AUD/JPY Price Analysis: Struggles near 94.00, on a mixed market mood

- The AUD/JPY finished almost flat down by 0.06% on Monday.

- Quarter and month-end flow dominated the session weighing on US equities and also in risk-sensitive currencies.

- AUD/JPY Price Forecast: The cross is upward biased, but downside risks remain if it stays below 94.00.

The AUD/JPY began the week on the wrong foot, slightly down in the day, though recovered from daily lows at 92.97 and reached a daily high at around 93.94, finally settling near 93.74, as market sentiment turned sour and US equities recorded losses.

As quarter and month-end approached, Monday’s session witnessed portfolio rebalancing. That sparked the fall in equities, while US Treasury yields bounced off daily lows, led by the US 10-year Treasury yield, which gained eight basis points and is back above the 3.20% threshold.

In the meantime, the AUD/JPY opened near 93.70 and dipped sharply below the 93.00 mark once the Monday Asian session began. Nevertheless, late in the same session, the cross marched firmly and was finally lifted near the 94.00 figure.

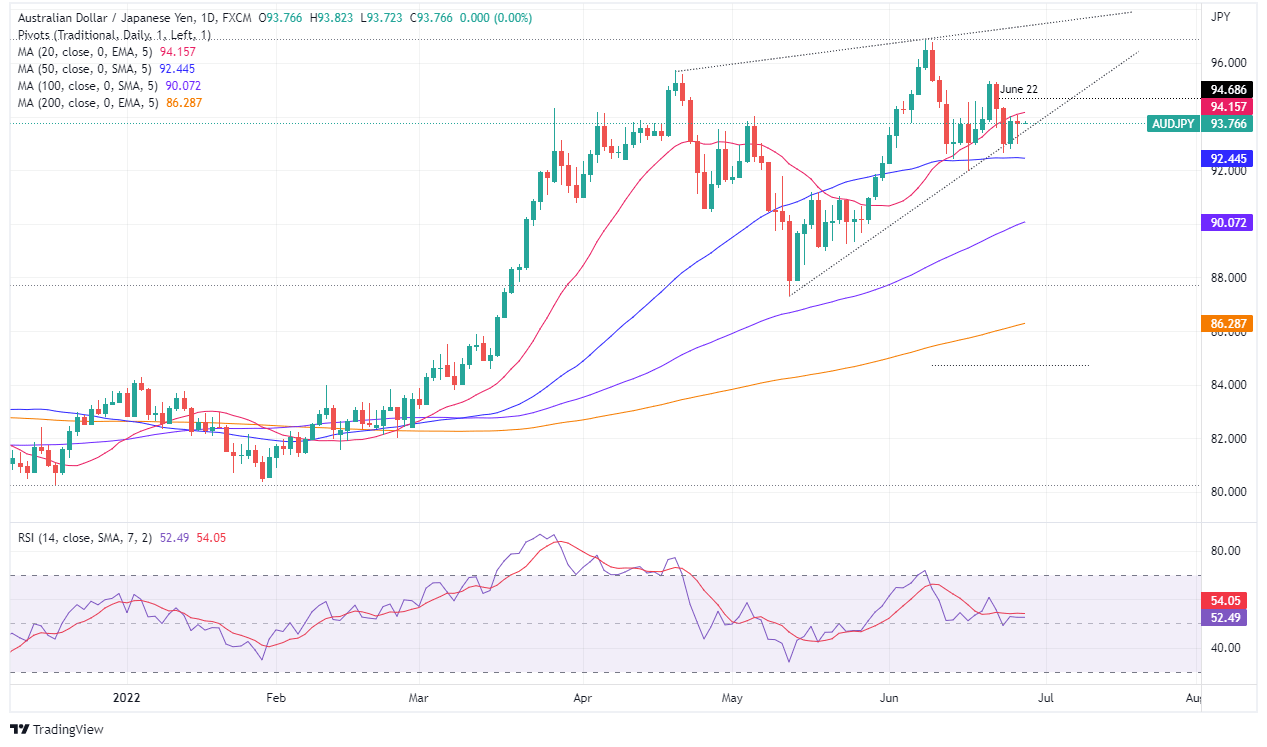

AUD/JPY Daily chart

The cross-currency faced strong support at the 20-EMA around 94.15, capping AUD/JPY upward intentions, as the pair continues its consolidation within familiar ranges around 92.60-94.30. Further confirmation of the previously mentioned is the Relative Strenght Index (RSI) at 52.38 flat for the last couple of trading sessions, meaning that despite that the moving averages (MAs) are below the exchange rate, the lack of a fresh upward impulse, keeps the pair constrained in the area mentioned above.

