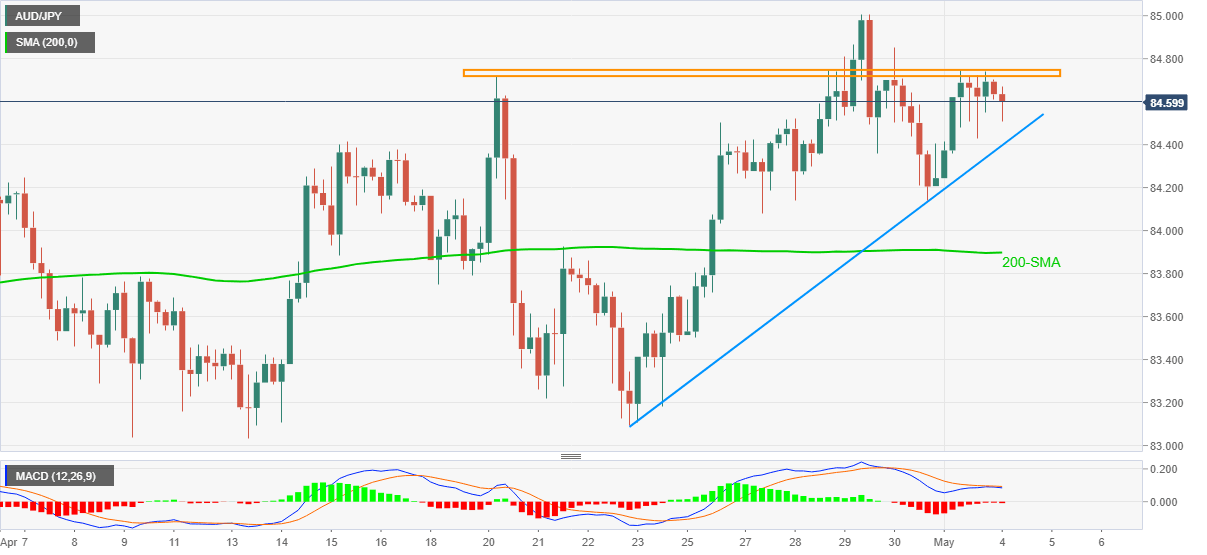

AUD/JPY Price Analysis: Looks set to visit immediate support below 85.00 ahead of RBA

- AUD/JPY prints mild losses while stepping back from two-week-old horizontal resistance.

- Bearish MACD, downbeat market sentiment backs further weakness ahead of the key event.

- RBA is likely to keep the benchmark rate, bond purchase unchanged but Rate Statement will be the key to watch.

AUD/JPY bounces off intraday low while picking up bids to 84.60, down 0.05% on a day, during early Tuesday. Even so, the quote registers another failure to cross the horizontal hurdle established since April 20.

Not only the nearby resistance area close to 84.75-70 but the market’s risk-off mood and cautious sentiment ahead of the Reserve Bank of Australia’s (RBA) monetary policy meeting also weigh on the quote.

Read: AUD/USD remains pressured around mid-0.7700s on downbeat Australia trade data, RBA eyed

Given the bearish MACD and the latest pullback moves, AUD/JPY is more likely to retest an ascending support line from April 22, around 84.40, should the RBA disappoint markets.

However, any further weakness past-84.20 will be challenged by the 200-SMA level of 83.90.

On the flip side, optimistic comments from the RBA could again help AUD/JPY to battle the 84.70-75 immediate resistance area.

It should be noted that a clear rise beyond 84.75 will propel the quote to the previous month’s high near the 85.00 threshold ahead of targeting March’s high near 85.45.

AUD/JPY four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.