AUD/USD drops heavily in risk-off markets following hawkish BoE, ECB and Federal Reserve

- The Australian Dollar is under pressure in a risk-off environment.

- The US Dollar has picked up the bid after a slew of hawkish central bank interest rate decisions.

- The Federal Reserve, Bank of England and European Central Bank have all sounded off a hawkish tone for subsequent meetings, risk-off.

AUD/USD is down heavily on the day, falling from 0.6869 to a low of 0.6681 as in-the-money longs get squeezed out of what has been several days of a demand for the Australian Dollar. The pair is down by over 2.5% on Thursday in a move that started in Asia, accelerated in Europe and continued in New York trade. AUD/USD is now trading near a one-week low around 0.6695 as investors fret over hawkish tones from a slew of central banks this week, including the Bank of England (BoE), the European Central Bank (ECB) and the Federal Reserve (Fed).

Australian Dollar down in risk-off markets

As a high beta currency, AUD suffers at times of risk-off. US stock indexes fell sharply on Thursday, with the Dow Jones Industrial Average (Dow) on track for its steepest single-day fall in three months. The Federal Reserve's guidance for protracted policy tightening quelled hopes of the rate-hike cycle ending anytime soon. The two-day Federal Open Market Committee (FOMC) meeting ended with a 50 bp hike in the target range to 4.0-4.75%, as expected. However, as the dust settled, financial markets eventually focused on the entirety of Federal Reserve chairman Jerome Powell’s message, which was overwhelmingly hawkish and negative for risk appetite and the Australian Dollar.

Bank of England and European Central Bank weigh

In Europe, the Bank of England delivered its ninth straight rate rise and the eighth of 2022. However, the key takeaway from the event is that even though UK inflation has peaked, the BoE believes more increases will be necessary. The European Central Bank also raised rates by half a percentage point. This was the ECB's fourth successive interest rate hike. The ECB outlined plans to shrink its bloated balance sheet from March, hoping that higher borrowing costs will finally arrest runaway inflation. While the ECB announced a smaller 50bp hike today, it stressed that this slowdown was not a pivot, adding that the terminal rate may have to be higher than the market had priced to date.

As per usual, the Australian Dollar is being driven, in the main, by external factors. With that being said, Australia released a highly anticipated employment report on Thursday. The data reflected a solid labour market performance in November. 64.0k jobs were added vs. 19.0k expected and a revised 43.1k (was 32.2k) in October. A total gain came from 34.2k full-time jobs and 29.8k part-time jobs. The Unemployment Rate was steady at 3.4%, as expected, but the participation rate rose a couple of ticks to 66.8%, bolstering the positive sentiment in the report and reaffirming the Reserve Bank of Australia's (RBA) view of a very tight labour market.

Markets assess grounds for further Reserve Bank of Australia rate hikes

The key issue for the markets will be what the Reserve Bank of Australia is going to do in February. The decision in December to raise the cash rate and maintain a strong tightening bias points to RBA ‘s firm commitment to the inflation target. WIRP now suggests 55% odds of a 25 bp hike on February 7, up from 45% at the start of this week, while the swaps market is pricing in a peak policy rate near 3.90% vs. 3.65% at the start of this week.

