AUD/JPY Price Analysis: Pair trades mid-range with mixed signals

- AUD/JPY was seen trading near the 94.40 zone after slipping slightly during Tuesday’s session.

- Despite short-term bullish signals, overall sentiment remains neutral as key momentum indicators show no clear direction.

- Support aligns near 94.30 and 94.20, while resistance stands around 94.55 and 95.25.

The AUD/JPY pair was seen around the 94.40 zone after the European session on Tuesday, registering a mild decline and sitting roughly at the midpoint of the day’s trading range. While short-term moving averages and some momentum tools lean bullish, longer-term trend signals and broader oscillators suggest that the pair is locked in a neutral stance heading into the Asian session.

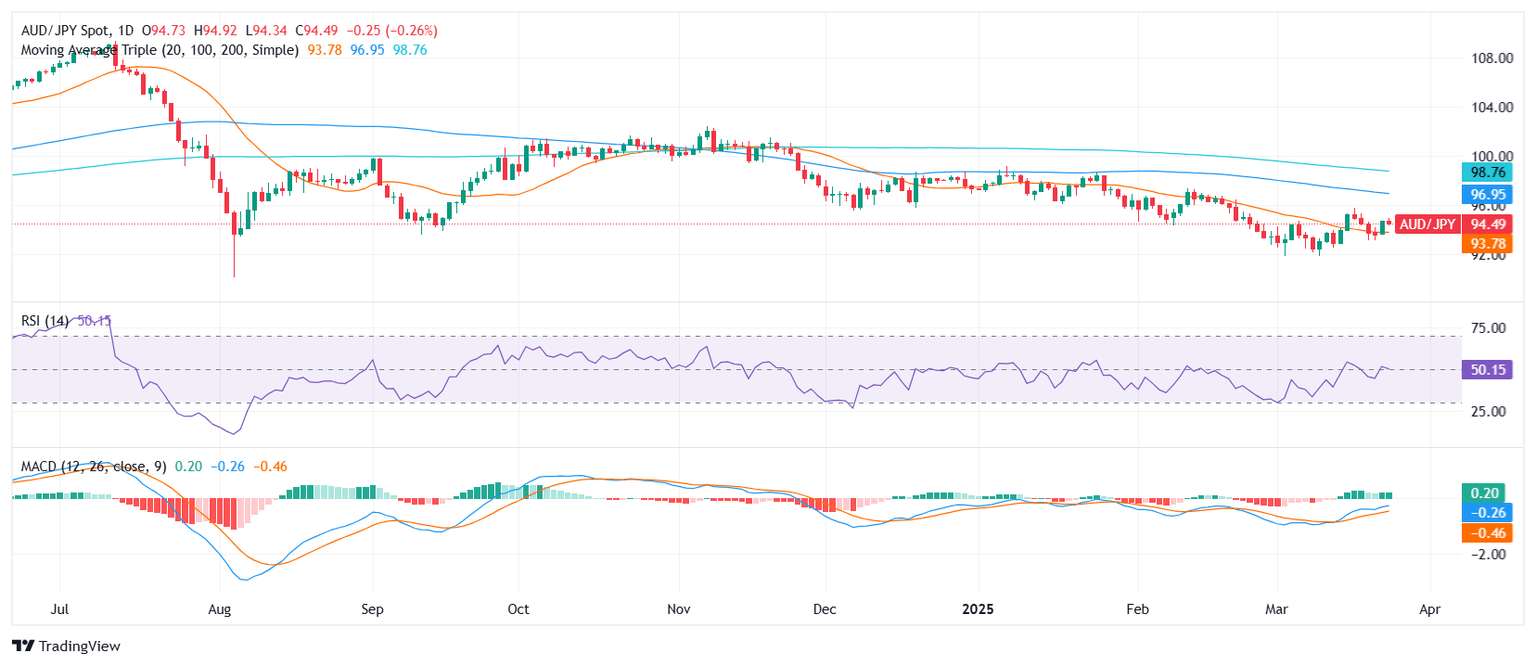

Technically, the MACD suggests a buy signal, while the standard Relative Strength Index (14) is flat at 49.41, consistent with a neutral outlook. The combined RSI and stochastic indicator also reads at 74.91, flashing a neutral tone and suggesting that directional momentum is currently absent. The Bull Bear Power sits at 0.878, reinforcing the lack of conviction from either side.

Looking at trend-based indicators, the 20-day Simple Moving Average at 93.84 supports a bullish short-term outlook. However, the 100-day SMA at 97.03 and the 200-day SMA at 98.85 remain far above current levels, suggesting that the broader trend bias still leans to the downside. The Ichimoku Base Line around 94.31 also sits in neutral territory, reinforcing the consolidative backdrop.

In terms of key levels, immediate support is found at 94.308 and extends to 94.20, where buyers may look to stabilize any further weakness. On the upside, resistance comes into play at 94.55 and 94.59, with a more significant hurdle standing around the 95.24 zone. A break above that area could tilt the balance toward the bulls, while sustained pressure below 94.30 might gradually shift sentiment downward.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.