AUD/USD correction could be in order ahead of Fed minutes

- AUD/USD bears stay in control into daily support but correction in sight.

- Central banks are the focus and FOMC minutes will be key.

AUSD/USD ended the day on Friday 0.67% lower falling from a high of 0.7291 to a low of 0.7227. The US dollar climbed Friday as investors sought safe havens in fear of covid contagion. Austria said it would be the first country in Western Europe to reimpose a full lockdown amid surging COVID-19 infections and Germany said it could follow suit.

After two straight down days, DXY is trading higher near 96 and on track to test this week’s cycle high near 96.241. Additionally, Federal Reserve Governor Christopher Waller said the US central bank should speed up the pace of tapering to give more leeway to raise interest rates from their near-zero level sooner than it currently expects if high inflation and the strength of job gains persist. Adding to the hawkishness, Fed Vice Chair Richard Clarida said it "may very well be appropriate" to discuss speeding up the Fed's asset purchase wind-down when it next meets, on Dec. 14-15.

Meanwhile, the Reserve Bank of Australia's governor, Phillip Lowe, has also been keen to point out the characteristics of the Australian labour market, specifically with respect to wage inflation. ''The RBA’s take on the Australian labour market is crucial to explaining the relative dovishness of the RBA,'' analysts at Rabobank explained. ''This message has been reinforced by the RBA fixing its guidance for rate hike directly to developments in wage inflation.''

Eyes on the Fed minutes

Looking ahead to the week, the Federal Reserve minutes will undoubtedly reflect a range of views on risks, analysts at Brown Brothers Harriman said, ''but with most officials seeing no rush for rate hikes given the large net drop in jobs and expected slowing in inflation. They will likely also make clear that realization of upside risks could lead to rate hikes soon after tapering ends, with the added point that tapering is highly unlikely to end before June.''

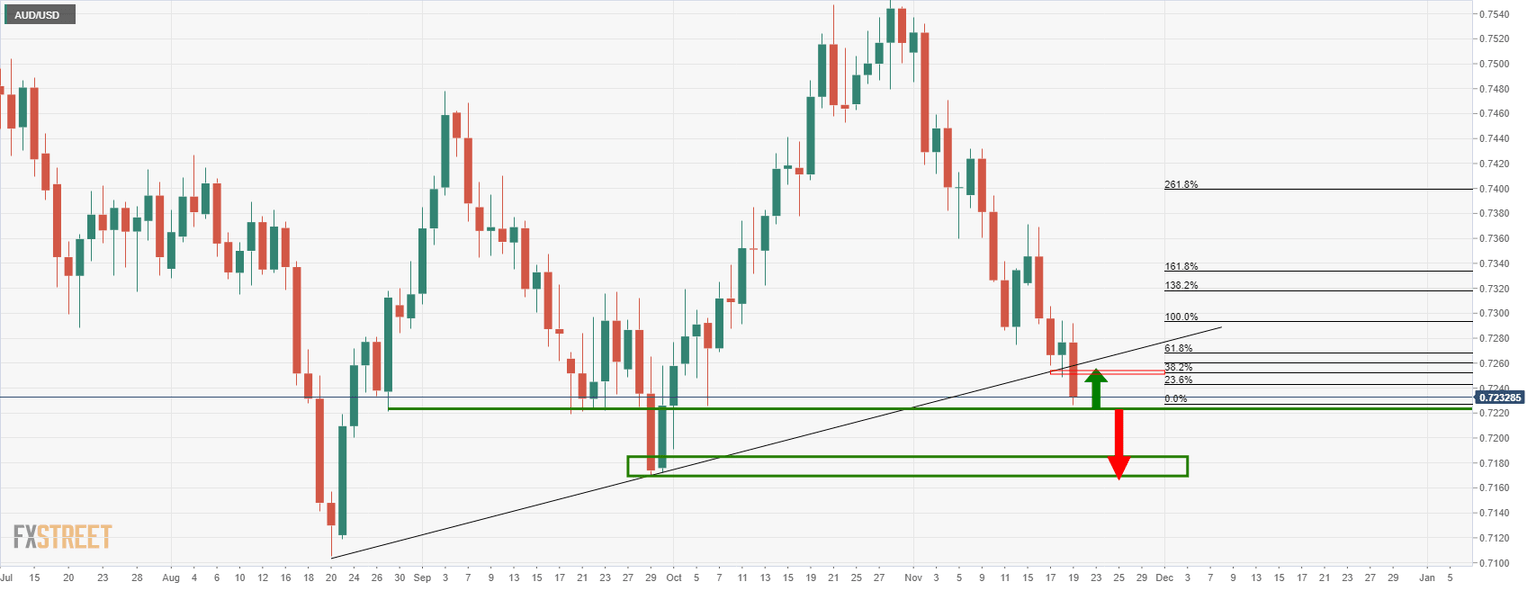

AUD/USD technical analysis

AUD/USD has been trending lower since the start of the month, with the greenback supported by the ongoing debate about the prospects of a 2022 Fed rate hike. Assuming the RBA reiterates a cautiously dovish message in its next policy meeting AUD/USD could struggle to win back ground, analysts at Rabobank argued. ''We target a move to 0.72 on a 3-month view.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.