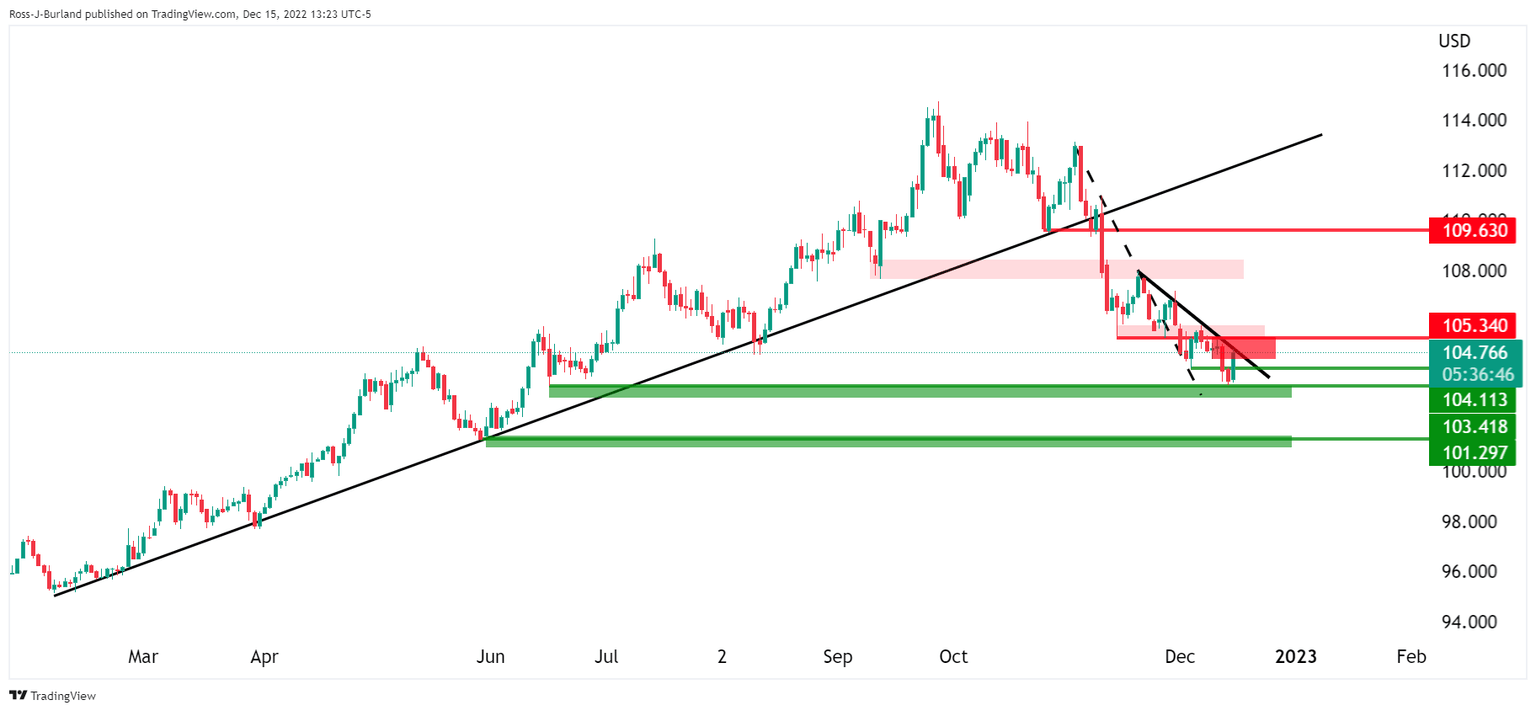

All in all, the US Dollar is getting traction as markets digest the central bank decisions and hawkish guidance, weighing on the commodity complex (an AUD proxy) and risk assets. DXY, an index that measures the US Dollar, is trading higher near the highs of the day, around 104.80 after two straight down days. However, there is a technically bearish bias in DXY while the index remains on the front side of the bear trend as follows:

