AUD/JPY Price Forecast: Extends rally, eyes break above 95.00

- AUD/JPY advances for fifth straight day, up 0.04% in early Asia.

- Pair tests descending trendline from 2024 highs, aided by bullish RSI.

- Break above 95.00 targets 95.63 and February high of 97.32.

- Support seen at 94.00, with key levels at 93.46 (Senkou Span B) and 93.29 (Tenkan-sen).

The AUD/JPY advances for the fifth straight trading session, up by a modest 0.04% as Wednesday’s Asian session begins. On Tuesday, the pair bounced off daily lows of 93.88 and posted gains of over 0.33%, closing the day near the actual price at 94.50, fueled by an improvement in risk appetite, as US-China talks extended for another day.

AUD/JPY Price Forecast: Technical outlook

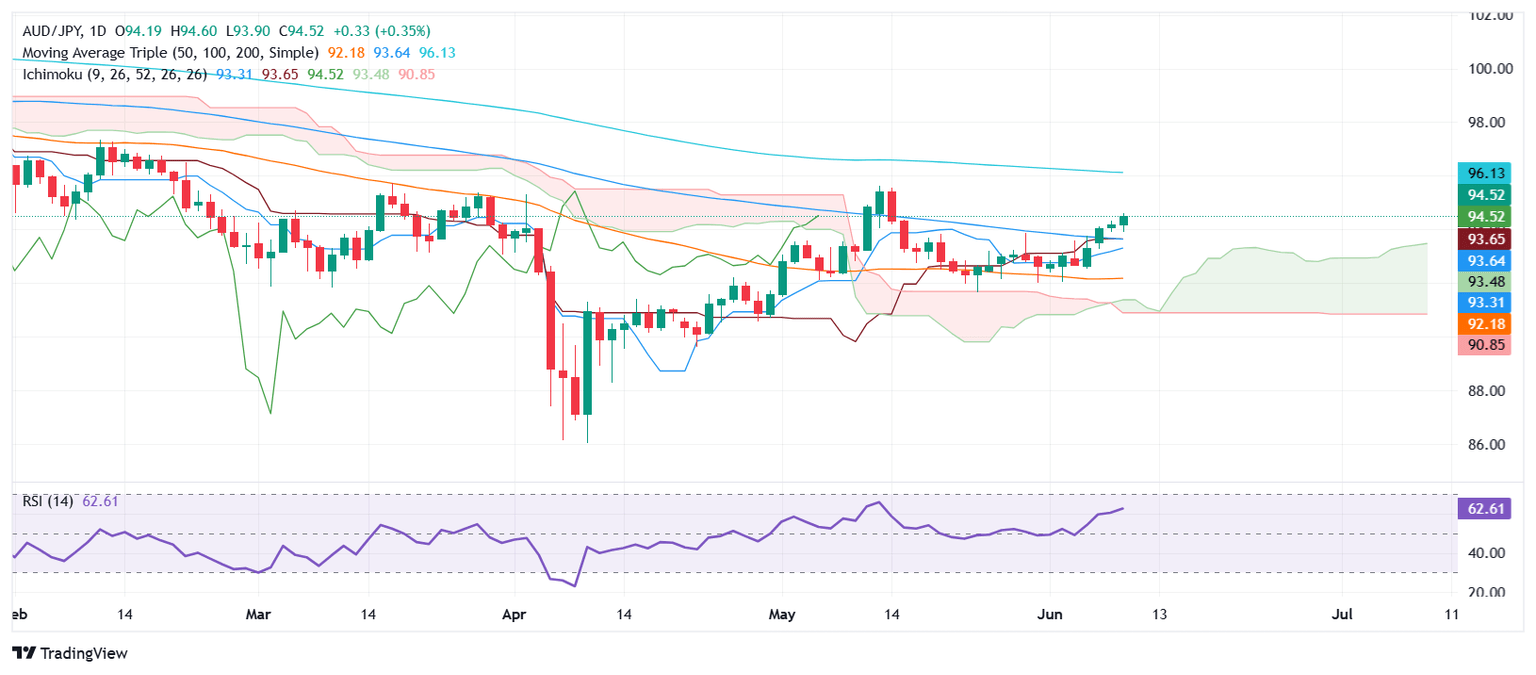

AUD/JPY appears to be testing a downslope resistance trendline drawn from the November 2024 highs, which intersects the May 13 high of 95.63, and buyers seem poised to clear it. It should be noted that the Relative Strength Index (RSI) is bullish and trending upward, indicating that buyers are gaining momentum.

If bulls clear the 95.00 figure, the next area of interest would be the May 13 peak ahead of 96.00. A breach of the latter will expose the February 12 high of 97.32, followed by the 98.00 mark.

On the contrary, a drop below 94.00 exposes the Senkou Span B at 93.46, followed by the Tenkan-sen at 93.29 ahead of 93.00.

AUD/JPY Price Chart – Daily

Australian Dollar PRICE This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.28% | 0.19% | 0.00% | -0.16% | -0.42% | -0.56% | 0.11% | |

| EUR | 0.28% | 0.45% | 0.26% | 0.11% | -0.12% | -0.30% | 0.37% | |

| GBP | -0.19% | -0.45% | -0.12% | -0.35% | -0.56% | -0.75% | -0.08% | |

| JPY | 0.00% | -0.26% | 0.12% | -0.15% | -0.47% | -0.62% | -0.01% | |

| CAD | 0.16% | -0.11% | 0.35% | 0.15% | -0.28% | -0.41% | 0.27% | |

| AUD | 0.42% | 0.12% | 0.56% | 0.47% | 0.28% | -0.18% | 0.50% | |

| NZD | 0.56% | 0.30% | 0.75% | 0.62% | 0.41% | 0.18% | 0.68% | |

| CHF | -0.11% | -0.37% | 0.08% | 0.00% | -0.27% | -0.50% | -0.68% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.