AUD/USD Price Analysis: Bears eye a run below 0.6875

- AUD/USD bulls are moving back in, but remain in the bear's lair.

- AUD/USD bears need to get below 0.6875 should 0.6890 hold as resistance.

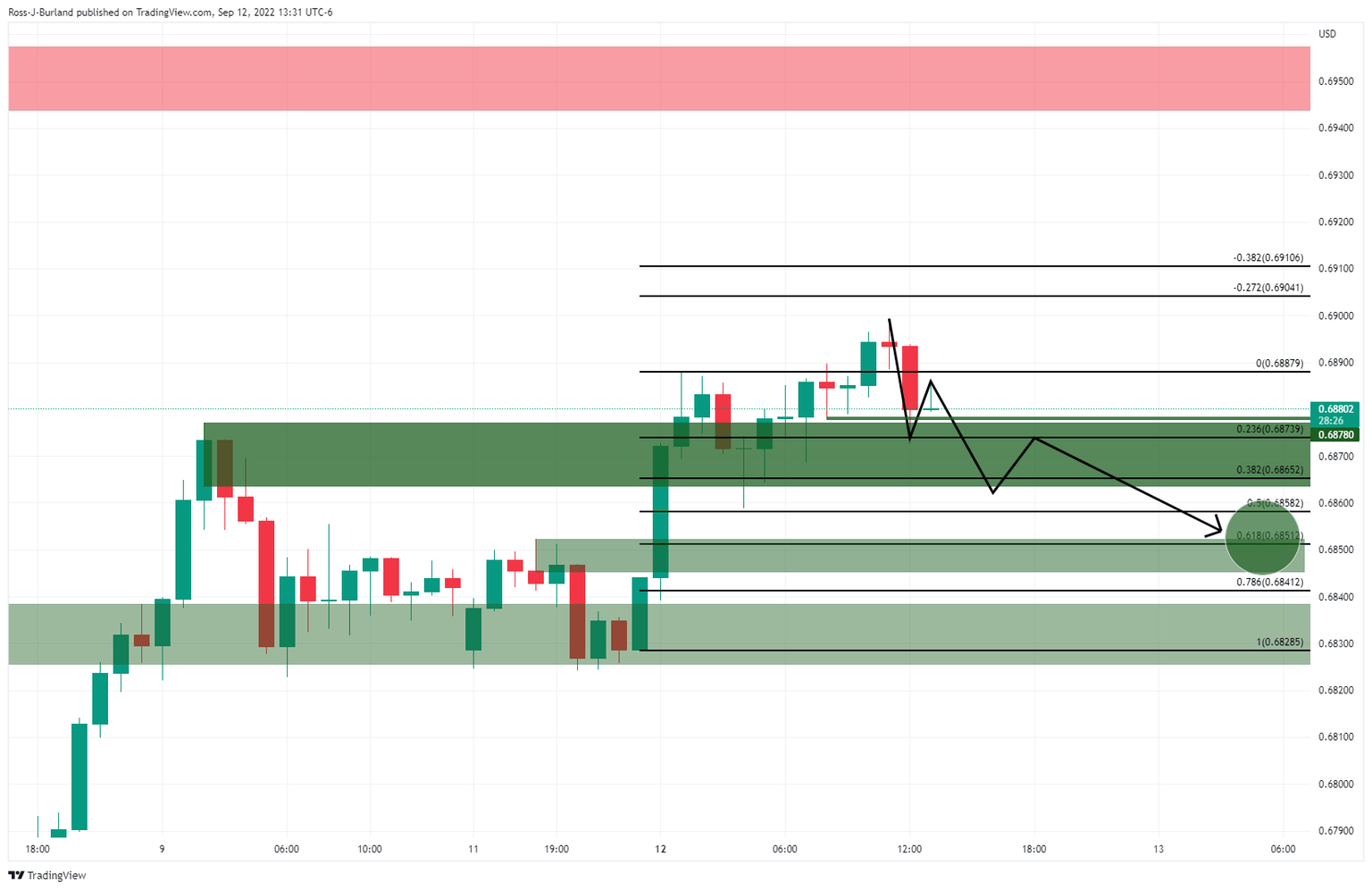

From a 1-hour basis, a peak formation was being formed at the start of the week and this was threatening to send the price into the 0.6850s for the day ahead on a break of 0.6880 structure.