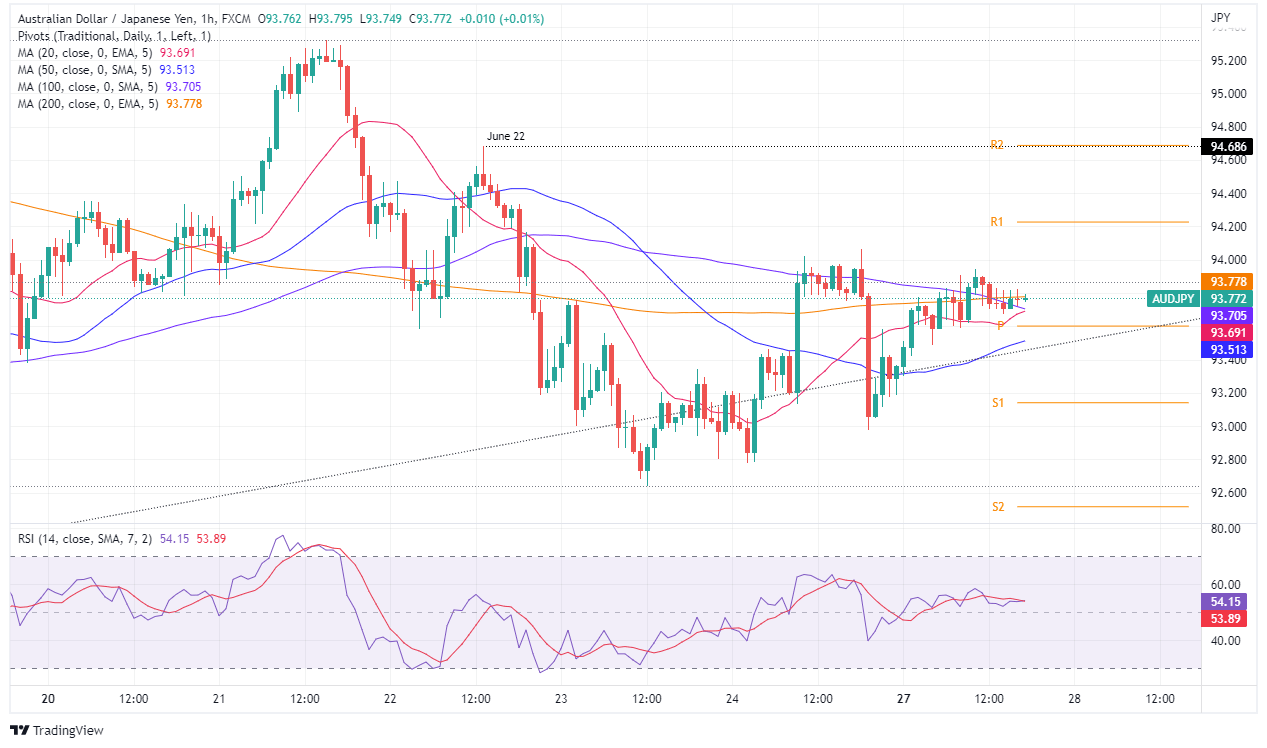

AUD/JPY 1-Hour chart

The AUD/JPY hourly chart illustrates the pair is consolidating but slightly moving to the upside, though at the time of writing, AUD/JPY buyers unable to break above the 200-EMA at 93.77 will leave the pair vulnerable to selling pressure. If that scenario plays out, the AUD/JPY first support would be the daily pivot at 93.60. Break below will expose the 50-EMA at 93.49, followed by the S1 pivot at 93.20.

On the other hand, and on the path of least resistance, the AUD/JPY’s first resistance would be the 200-EMA at 93.77. A breach of the latter would expose 94.00, followed by the R1 daily pivot at 94.23, followed by the confluence of June 22, and the R2 daily pivot at 94.68.

AUD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.