AUD/USD: It's a big week for the Aussie, a come back could be on the cards

- It is a key week for AUD/USD traders with the RBA in focus.

- The overstretched net-short positions could result in a short squeeze with 0.71 eyed ar key resistance.

AUD/USD ended a bad week at a critical support area on the charts, however, traders will be keen to reposition themselves ahead of what could be a hawkish teat at the Reserve bank of Australia. For the open, 0.7010 will be an important level on the upside for the bulls to clear.

AUD/USD traded between 0.6967 and 0.7045 recovery mode after spiking through the December lows of 0.6993. The bulls managed to get the price back over the line to the upside to close there as bears cashed in ahead of another critical central bank week.

Short positions are relatively overstretched on AUD/USD due to the recent lack of an appetite for high-beta currencies/high appetite for USD. Should there be another step in the direction of policy normalisation at the RBA, owing to a tighter jobs market and higher inflation readings for the fourth quarter, then traders could jump on the opportunity to force a timely correction on the daily charts, (see below).

''We expect the RBA to forecast trimmed mean inflation of 3% by mid-2022 in Friday’s Statement on Monetary Policy, with unemployment falling below 4% by the end of year,'' analysts at ANZ Bank said.

''These numbers will be referenced in Tuesday’s RBA Board statement, though we expect the RBA Board to say it will wait until wages growth accelerates further before it lifts the cash rate.''

''Its forecast for wages growth will likely point to a rate hike in the first half of 2023 as being its central case, but Lowe is expected to admit for the first time, in Tuesday’s statement and/or his speech the following day, that a move in 2022 is a possibility if wages growth comes through faster than forecast.''

AUD/USD technical analysis

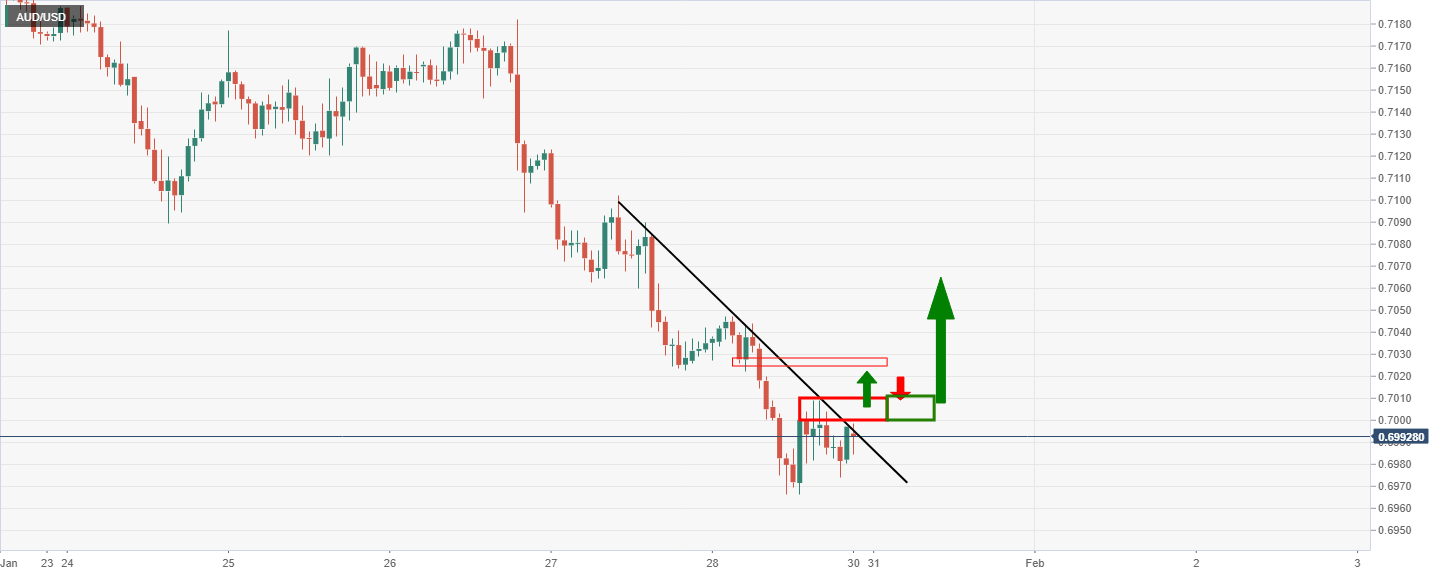

For the open, 0.7010 will be key:

The hourly resistance at 0.7010 guards a breakout of the hourly downtrend. The bigger picture, however, is as follows:

