AUD/USD clings to gains above 0.7100 after reaching a 7-month high around 0.7140s

- AUD/USD continues to gain ground, advancing 0.17% on Thursday.

- Upbeat US data, with GDP exceeding estimates and unemployment claims edging lower, justify further tightening by the Federal Reserve.

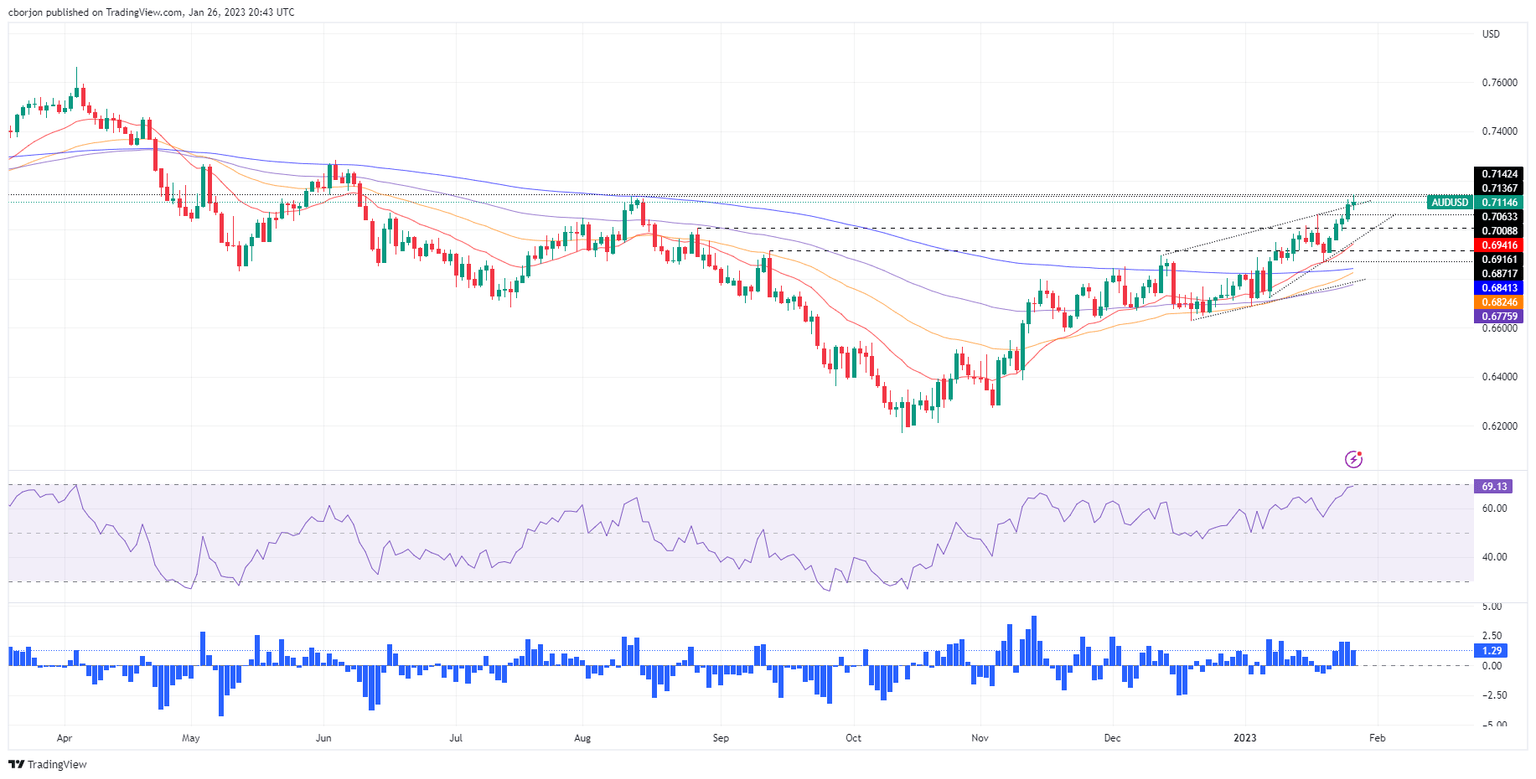

- AUD/USD Price Analysis: it might pull back before resuming its uptrend, eyeing 0.7200.

The Australian Dollar (AUD) is still gaining some ground against the US Dollar on Thursday but retreats after hitting a new 7-month high at 0.7142. Some of the earlier AUD/USD gains were erased on upbeat economic data from the United States (US). Therefore, the AUD/USD is trading at 0.7109, slightly above the opening price.

AUD/USD retreated as US data boosted the US Dollar

US economic data, particularly growth, has been the main driver of Thursday’s session, surpassing expectations of 2.6% QoQ, as the Gross Domestic Product (GDP) rose 2.9% in Q4, as the Department of Commerce reported. That, alongside Q3’s expanding 3.2%, bolstered the US Dollar (USD), which has been treading water on the week. For 2022, the economy grew by 2.1%, lower than in 2021, 5.9% YoY.

In other data also revealed by the US Commerce Department, Durable Good Orders for December grew 5.6% MoM, recovering from November’s -2.1% contraction. However, the report was mixed as core Durable Goods dropped -0.2% MoM. Higher interest rates, attributed to the US Federal Reserve (Fed) lifting rates by 425 bps since March 0f 2022, are weighing on demand for goods, usually bought on credit.

Elsewhere, the jobs market continues to show resilience, as the US Department of Labor reported that Initial Jobless Claims for the week ending January 21 fell to 186K, below estimates of 205K.

Given the backdrop, the AUD/USD retreated once headlines crossed newswires after hitting a daily high and failed to hold to the R1 daily pivot point at 0.7139. So the AUD/USD pair lost traction and dived, but the daily pivot point capped its fall at 0.7085. In the meantime, the US Dollar Index (DXY), which tracks the greenback’s value against a basket of six peers, is erasing Wednesday’s losses and rising 0.19%, up at 101.829, a headwind for the AUD/USD.

On the Australian side, a hotter-than-expected inflation report for December keeps investors assessing the next move for the Reserve Bank of Australia (RBA). Sources cited by Reuters said, “Today’s report should quickly eradicate hopes of an RBA pause in February.” Therefore the Australian Dollar (AUD ) might continue to hold its ground as higher interest rates are coming, while China’s reopening will augment commodities demand.

AUD/USD Technical Analysis

Therefore, the AUD/USD might continue its uptrend, albeit trimming some of its gains. Achieving a daily close above 0.7100 exacerbated an upward move towards a fresh 7-month high, keeping bulls hopeful of testing the 0.7200 mark. However, on its way north, the AUD/USD needs to clear 0.7142, followed by 0.7150, and then the 0.7200 psychological figure.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.