AUD/USD prior analysis

The doji followed by the bearish engulfing was a compelling formation that exposed the 61.8% Fibo of the prior bullish impulse that meets the prior resistance structure.

AUD/USD live market

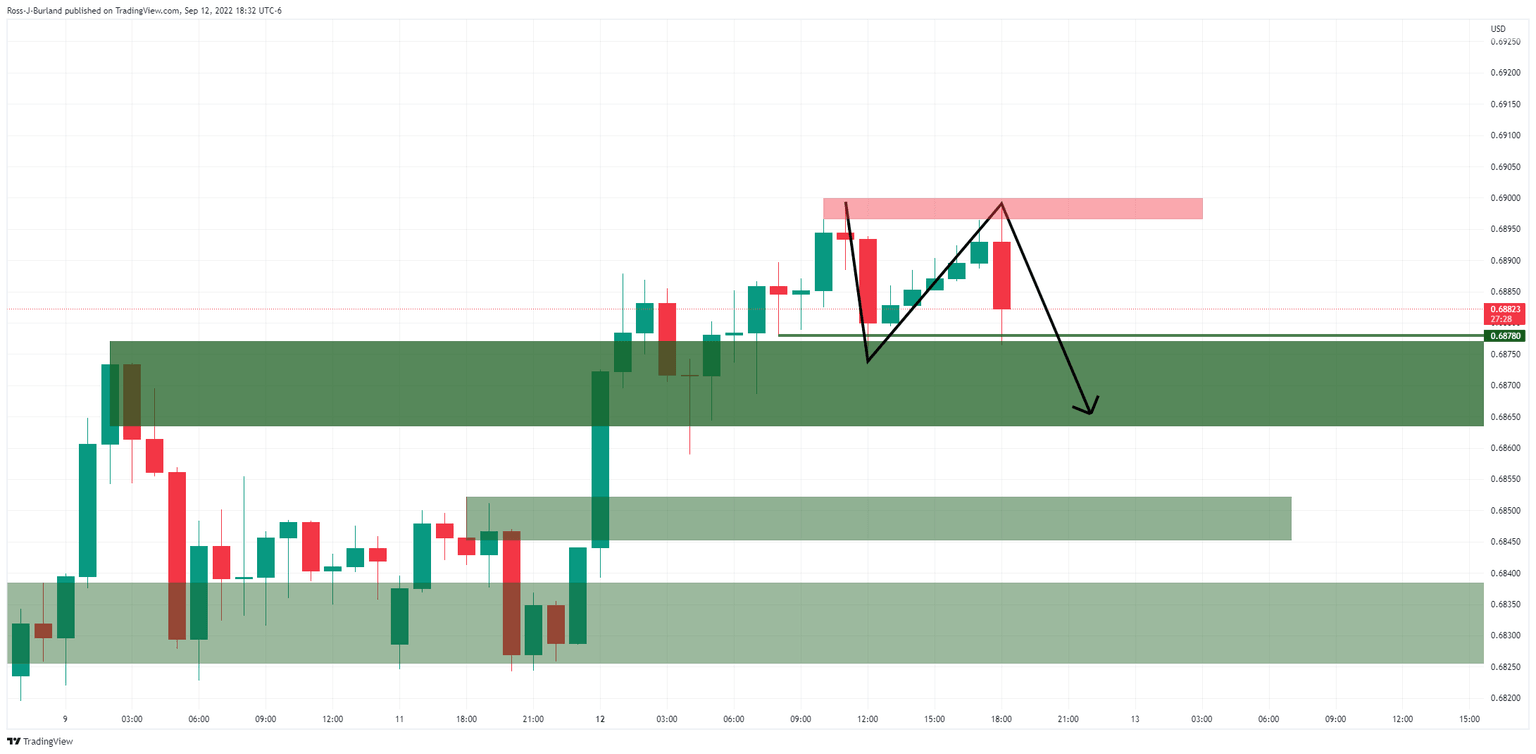

The price has since corrected to test the prior highs again but has failed to do so with conviction considering the tepid pace followed by a shape move to the downside.