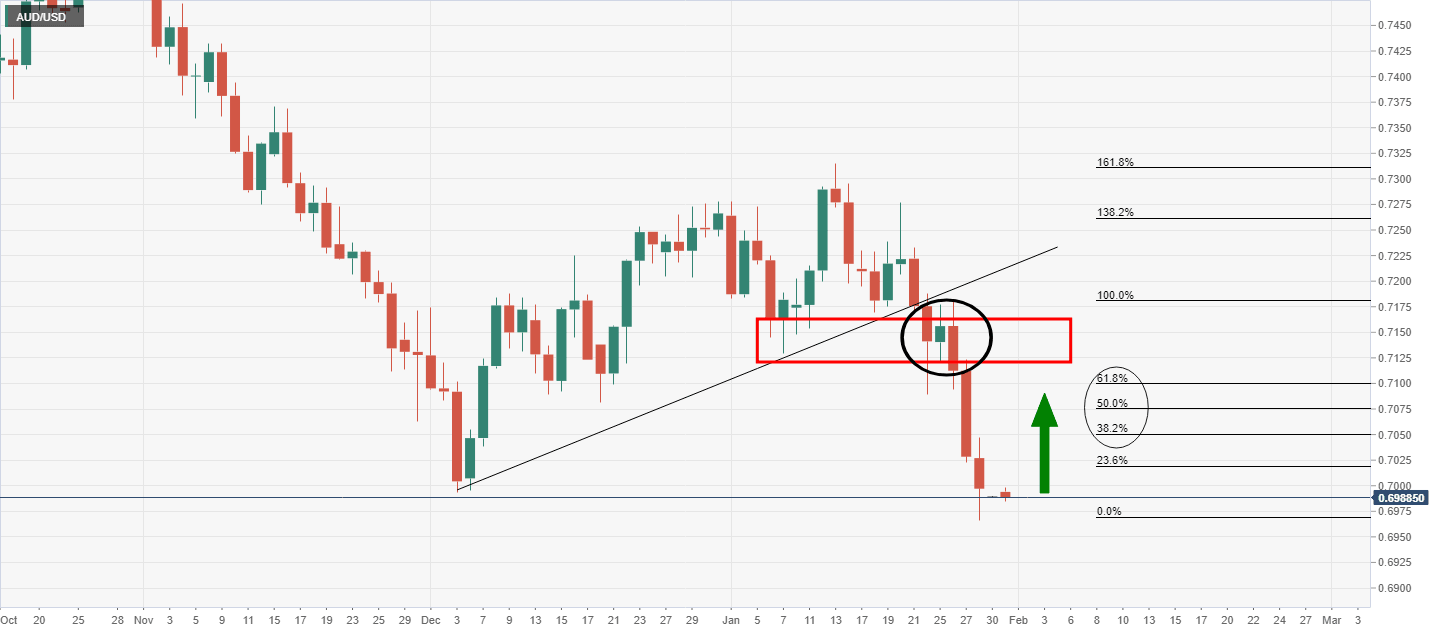

As per the chart above, the bulls can target the Fibonaccis on the way to the prior structure and the lower highs of the December bullish trend near 0.7130. The golden ratio, 61.8%, should be a key area near the psychological 0.71 round number. 0.7180 would be expected to act as a critical resistance below the counter trendline.