AUD/USD and DXY technical analysis

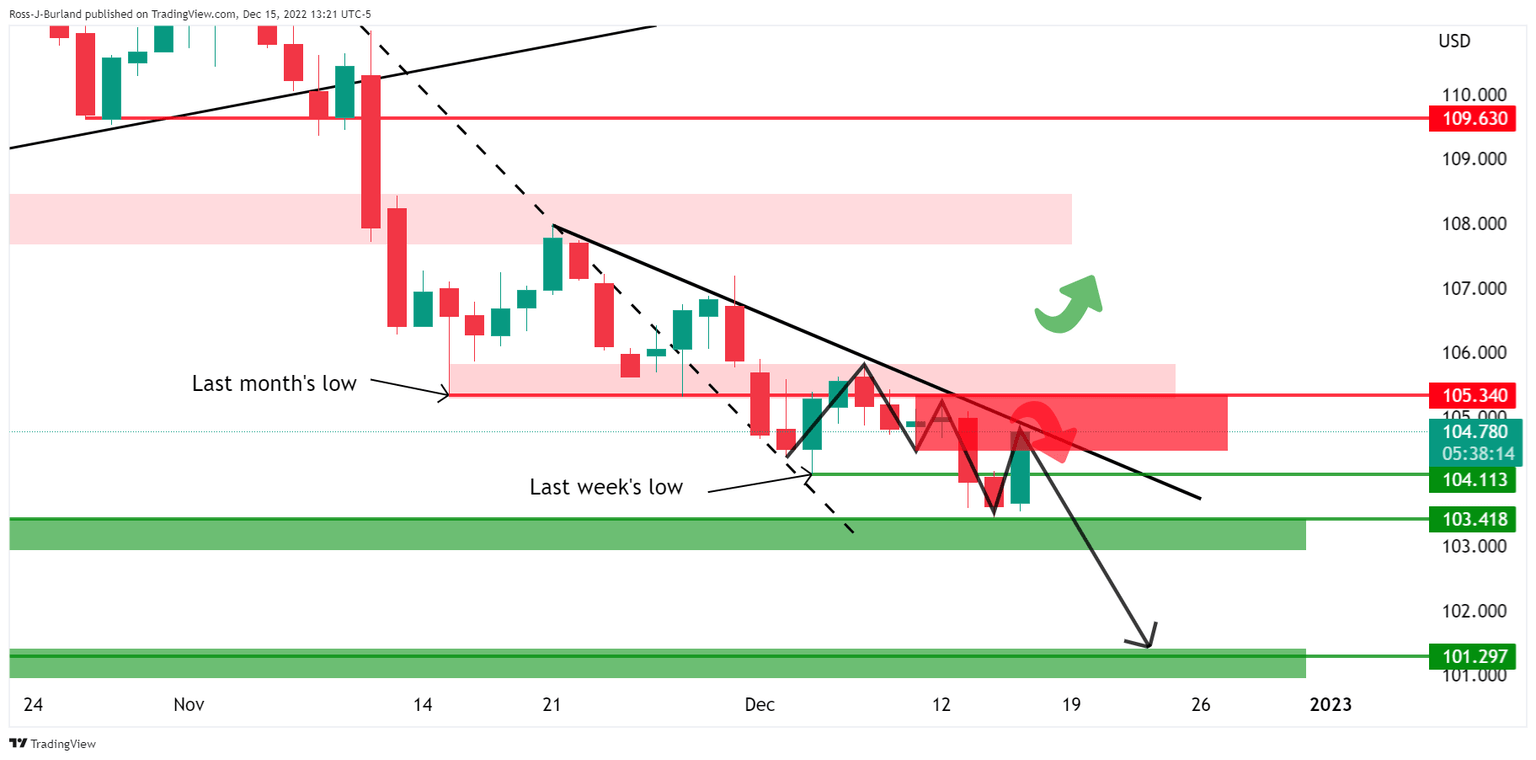

DXY is consolidating below last month's low of near 105.30 and has pierced last week's low of near 104.10:

The US Dollar M-formation is a reversion pattern on the daily charts above which has seen the price rally into the neckline resistance area that meets the bearish trendline. US Dollar Bears need to commit at this juncture or face prospects of the bulls taking on last month's lows of near 105.30 in what could turn into a short squeeze. If on the other hand, the US Dollar bears do commit, then a downside extension will be on the cards with eyes on the June lows near 101.30.

