AUD/USD climbs above 0.6750s after hot US CPI on a weak US dollar

- A risk-off impulse was no excuse for the AUD/USD to rise but remains negative in the week.

- US inflation above 9%, for the first time since 1981; Fed odds of a 100 bps hike lie at 84%.

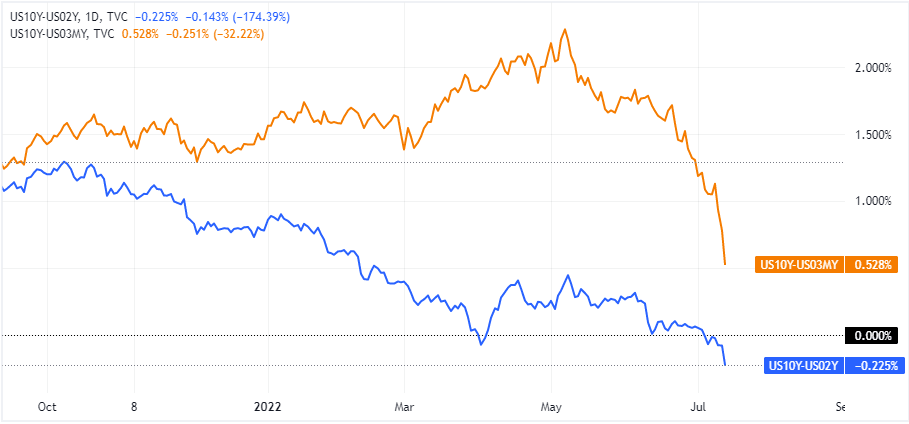

- US 2s-10s yield curve inverted the most since 2001; is recession around the corner?

- The Australia business and consumer confidence surveys show pessimism is increasing amongst Australians.

The Australian dollar found bids during the North American session and is edging up 0.33% on Wednesday after a US Department of Labor report showed US inflation refreshing new 40-year highs amidst a mixed market sentiment, as shown by US equities fluctuating but at a brink of turning negative.

Investors’ sentiment is mixed; the US 2s-10s yield curve signals recession

The AUD/USD is trading at 0.6776 after seesawing on a volatile trading session that witnessed the major dipping towards the 0.6725 daily low, followed by a short-lived rally above the 0.6800 figure, until settling down at around the current price level.

During the New York session, the US Bureau of Labor Statistics (BLS) reported that June’s inflation in the US hit 9.1% YoY, the highest reading since 1981, topping the previous reading at 8.6%. At the same time, inflation that strips volatile items like food and energy, the so-called core CPI, rose by 5.9% YoY, less than May’s 6%, but above expectations of 5.7%, further cementing the case for the Fed 75 bps rate hike.

In the meantime, STIRs money market futures have begun to price in an 84% chance that the Federal Reserve would hike 100 bps whilst fully pricing a 75 bps increase.

US 2s-10s yield curve inverted the most since 2001

Of late during the session, its worth noticing that the US 2s-10s yield curve touched levels last seen in the late 2001s, currently at -0.225%, while the US 3months-10-year curve plunges more than 30 bps, to 0.528%, both signaling that investors recession fears are increasing.

Regarding the Australian economy, last Monday’s Business confidence showed that businesses are becoming more pessimistic, dropping to their lowest level in six months. Despite a bad reading, the report disclosed some positives regarding capacity utilization and forward orders. Concerning Australia’s consumer confidence slipped by 2.5% last week.

What to watch

The Australian economic docket will feature employment reports and consumer inflation expectations. Australia’s Employment Change for June is expected at 30K, less than May’s 60.6K, while Consumer Inflation Expectations are foreseen at 6.8%, more than the previous reading. Across the pond, the US economic calendar will feature Initial Jobless Claims, inflation on the producer side, and Fed speakers will update the status of a battered US economy, with inflation above 9%.

AUD/USD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.