AUD/USD Price Analysis: 0.6800 remains critical for the Australian Dollar

- AUD/USD has sensed a minor correction after a perpendicular recovery from 0.6720.

- An improvement in investors’ risk appetite has underpinned the Australian Dollar.

- The Aussie asset needs to surpass 0.6800 for an upside move ahead.

The AUD/USD pair has sensed a minor correction in the early Tokyo session after a perpendicular recovery from 0.6720. The Aussie asset is likely to extend its recovery to near the round-level resistance of 0.6800 as the risk appetite of the market participants has improved dramatically.

A stellar recovery in the S&P500 on Thursday as investors rushed for dip buying after a two-day sell-off underpinned risk-off mood. The US Dollar Index (DXY) dropped to near the lower end of the weekly trading range around 103.60.

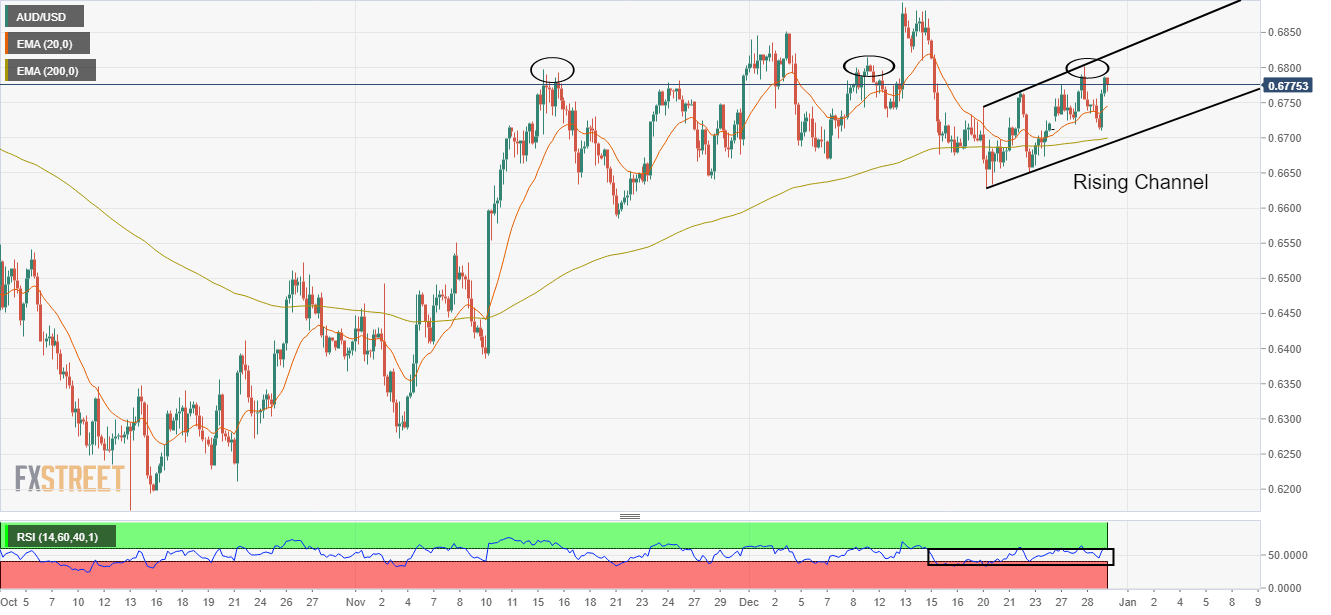

On a four-hour scale, the Aussie asset is auctioning in a Rising Channel chart pattern, which is highly neutral as it has formed after a sell-off move from December 13 high around 0.6900. The round-level resistance of 0.6800 has remained a critical barrier for the Australian Dollar for the past 15 trading sessions.

A recovery move in the Aussie asset has pushed it above the 20-period Exponential Moving Average (EMA) around 0.6747. Also, the 200-EMA at 0.6700 is still solid, which indicates that the long-term trend is still bullish.

The Relative Strength Index (RSI) (14) is struggling to shift into the bullish range of 60.00-80.00. An occurrence of the same will trigger bullish momentum.

For an upside move, the Australian Dollar needs to surpass Wednesday’s high around 0.6800, while will drive the Aussie asset towards December 13 high around 0.6880 followed by the psychological resistance at 0.7000.

On the contrary, a breakdown of December 27 low at 0.6719 will drag the major towards December 15 low around 0.6677. A slippage below the latter will expose the asset for more downside toward December 20 low at 0.6629.

AUD/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.