AUD/USD bears lurking

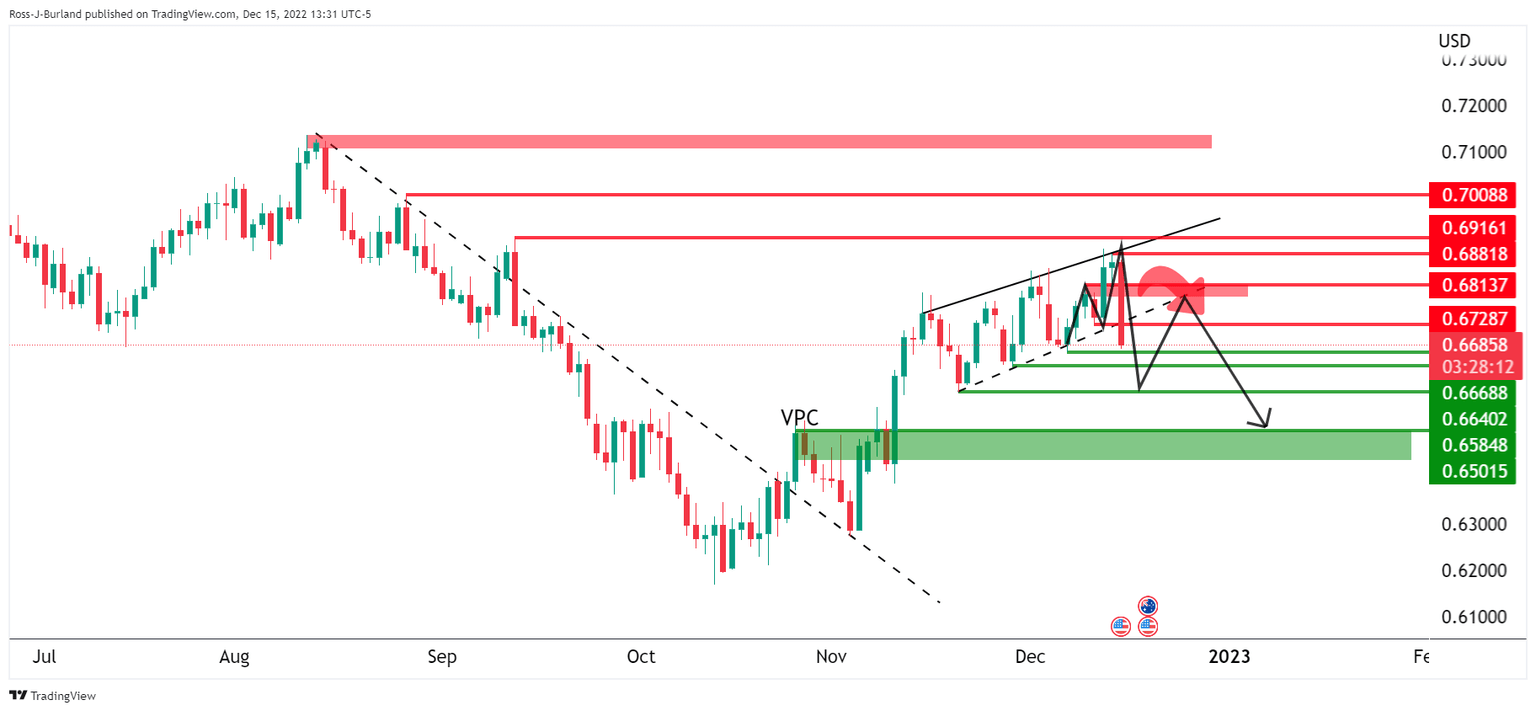

As for AUD/USD, the price has broken channel support and there are eyes on a break to the Volume Point of Control (VPC) of the late August to mid-October bear cycle:

The neckline of AUD/USD M-formation could serve as the resistance of a restest in the coming days and that could lead to a downside continuation below the now counter-trendline to target the 0.65s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.