AUD/USD bulls running into the wind towards daily targets

- AUD/USD bulls in charge despite woes n the horizon for AUD.

- Fed takeaways are balanced but central bank divergence is bearish for AUD/USD.

AUD amongst commodity-fx underperformed, reflecting the concerns around the Sydney lockdown and the implications this will have for next week’s RBA meeting.

However, vs the greenback, it rallied all the way to take out the prior corrective highs as the markets digest the mix of takeaways from Wednesday's Federal Open Market Committee meeting.

On the one hand, the outcome could be perceived to be hawkish, more hawkish than what might have been expected.

On the other hand, to the contrary, the chairman, Jerome Powell was uber dovish in his rhetoric regarding inflation risks and rate hikes.

However, importantly, tapering was mentioned in the official statement for the first time this cycle, with the Fed noting that there has been some progress made towards the goals laid out to justify tapering.

''This was a very hawkish surprise and we believe it moves the timeline for actual tapering up a bit,'' analysts at Brown Brothers Harriman (BBH) argued.

Given it being month-end at a time where the market was net long US dollars leading into the meeting, squaring of postings in a buy the rumour sell the fact could arguably be the reason for the dollar's abrupt burst below dynamic support.

Either way, current consensus sees tapering in either the fourth quarter of 2021 or by early 2022 and in contrast and far ahead of other central banks.

This would be expected to underpin the greenback for the medium term and see demand for the currency again in the near future.

The dollar index DXY, which measures the greenback against a basket of six other currencies, was 0.42% lower at 91.85, its lowest since June 28.

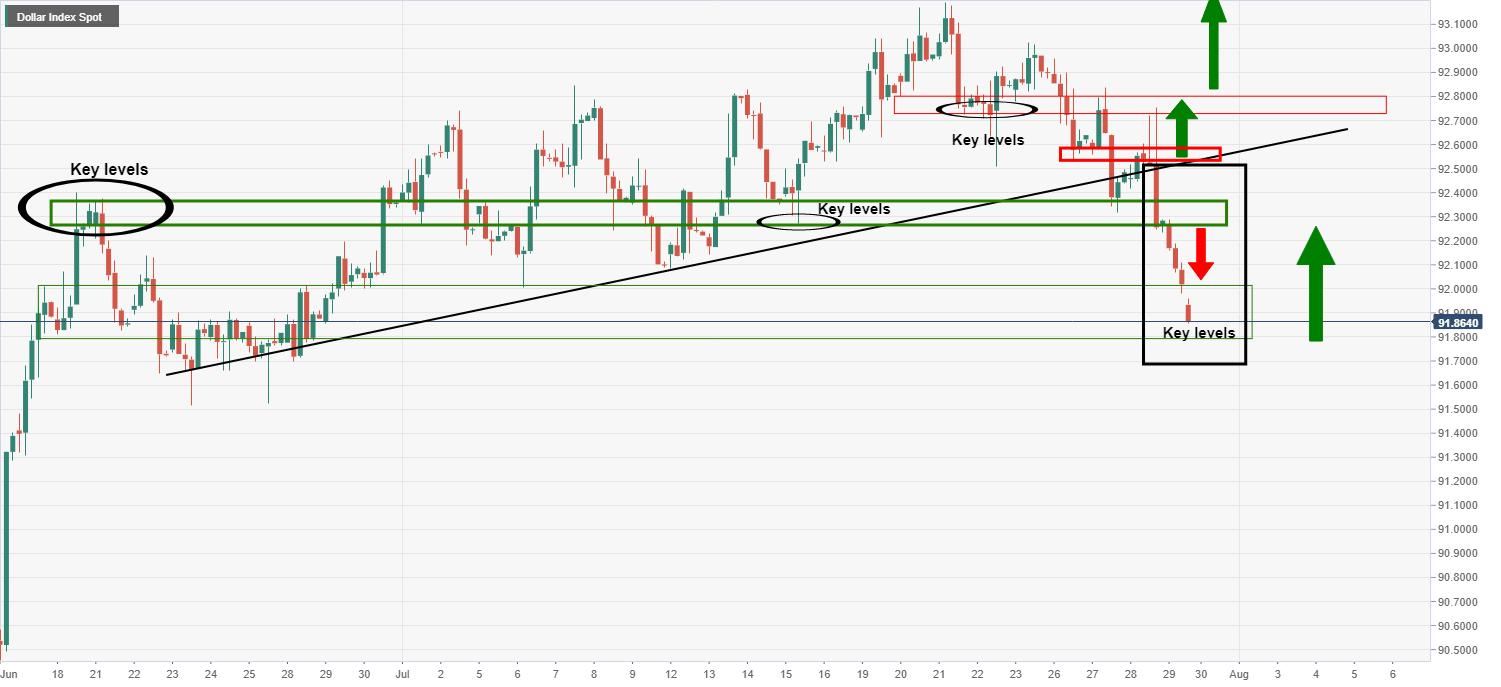

DXY 4-hour chart

There are prospects of a correction at this juncture as the dust settles and markets align more with the various attributes of the US dollar which has kept it elevated since May of this year.

''Much will depend on the data but we believe that tapering and rate hikes both happen sooner than the market expects,'' the analysts at BBH said.

''This is because we remain very optimistic about the US economic outlook and see heightened inflation risks ahead.''

Meanwhile, market risk appetite improved as investors cherry-pick the positive aspects from the data releases, politics and the Fed.

For one, the US Senate has reached an agreement on a USD550b infrastructure project that was supportive to markets.

The S&P 500 rose 0.5% and Dow Jones gained 0.5%, while the Nasdaq was up 0.2%.

The advanced US Gross Domestic Product data for the second quarter 2 was not quite as strong as expected coming in at 6.5% QoQ, compared to expectations of 8.4%.

However, analysts at ANZ Bank explained that final demand was strong due to an 11.8% jump in consumption. Business investment rose (8.0%) while housing investment fell (9.8%). Core inflation lifted 6.1% QoQ.

''This data indicates the US economy is larger than it was prior to the pandemic.''

As for the Aussie, there are headwinds for the Reserve Bank of Australia and expectations for tapering have shifted.

Sydney’s monthlong lockdown has been extended until late August as the virus numbers worsen which is putting a damper on the GDP which is likely to contract in Q3.

''Despite the worsening news stream, AUD is trading at the highest level since July 19 and is testing the 0.74 level,'' analysts at BBH noted.

''Still, AUD has retraced only about a third of this month’s losses. A break above 0.7480 is needed to set up a test of the July 6 high near 0.7600. This will be increasingly difficult if the RBA does make a dovish pivot next week.''

AUD/USD technical analysis

The bulls are tracking down the neckline of the M-formation near 0.7430.

The 78.6% Fibonacci retracement level is located near0.7445 which will be a test for the bulls

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.