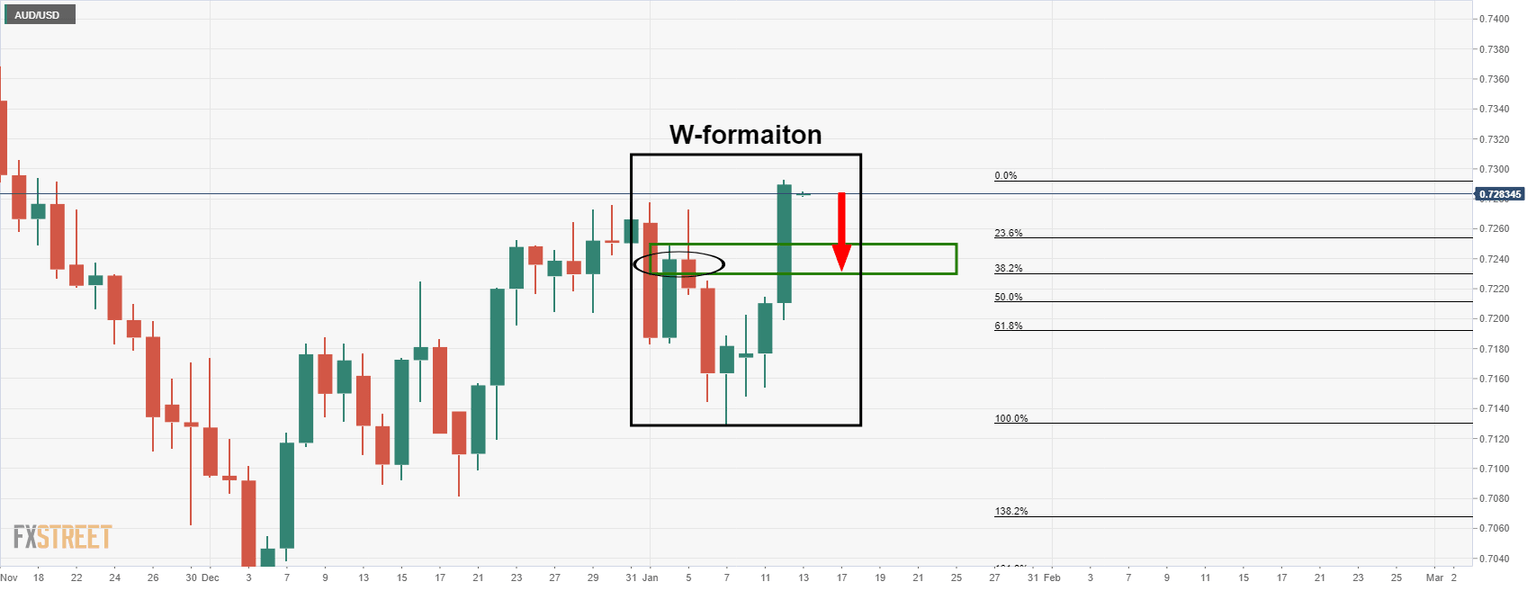

AUD/USD daily chart

This rhymes with a downside correction in the Aussie as illustrated above. The W-formation is a reversion pattern and there is a high probability that the neckline will be retested as support in due course. This comes in near 0.7235.

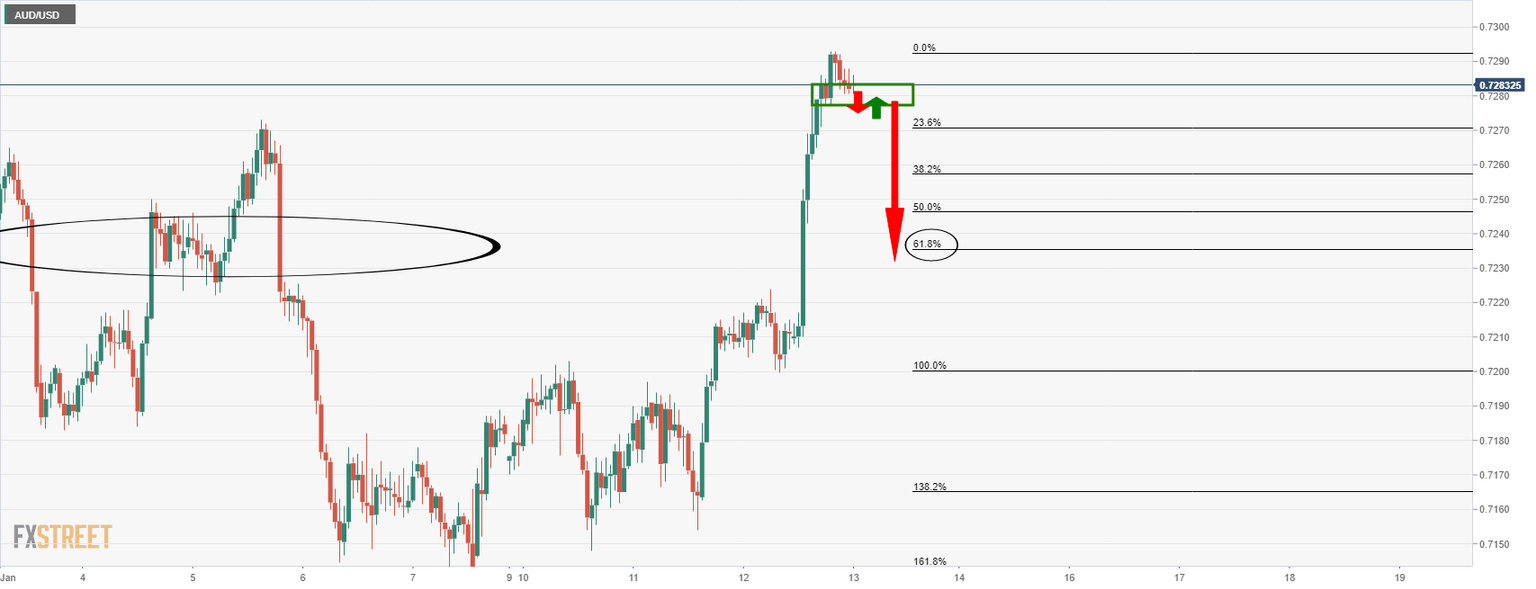

AUD/USD H1 chart

From an hourly perspective if the price breaks support, then the 61.8% Fibonacci retracement that aligns with prior structure and the W-formation's neckline will be eyed.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.