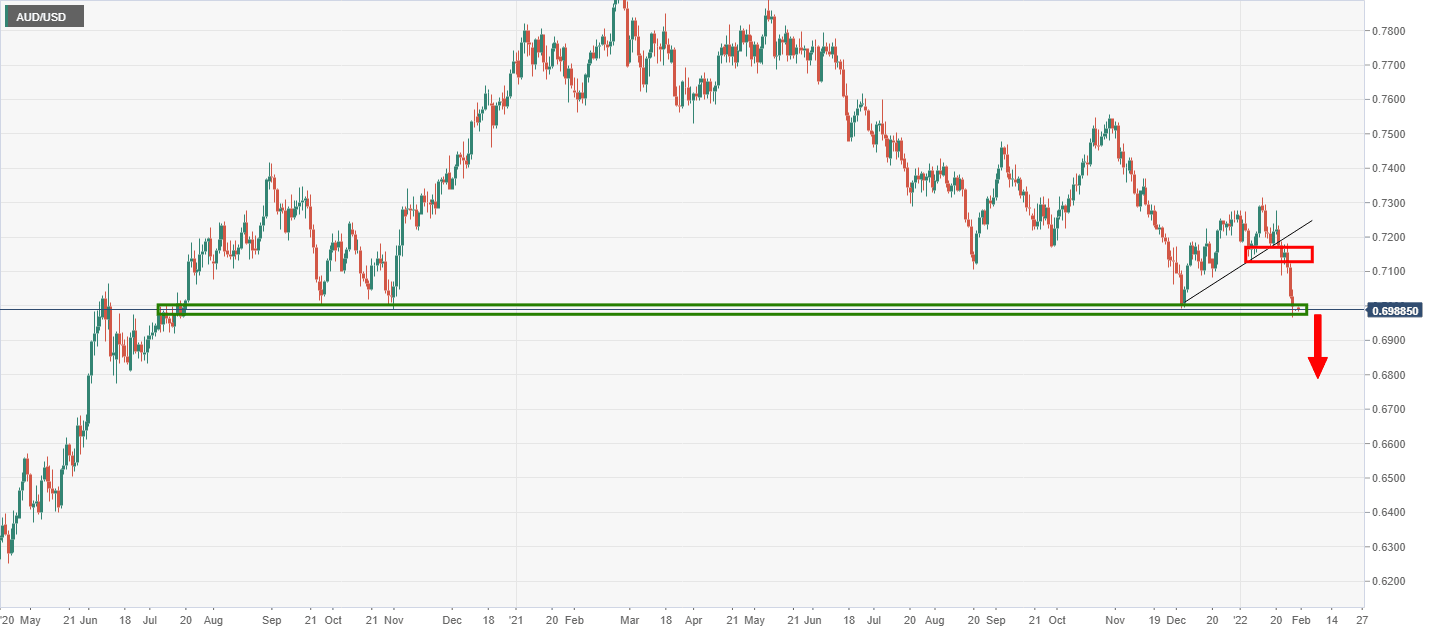

Failing that scenario, the bears could push the price into the abyss below 0.6950:

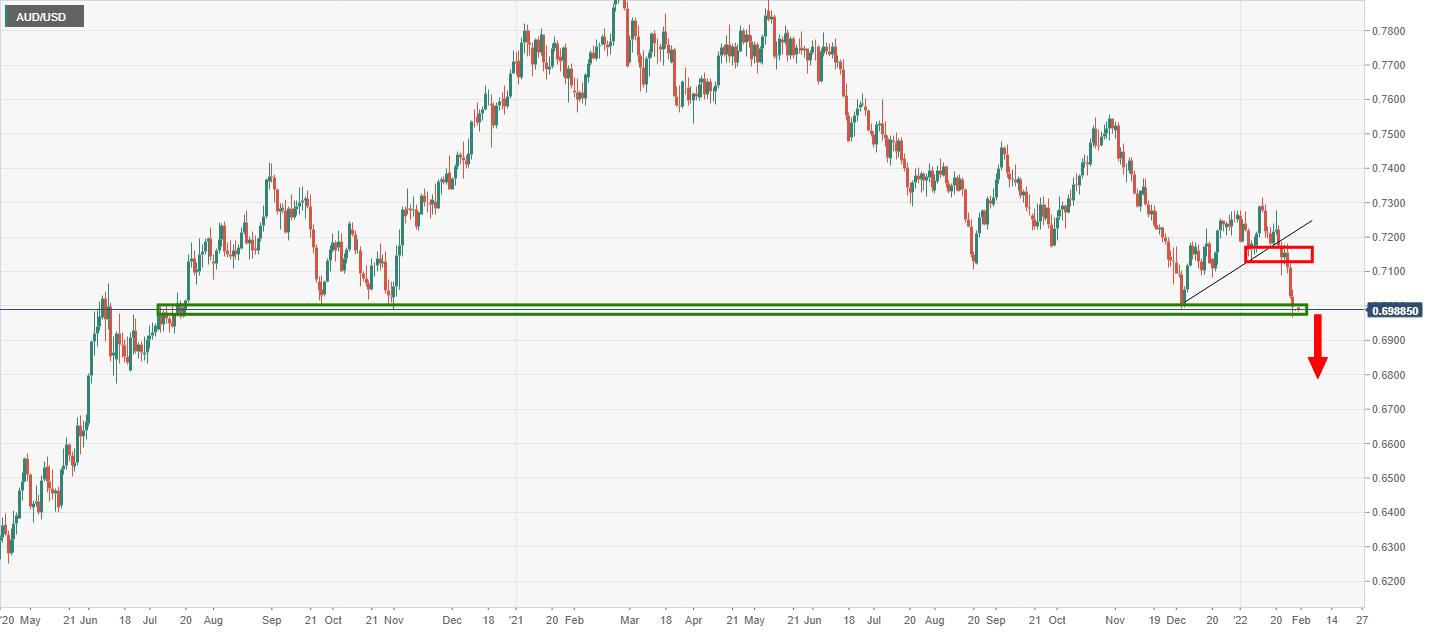

However, a correction would be the most typical course for the pair at this juncture prior to further downside:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.