AUD/USD extends gains as Fed uncertainty threatens the US Dollar ahead of Australian PMI data

- AUD/USD climbs as RBA Minutes reveal a less dovish stance ahead of key PMI data.

- US Dollar weakens on rising concerns over Fed independence.

- AUD/USD tests critical level at 0.6550 with psychological resistance firming at 0.6600.

The Australian Dollar (AUD) is extending its climb against the US Dollar (USD) on Tuesday as a softer Greenback and a slightly more balanced tone from the Reserve Bank of Australia (RBA) support the upside move.

With AUD/USD trading above 0.6550 at the time of writing, attention is shifting to upcoming economic data releases and monetary policy to determine the next major move.

AUD/USD rises as RBA Minutes reflect a data-dependent stance

The RBA released its Minutes from the July Monetary Policy Meeting on Tuesday, which confirmed the Board’s decision to leave the cash rate unchanged at 3.85% in July, citing a balanced assessment of risks.

While the official post-meeting statement was cautious, the Minutes revealed a more nuanced stance.

Policymakers noted there was "no compelling case for a move in either direction" but highlighted a “low tolerance” for inflation drifting further from target.

Particular focus is now on the Q2 Consumer Price Index (CPI) data, due July 31, which will help shape the outlook ahead of the next RBA meeting.

On employment, the RBA acknowledged that the labour market has eased slightly. The Unemployment Rate has edged up to 4.3%, and hiring intentions have softened. Wage growth appears to have peaked, while services inflation remains elevated, keeping inflation risks skewed to the upside.

The next near-term catalyst for AUD is the S&P Global Australia Composite PMI (Purchasing Managers Index), due to be released on Wednesday at 23:00 GMT, offering a snapshot of private-sector business conditions for July.

US Dollar weakens as concerns over Fed independence rise, trade tensions linger

Meanwhile, the US Dollar remains under pressure as trade tensions and questions about Federal Reserve (Fed) independence continue to weigh on market sentiment.

Growing political pressure from President Donald Trump on Fed Chair Jerome Powell, including renewed calls for rate cuts and even Powell’s resignation, has supported recent gains in AUD/USD.

During a meeting with Philippine President Ferdinand Marcos, Trump criticized Powell, saying he had “done a bad job” and would be “out pretty soon.”

Although the Fed is currently in its pre-meeting blackout period, these comments have intensified concerns about the central bank’s independence. Combined with rising tariff risks and broader trade uncertainty, this has reduced demand for the US Dollar and shifted investor focus to incoming economic data.

June Existing Home Sales, due to be released on Wednesday, will provide further insight into consumer and housing market resilience amid elevated interest rates.

A weaker-than-expected print could reinforce expectations for policy easing later this year, adding further downward pressure on the Greenback.

AUD/USD tests critical level at 0.6550 with psychological resistance firming at 0.6600

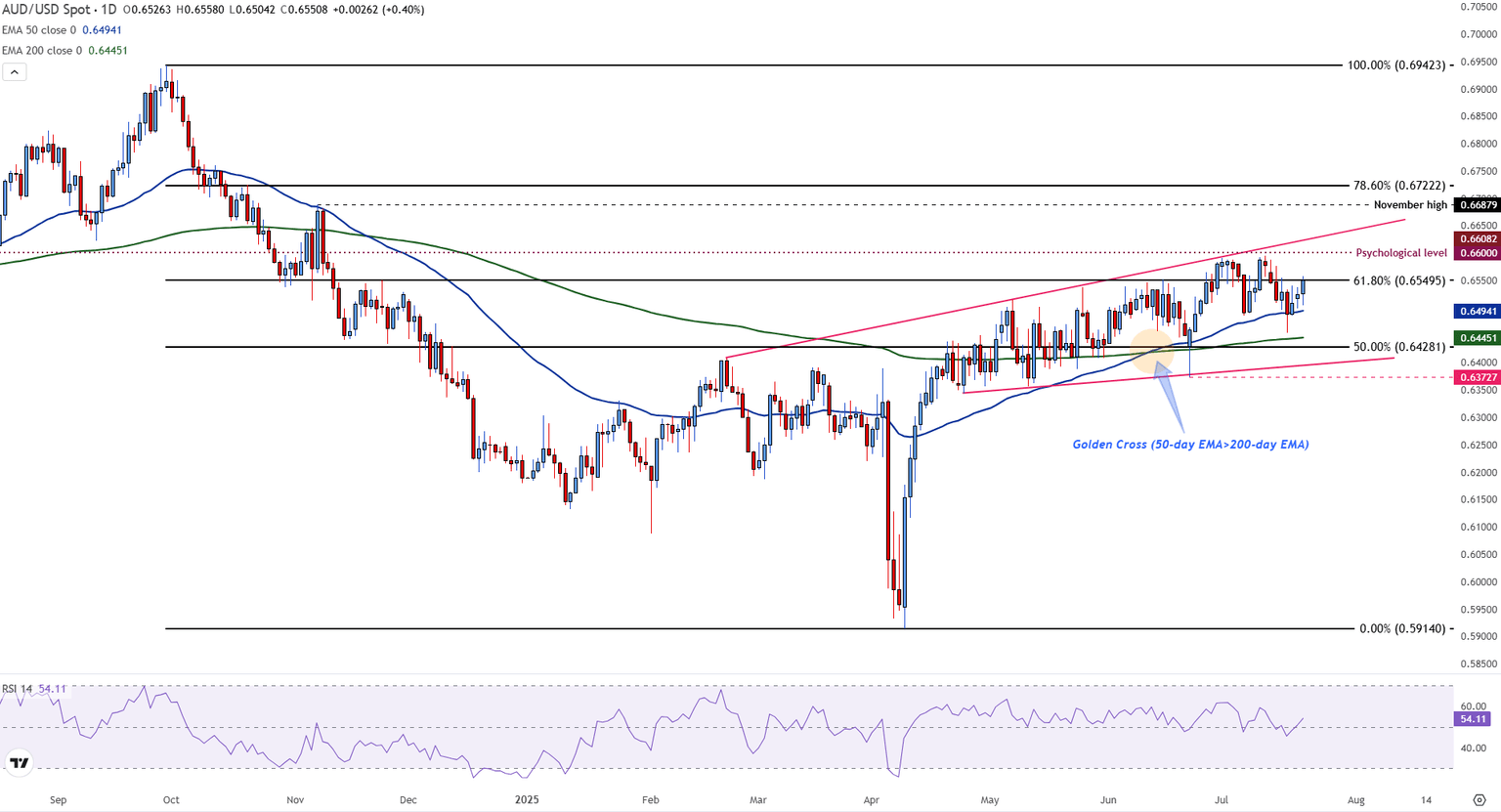

From a technical standpoint, AUD/USD remains supported above the 50% Fibonacci retracement of the September–April decline, which comes in at 0.6428.

Price action continues to move within a rising wedge pattern, characterized by higher lows and higher highs, indicating an ongoing bullish structure.

A Golden Cross formation, where the 50-day Exponential Moving Average (EMA) crossed above the 200-day EMA, is helping reinforce medium-term upside momentum.

The pair is currently trading near 0.6550, with immediate resistance seen at the 0.6600 psychological level and the November high at 0.6688.

On the downside, initial support lies at the wedge’s lower boundary near 0.6450 and the 200-day EMA at 0.6445. A clean break below these levels could shift momentum bearish and expose further downside toward 0.6400.

The Relative Strength Index (RSI) is currently at 54, suggesting neutral momentum, with room for either further consolidation or a breakout depending on incoming data.

AUD/USD daily chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.