AUD/USD kisses 0.6900 as USD Index extends losses, RBA and FOMC minutes hog limelight

- AUD/USD has touched a high of 0.6900 as the USD Index has surrendered its morning gains.

- Persistent inflation in the United States has bolstered the odds of more interest rate hikes by the Federal Reserve ahead.

- The minutes from the Reserve Bank of Australia might remain hawkish for further guidance as inflation has still not peaked yet.

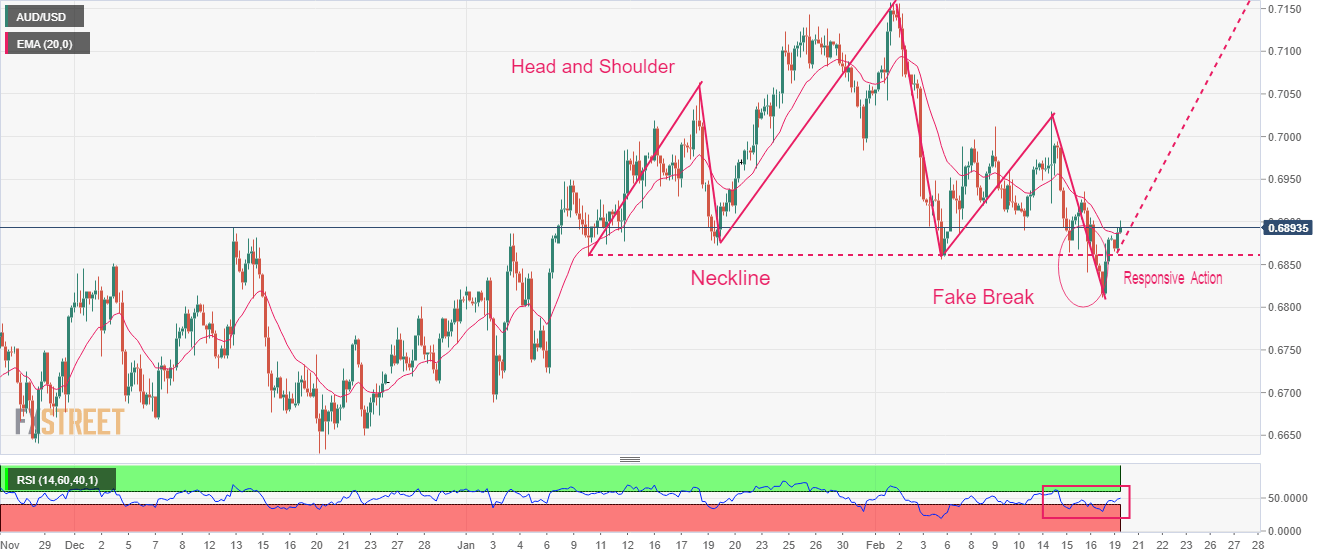

- AUD/USD has negated the downside break of the H&S pattern and has shifted into a bullish trajectory.

AUD/USD touched the round-level resistance of 0.6900 in the early European session. The Aussie asset has been strengthened as investors have shrugged-off uncertainty associated with US-China tensions and the launch of three projectiles from North Korea near Japan’s Exclusive Economic Zone (EEZ).

The US Dollar Index (DXY) has surrendered its entire gains added in the Asian session and is looking to continue its downside journey ahead. Meanwhile, the risk appetite theme has regained traction, which is supporting the risk-perceived assets. S&P500 futures have turned volatile ahead of the market holiday on account of Presidents’ Day.

People’s Bank of China maintains the status quo on interest rates

The Australian Dollar remained in action after the People’s Bank of China (PBoC) kept its monetary policy unchanged. An interest rate decision of unchanged policy was widely anticipated as the Chinese economy is focusing on accelerating the economic recovery after remaining bound by pandemic controls.

The People’s Bank of China has kept one-year and five-year Loan Prime Rates (LPR) unchanged at 3.65% and 4.30% respectively. It is worth noting that Australia is a leading trading partner of China and the continuation of expansionary monetary policy by the People’s Bank of China will strengthen the Australian Dollar ahead.

Fresh concerns for higher US Inflation call for more rates by the Fed

Last week, a majority of economic indicators cleared that it would be early for the Federal Reserve to announce a win in the battle against stubborn inflation as it is set to surprise the market ahead. The United States Consumer Price Index (CPI) landed higher at 6.4% than the projections of 6.2%, Producer Price Index (PPI) released at 6.0% higher than the consensus of 5.4%. And, the release of the monthly Retail Sales data at 3.0% against the consensus of 1.8% was the last nail in the coffin, which cleared that consumer spending is gaining traction.

A note from Goldman Sachs states the investment banking firm expects the U.S. Federal Reserve to raise interest rates three more times this year, lifting their estimates after data pointed to persistent inflation and a resilient labor market, as reported by Reuters.

Spotlight shifts to Reserve Bank of Australia and Federal Reserve’s minutes

This week, the release of the minutes from the Reserve Bank of Australia and Federal Reserve’s and Federal Reserve will lead from the front for the power-pack action in the Aussie asset. Federal Reserve policymakers are aware of the persistent nature of the US inflation, which is why hawkish guidance is expected on interest rates.

The minutes from the Reserve Bank of Australia policy announced in the first week of February resulted in a ninth consecutive interest rate hike to 3.35%. Inflationary pressures in the Australian economy have not softened yet amid solid consumer spending, which is bolstering the case of hawkish guidance on the monetary policy.

Later this week, Australia’s Labor Cost Index (Q4) data will remain in focus. The economic data is seen at 3.4% vs. the prior release of 3.1% on an annual basis. And, the quarterly data is seen lower at 0.7% against the prior release of 1.0%.

AUD/USD technical outlook

AUD/USD has negated the downside break of the Head and Shoulder chart pattern formed on a four-hour scale. The responsive buying active from the market participants has pushed the Aussie asset above the neckline of the aforementioned chart pattern plotted from January 10 low at 0.6860. The asset has scaled above the 20-period Exponential Moving Average (EMA) at 0.6888, which indicates that the short-term trend is bullish now.

The Relative Strength Index (RSI) (14) has rebounded into the 40.00-60.00 range, which indicates that the asset is no more bearish now.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.