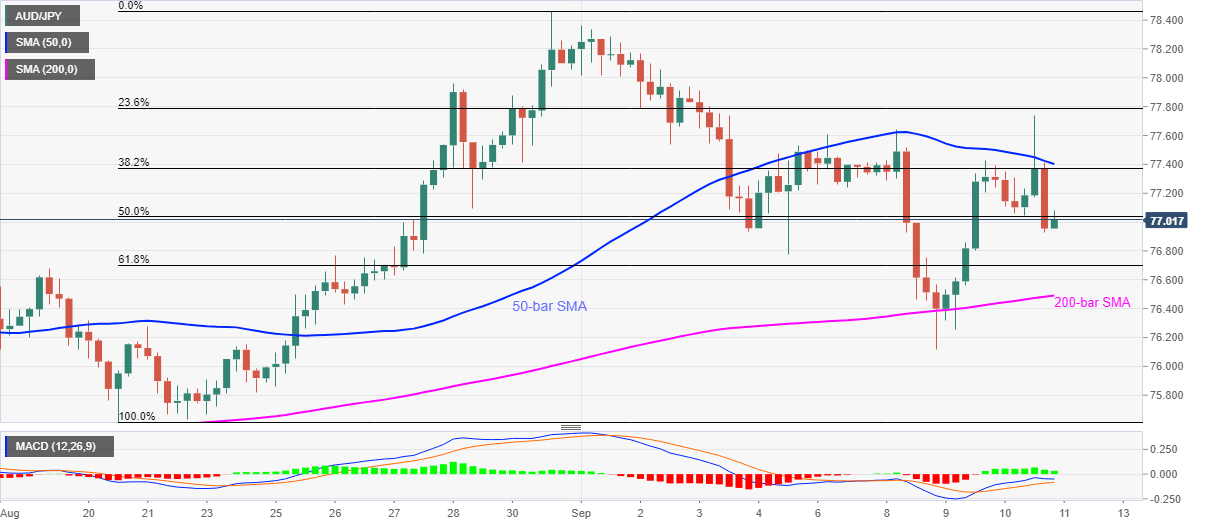

AUD/JPY Price Analysis: Marks another downward swing from 50-bar SMA

- AUD/JPY prints fifth failure to cross 50-bar SMA in the last seven days.

- Bullish MACD keeps the quote above 200-bar SMA.

- Monthly high will get the bull’s attention during the strong upside, sellers may eye August 20 low.

AUD/JPY stays pressured around 77.00 amid the early Friday morning in Asia. In doing so, the Aussie cross keeps 50-bar SMA as the key immediate resistance since September 03 while 200-bar SMA offers strong downside support.

Considering the pair’s latest pullback from the upside barrier, its drop to 61.8% Fibonacci retracement level of August 20-31 upside, at 76.70, becomes more likely. Though, any further weakness will be challenged by 76.50 level comprising 200-bar SMA.

In a case where the AUD/JPY prices remain depressed below 76.50, the monthly low of 76.12 and August 20 bottom surrounding 75.60 will be in the spotlight.

On the contrary, a clear break above the key SMA resistance, at 77.40 now, can quickly target the 78.00 threshold before diverting the bulls to the month’s peak of 78.36.

Even so, 78.50 and 79.00 are likely to cap the pair’s upside attempts, a break of which can put the 80.00 psychological magnet in the spotlight.

AUD/JPY four-hour chart

Trend: Further declines expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.