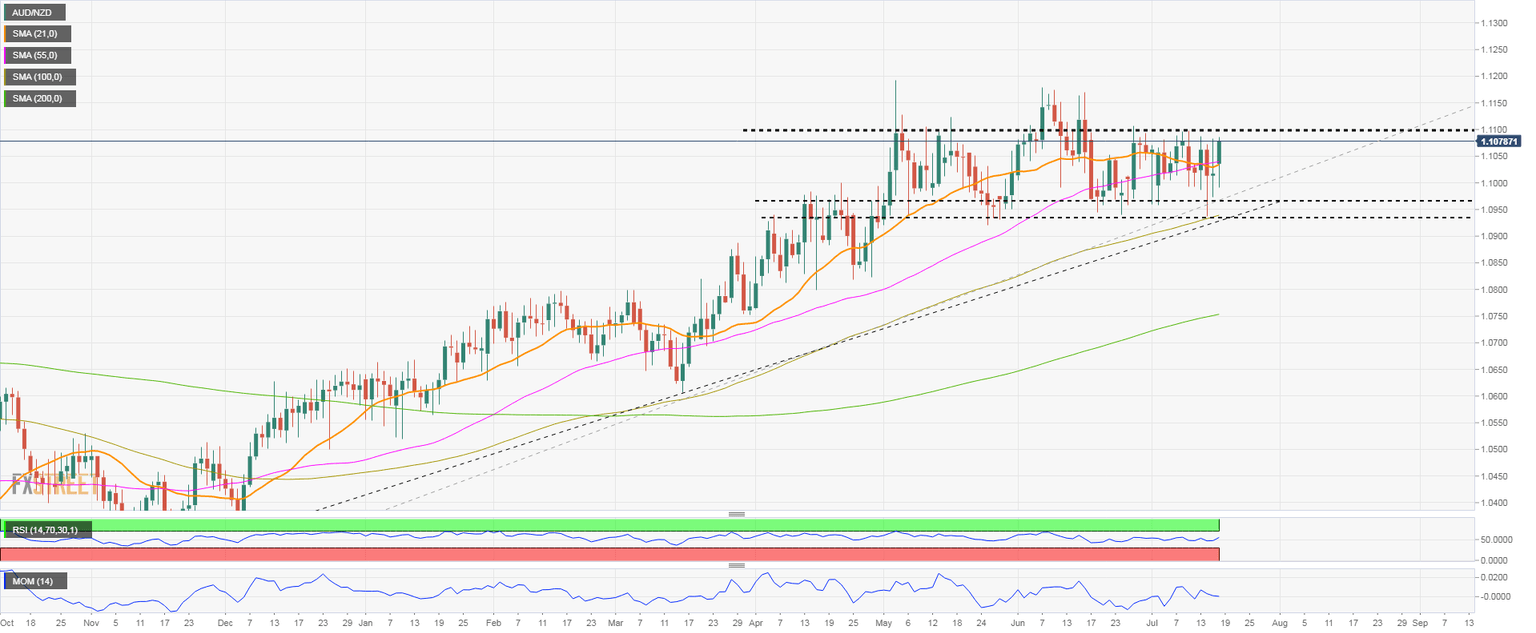

AUD/NZD Price Analysis: Sideways below 1.1100 ahead of RBA minutes

- AUD/NZD continues to move sideways, around the 20 and 55-day SMA.

- Medium-term bullish rally faces resistance at 1.1100.

- Key event ahead: RBA meeting minutes on Tuesday.

The AUD/NZD cross continues moving sideways below 1.1100. The 1.1100 area caps the upside. A break higher should strengthen the aussie, and would target 1.1150 initially and then a test of 1.1180.

The 20 and 55-day Moving Simple Moving averages are flat near the current price, reflecting how the cross has been trading during the last thirty days. Technical indicators offer no clear signs, also affected by recent price action.

On the flip side, a consolidation below 1.1000 should expose an uptrend line at 1.0970. A break lower would open the doors to more losses, initially to 1.0950 (20-week SMA). A confirmation under 1.0920 would be a more solid bearish sign, targeting 1.0800.

While between the uptrend line and the 1.1100 area, volatility in AUD/NZD will likely remain limited. On Tuesday, the Reserve Bank of Australia will release the minutes of its latest meeting.

AUD/NZD daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.