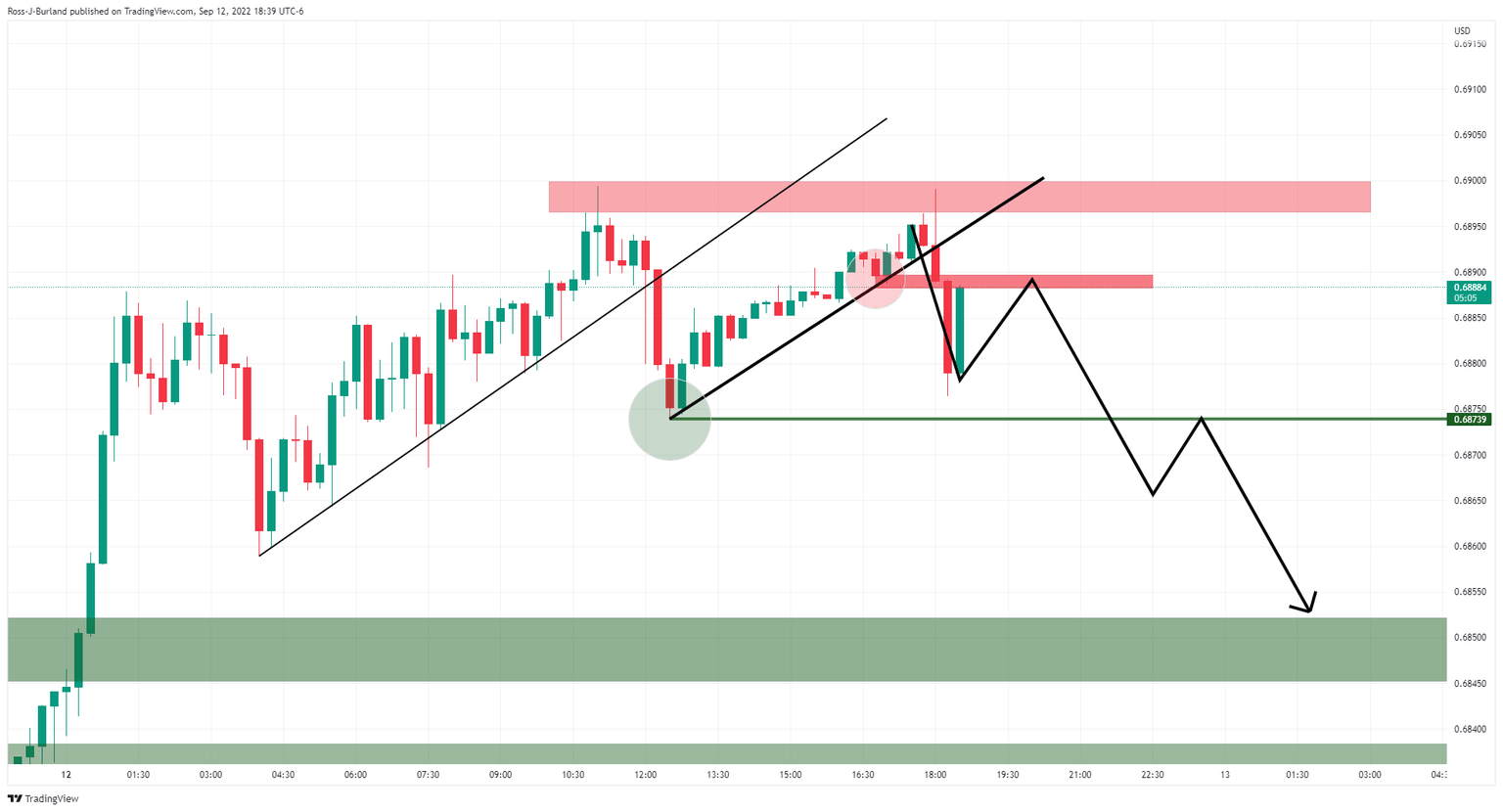

AUD/USD M15 chart

From a 15-minute perspective, the bears need to get below 0.6875 should 0.6890 hold as resistance.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.